Get Focus insights straight to your inbox

Key takeaways of the February 2021 Budget Review

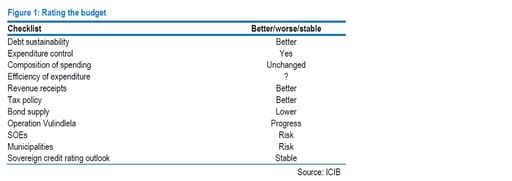

The February 2021 Budget Review's key focus has been on how far South Africa is on the road to debt stabilisation to avoid a debt trap. In the October 2020 MTBPS, fiscal consolidation was stretched out over five years with a strong reliance on spending cuts (mainly a freeze in the public sector wage bill) which curtailed the increase in non-interest spending. Fiscal consolidation is now expected to materialise at a faster pace, as the overrun in revenue receipts of R99.6bn is directed to (1) lowering bond supply by running down cash balances, and (2) to finance additional spending in F21/22. The main budget deficit has been reduced by R278bn over the MTEF period compared to the October 2020 MTBPS forecast (F20/21 at 12.3% of GDP vs MTBPS at 14.6%; F21/22 at 9.0% vs 10.1% and F23/24 at 6.5% vs 7.3%).

Main points

Debt stabilisation

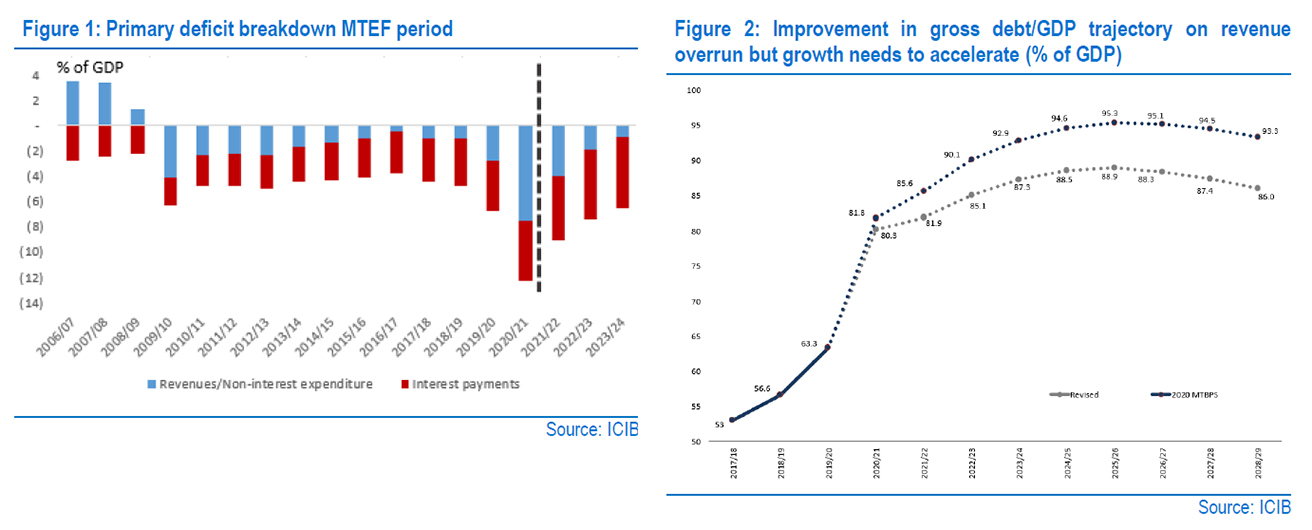

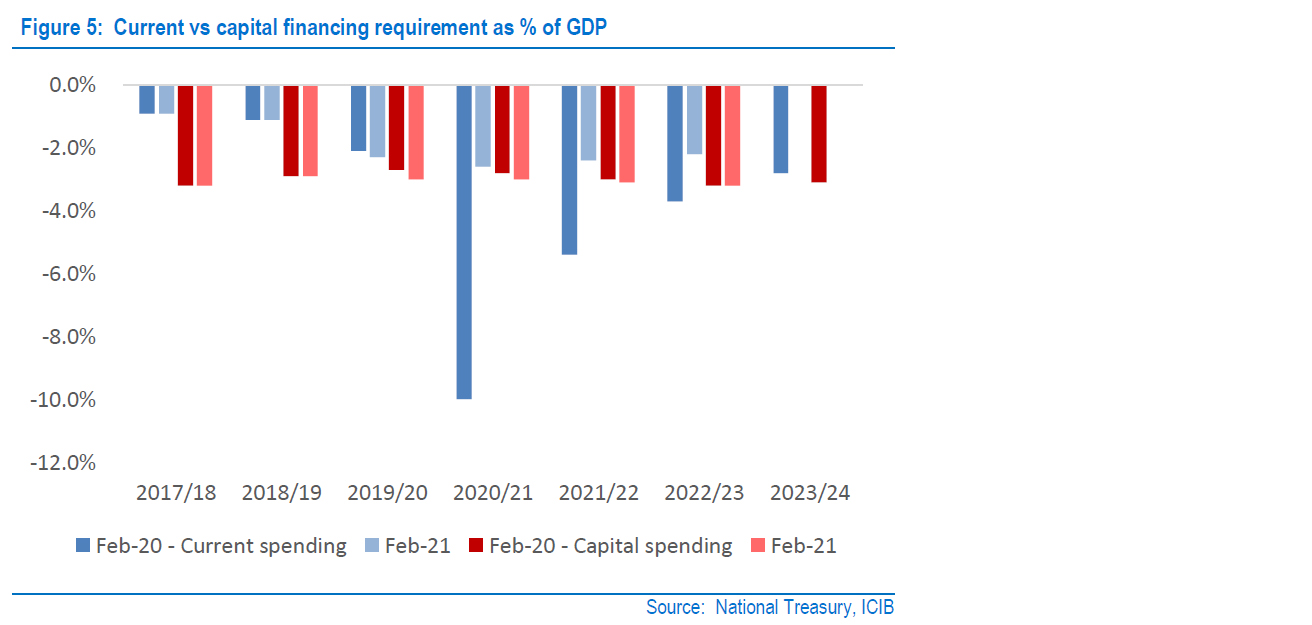

