Get Focus insights straight to your inbox

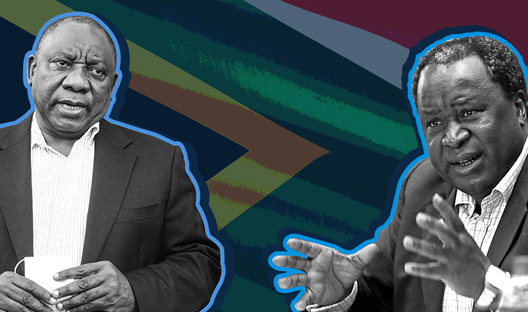

Finance Minister Tito Mboweni’s eyes glinted as he talked about the scale of South Africa’s road network during his delivery of the 2021 budget speech. From the N1’s uninterrupted diagonal between Cape Town and Beitbridge to the N2’s ocean-hugging meander, all the way down to the N18’s northward climb from Warrenton to the Botswanan border – these, along with our railway and port infrastructure, he crowed, are the arteries that keep our economy alive.

His enthusiasm was tempered by a quiet and quick disclaimer: the infrastructure is ailing. Its deterioration is but one example of the accumulated plaque clogging the arteries of business in SA. As the Finance Minister worked through his speech, efforts to repair the damage raised more than the long-furrowed eyebrows of jaded analysts; it raised hope, too.

Surprise fiscal consolidation

To grow, businesses must invest. To invest, the risks must be palatable.

In the context of an emerging market like South Africa, where international opinion has an outsized influence on our economic fortunes, a mismanaged fiscus is a big risk. It makes it harder to attract sticky foreign capital; it erodes the foundations on which businesses are built; and it causes a raft of socioeconomic problems that undermine the confidence of business and the consumers who support them.

Curious, then, that members of parliament withheld their applause when Mboweni announced that gross government debt would stabilise at 88,9% of GDP by 2025/26, instead of the 95,3% tabled in the 2020 Mid-Term Budget Policy Statement (MTBPS).

The improvement is a big deal and generous clapping was in order.

In her note summarising the budget, titled ‘Nimble footwork', Tertia Jacobs, Treasury Economist at Investec, estimated that, thanks to a better revenue line and relatively disciplined expenditure, the SA government will be able to reduce their weekly borrowing by about R2 billion per week.

Accelerated fiscal consolidation of this sort comes with meaningful benefits:

1. Ratings agencies are unlikely to push through further downgrades in the short-term.

2. Foreign investors will be more willing to allocate capital to SA.

3. Our government can spend less on servicing debt and more on pro-growth initiatives.

Providing certainty of a different kind was the R10 billion allocated to cover the Covid-19 vaccination rollout. The contingency fund, established in case more funding is needed to combat the pandemic, also saw its funding increase from R5 billion to R12 billion.

It’s important to note that the improved fiscal outlook is largely thanks to a R100 billion revenue windfall. Some of it came from VAT on the back of stronger than expected economic activity toward the end of 2020; but bumper tax collections from the mining industry, thanks to higher commodity prices, played a big part. It’s an outcome that those on the Investec trading desk hope the government sits up and takes heed of:

The desk’s collective view is that the budget would have looked very different without the tax contribution from the mining sector and that this hopefully illustrates just how key this sector is to the wellbeing of our economy, and how important it is to have a supportive, functioning Department of Mineral Resources.

It’s a call every SA business will surely echo to their respective government counterparts. In light of recent events, they might just be lent an ear.

Business gets a break

The erroneous notion that it’s solely the state’s responsibility to drive economic growth has seen clunky policymaking and stifling bureaucracy mushroom over the last decade. It looks like there’s progress being made to improve this damaging status quo.

Operation Vulindlela, launched late in 2020 to fast-track the host of structural reforms proposed in the President’s Economic Recovery and Reconstruction Plan (ERRP), is gaining traction.

And there are more positive signs to take notice of says Jacobs: "The release of digital spectrum, expansion of the electronic visa system, waivers to support tourism, improving the efficiency and competitiveness of South Africa’s ports, and strengthening the monitoring of water quality and energy are all receiving due attention."

The release of digital spectrum, expansion of the electronic visa system, waivers to support tourism, improving the efficiency and competitiveness of South Africa’s ports, and strengthening the monitoring of water quality and energy are all receiving due attention.

