Local insight, global expertise

Our rigorous investment process draws on our expertise in the UK, South Africa and Switzerland. A global strategy team determines the overall positioning and how much risk we take on, while regional asset allocation teams determine the best mix of asset classes and sectors. Our experienced portfolio managers and analysts have decades of local and international market and industry knowledge. They are highly skilled at the in-depth fundamental research which underpins all our investment decisions.

Drawing on a wide range of perspectives

The investor insights mapped out by the Global Investment Strategy Group (GISG) on a quarterly basis, directly inform the strategy from which asset allocation committees in different regions make their investment decisions.

The GISG draws on the expertise of Investec professionals from the UK, South Africa, Mauritius and Switzerland. The Group is a voting forum, which operates on the principle of one member, one vote. When votes are cast, the results define what the risk position and budget for the quarter will be.

An inside look at an Out of the Ordinary process

Regular assessment of strategy

To ensure our investment outlook and risk positioning is always informed by the latest market developments, the GISG meet on a quarterly basis to do the following:

-

Map out and analyse the economic outlook for the next 18 months

-

Coordinate the risk appetite of the group – defining how much risk we are comfortable to assume

-

Discuss how this 'risk budget' is to be spent – including the most and least appealing areas to assume risk and how we insure against it

-

Identify and validate key investment themes

-

Identify potential threats (the 'icebergs' ahead) in the global investor’s path

-

Discuss new developments that could have an impact on returns.

South Africa Asset Allocation Committee

The South Africa Asset Allocation Committee (SA AAC) meets once a quarter and is generally after the GISG meeting and the Global Asset Allocation Committee (GAAC) meeting. The purpose of the SA AAC is to give guidance on the investment strategy view for the business within a purely South African context but also considering the global views from GISG and GAAC.

The SA AAC considers the following:

- Map out and analyse the broad SA -specific economic outlook over the coming 18-months or so;

- Develop, by consensus, a strategic asset allocation view (measured by the risk appetite of the committee) considering the broad macro and asset classes specific trends;

- Identify, test and validate key investment themes and threats;

- Discuss and determine how the “risk budget” ought to be spent

The output of the meeting is generally presented to the broader Investec Wealth & Investment team, and feedback provided to clients through the Macro Monday platform.

Global Investment View

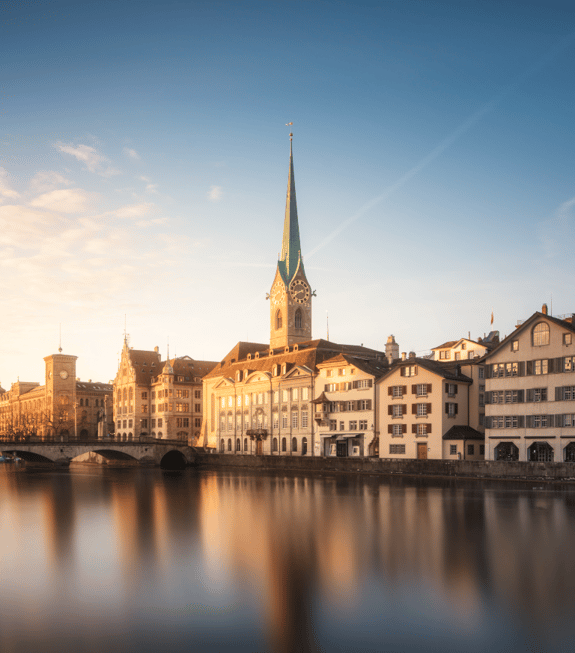

The Global Investment Strategy Group brings together the insights of Investec professionals in the UK, South Africa, and Switzerland, mapping their outlook, setting a risk budget, and identifying potential pitfalls that lie in the global investor's path.

Partner with us

Partner with our experts to preserve and grow your clients' wealth.