The key focus of the February 2021 Budget Review has been on how far South Africa is on the road to debt stabilisation to avoid a debt trap. In the October 2020 MTBPS, fiscal consolidation was stretched out over five years with a strong reliance on spending cuts (mainly a freeze in the public sector wage bill) which curtailed the increase in non-interest spending. Fiscal consolidation is now expected to materialise at a faster pace, as the overrun in revenue receipts of R99.6bn is directed to (1) lowering bond supply by running down cash balances, and (2) to finance additional spending in F21/22. The main budget deficit has been reduced by R278bn over the MTEF period compared to the October 2020 MTBPS forecast (F20/21 at 12.3% of GDP vs MTBPS at 14.6%; F21/22 at 9.0% vs 10.1% and F23/24 at 6.5% vs 7.3%).

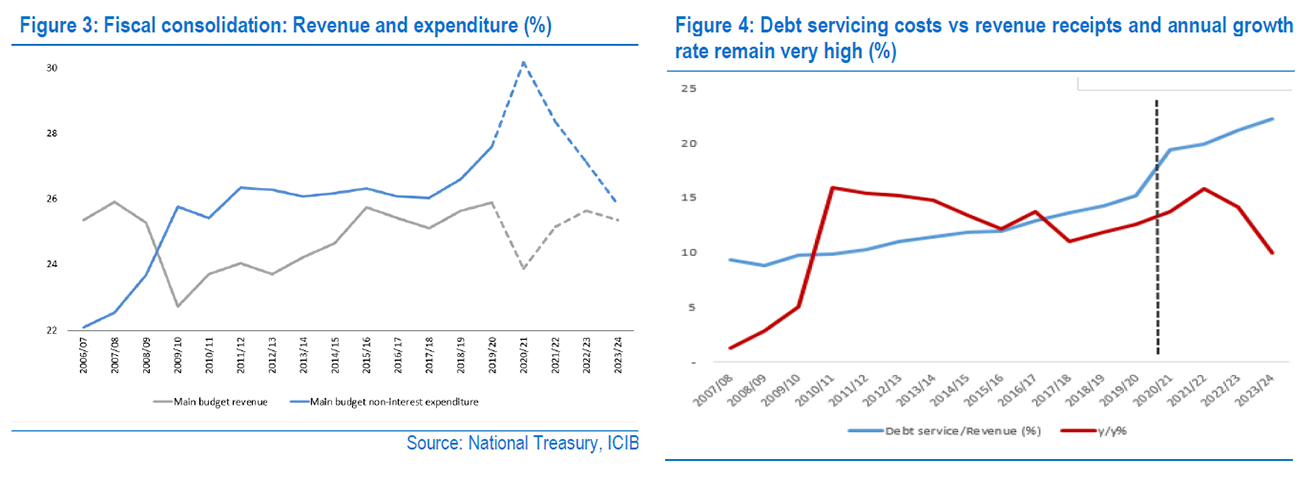

Progress is made in reducing the primary balance deficit from 7.5% of GDP (MTBPS: 9.8%) in the current fiscal year to 0.8% of GDP (MTBPS 1.4%) by F23/24 and a surplus in F24/25. This is helping to stabilise the growth rate in debt servicing costs, although it remains elevated, averaging 13.3%y-o-y (previously 14.9%) over the MTEF period and constituting 23.7% of revenues. Debt consolidation is now expected to materialise at a faster pace than announced in the MTBPS. The gross debt to GDP ratio could peak at 88.9% by F25/26 (MTBPS 95.3%).