In addition, there’s tax relief for businesses on the horizon. To be sure, a 1% reduction in the corporate tax rate, down to 27% effective in the 2022/23 tax year, won’t spark celebrations in the street. But it points to a growing recognition by government that the private sector needs more support.

"The change may seem small, but it sends a clear message that government expects the private sector to play a leading role in the economic recovery," says Phil Dube, Head of Equity Finance at Investec.

The change may seem small, but it sends a clear message that government expects the private sector to play a leading role in the economic recovery.

Echoing these sentiments was Nosiphiwo Balfour, Structured Property Finance Specialist at Investec:

“As a significant contributor to GDP growth, the construction and real estate sectors welcome the corporate tax relief tabled in the 2021 budget.”

SA businesses should be excited by these developments as tangible outcomes of this nature have been rare in years gone by.

Is that action we see?

The word ‘implementation’ is surely considered a cuss in state hallways. Those running businesses in SA have grown indifferent to the hype around government’s porous proposals and leaky lekgotlas. But again, there seems to be some walking to match the talking.

"Despite the revenue overshoot relative to the October MTBPS, it seems government is holding the line on the wage bill. Expenditure on this critical line item is only expected to increase by 1.2% p.a. over the medium term," says Chris Holdsworth, Chief Investment Strategist, Investec Wealth & Investment.

Despite the revenue overshoot relative to the October MTBPS, it seems government is holding the line on the wage bill. Expenditure on this critical line item is only expected to increase by 1.2% p.a. over the medium term.

If there’s one outlay that can make or break the government’s commitment to fiscal consolidation, it’s the wage bill. Negotiations on this front are ongoing, but the days of above-inflation increases thankfully seem to be a thing of the past.

Returning to the workings of the ERRP, it’s the spending on infrastructure that’s touted to champion SA job creation. However, this cannot be achieved without the funding and skills that reside in the private sector. And Mboweni again talked to the public private partnership (PPP) model, making reference to a planned overhaul of the infrastructure at the Beitbridge border.

While the PPP concept is nothing new, the introduction of blended finance – where the government essentially de-risks infrastructure projects (using concessionary capital) to attract private investment – is, again, another indication that government is trying to harness the power of the private sector.

The R100 billion earmarked by the state for blended finance opportunities aims to unlock R1 trillion of private capital investment for infrastructure projects.

Obviously, it’s not all roses. There’s still little guidance on how government is going to handle malnourished SOE’s when they inevitably come knocking; nor is there a solid plan for how to address the rot in many of the local municipalities; and nor is our projected GDP growth good enough to put the worst of our fears to bed.

Pray for a long and strong recovery

Before the budget speech commenced in parliament, the honourable members were given an opportunity to pray. Hopefully there were a few silent pleas for a strong global economic recovery.

It remains a hard reality that the fortunes of the South African economy are inextricably linked to the Chinese, European, and US demand for our exports. These sentiments where shared by Dhiren Mansingh, Head of Treasury Sales & Structuring at Investec:

“Although our fiscal consolidation is important in influencing the trajectory of our currency and interest rates, these financial indicators are still largely driven by international dynamics. Global growth and inflation projections, developed market bond yields, the global demand for commodities, and further fiscal stimulus in the US and Eurozone are all, therefore, important to watch when building forecasts for South Africa and other emerging markets.”

Although our fiscal consolidation is important in influencing the trajectory of our currency and interest rates, these financial indicators are still largely driven by international dynamics.

China is expected to grow by about 9% in 2021, with the global economy expanding by 5,5% this year, and 4,2% in 2022. These are good numbers.

And yet, even with those bullish projections baked in, South African GDP is forecasted to grow by only 3,3% in 2021, moderating to 2,2% and 1,6% in 2022 and 2023 respectively. At that clip, we’ll only get back to our 2019 GDP level in 2024. This growth deficit – when compared to our trading partners – may have an adverse effect for some SA businesses.

Let’s not be ambiguous; the 2021 budget speech is good for business. But it’s only loosened a fraction of the plaque blocking the arteries that give life to our economy; if they are to become the free-flowing highways that Mboweni is doggedly fighting for, the nascent but tangible momentum of our fiscal consolidation and improving business conditions must be built upon.

Get all Investec's insights on the latest Budget Speech and SONA

Our economists, tax experts, personal finance and investment experts unpack what the latest fiscal measures mean for income, savings and daily expenses of individuals and businesses.