The macro economic assumptions factored into the fiscal forecasts are reasonable. Real GDP growth in 2021 is expected at 3.3% (ICIB at 3.5%) and CPI inflation at 3.9% (ICIB at 4.4%). The nominal GDP growth forecast for F20/21 is revised up from -5.6% to -4.4% and marginally lower in F21/22 from 9.6% to 8.8%, reflective of the increase in the terms of trade. However, we deem the tax buoyancy assumption for revenue receipts in F21/22 at 1.4 times at the high end and the risk to gross tax receipts (forecast to increase by 12.6%y-o-y), is to the downside. The forecast emphasises the importance of growth reforms to kick in in conjunction with an increase in business and consumer confidence.

Non-interest spending accelerates by R34.6bn in F21/22, which is ahead ICIB’s forecast of R25bn. However, this is not unexpected considering the COVID-19 vaccine programme, which has received R15.0bn and a potential top up in the contingency reserve account from R5bn to R12bn. The public employment creation programme has been allocated R11bn and is an extension of the R12bn allocated in the current fiscal year. The growth rate in the public sector wage bill, however, remains unresolved as wage negotiations for the MTEF period has kicked off. The forecast for the compensation bill over the MTEF period has been raised to an average rate of 1.2% from 0.8% in contrast to the MTBPS which pencilled in a wage freeze in F21/22, an increase of 2.1% has been assumed, before moderating by 0.9% and 0.5% in the outer years.

Alleviating the tax burden on households and corporates

The decision not to hike taxes and remove an increase of R40bn factored in previously over the MTEF period to reduce the budget deficit, is supportive of consumers. Disposable income is raised by allowing for an above inflation adjustment in tax brackets (which raise incomes by R2.0bn whereas no adjustment could have raised tax revenues by R11.0bn). Alcoholic and cigarette duties are increased by 8% and the fuel levy by 26c/l.

The Budget Review mentioned that tax increases over the past six years have had a larger negative effect on growth than spending reductions, as the spending multiplier has declined. Additionally, the tax base has narrowed. However, progress is made in rebuilding SARS with the re-establishing of the Large Business Centre, and units focusing on litigation, compliance and integrity.

The corporate income tax rate has been reduced from 28% to 27% in 2022 and the number of tax incentives, expenditure deductions and assessed loss offsets, are to be reduced.

Sensible (productive) allocation of expenditure

A key concern remains the competency of government and wasteful spending. In this regard, the Budget Review reported that government is reviewing spending across sectors to improve its efficiency. Government has conducted a series of spending reviews in April 2020, of which 30 has been conducted. There are opportunities for restructuring, including merging or closing entities to reduce duplication of functions. There are also massive inefficiencies in some infrastructure programmes. During F21/22, zero-based budgeting principles will be piloted by the Department of Public Enterprises and the National Treasury.

SOEs support remains unresolved with elevated risks

The financial position of SOEs remains a major risk to the fiscus. Contingent liabilities have been contained with exposure to Eskom down to R316.8bn from R326.9bn and SAA to R6.2bn from R17.9bn. The Budget Review stated that “Public entities and SOEs cannot apply for guarantees they cannot afford to repay”. However, in view of the Land Bank’s strategic importance, a capital injection of R7.0bn will be provided as expected of which R5.0bn will be disbursed in F21/22. No additional transfers to SAA and Eskom have been provided over and above allocations included in the baseline forecast.

A detailed plan for dealing with SOEs is awaited.

Implementation of structural reforms need to be accelerated

Operation Vulindlela is focused on a faster rollout of structural reforms announced in the ERRP. These include speeding objectives set out in the SONA and include the release of digital spectrum, expanding the electronic visa system and waivers to support tourism, improving the efficiency and competitiveness of South Africa’s ports, strengthening the monitoring of water quality and energy.

Revenue overrun directed to lowering bond supply and stabilising the debt trajectory

- The main budget deficit in FY21/21 has been reduced from R537.4bn (-10.1% of GDP) to R482.6b (9% of GDP). The funding strategy will consist of a large draw down of cash balances of R112.6bn (bolstered by the R99.6bn revenue overrun), a smaller net increase in T-bills of +R9bn; domestic net bond issuance of R380bn and foreign loans of $3bn. The funding strategy also takes into consideration risks to the banking sector where ownership of government bonds has increased from 16% to 22%.

- The mix of instruments in the domestic bond funding programme will be diversified to include a rand Suck bond and FRNs in addition to retail bonds, SAGBs and ILBs. We are of the view that the size of the weekly ILB and SAGB auctions could be reduced by at least R2.0bn - the ILBs from R2.0bn to R1.4bn and SAGBs from R6.6bn to R5.2bn. Our assumption for SAGBs factor in a take up of non-competitive bond auctions of ~R50bn. This is considerably lower than an estimated outcome of R135bn in FY20/21, which raise upside risk to the forecast if the SAGB yield curve remains very steep.

- The switch bond auction programme will continue but the funding strategy has not revealed amounts by which the R212 or R2023 could be lowered.

Get all Investec's insights on the latest Budget Speech and SONA

Our economists, tax experts, personal finance and investment experts unpack what the latest fiscal measures mean for income, savings and daily expenses of individuals and businesses.