18 Dec 2020

Change is inevitable: how to adapt

Some initial thoughts on proposed changes to CGT

As former Prime Minister Benjamin Disraeli once said, “Change is inevitable. Change is constant,” and these words certainly ring true in 2020. Though many things have been subject to change this year, the topic on our minds today is capital gains tax (CGT).

Last month, the Office for Tax Simplification (OTS) published the first of two reports on CGT, entitled ‘Simplifying by design’, summarising findings from a months-long review of the current policy intent and rules. It makes 11 recommendations in total and touches on how CGT interacts with inheritance tax.

Though no-one can say for sure, many experts believe it is likely that the government will make changes to the CGT regime in the next tax year, once both reports have been published.

Hannah Dampney and I met for a virtual coffee to discuss our perspectives as an investment manager and financial planner respectively, and answer some key questions that clients may have.

What part does CGT play in investment management?

As an investment manager, managing portfolios in a tax-efficient manner is an essential part of what I do. Assessing the tax position is a key consideration when making investment decisions and utilising CGT allowances is considered general housekeeping. For discretionary managed clients, we take on the responsibility for utilising these allowances, if appropriate to do so.

What recommendations are you making to clients regarding CGT?

There are several suggestions I’ve been discussing with clients, if applicable to their individual financial situation:

1. Consider realising gains whilst rates are low. Since George Osbourne slashed CGT rates in March 2016, investors have enjoyed a favourable tax environment. This has been paired with an increasing CGT allowance, currently £12,300, whereby individuals can crystallise profits up to this amount without triggering a tax liability. Investors might consider this an opportunity to review all investments with the view to taking profits and paying CGT at a lower rate.

2. Consider using losses. There is a phenomenon known as ‘loss aversion bias’, which describes the human tendency to avoid loss even at the expense of acquiring gains. Because of this bias, we may be reluctant to sell an investment that is making a loss. However, realised losses can be used to offset gains elsewhere and consequently reduce a potential tax liability.

3. Don’t let the tax tail wag the investment dog. Managing portfolios in a tax-efficient matter is critical, but there are moments when a portfolio needs to be rebalanced to ensure sufficient diversification and manage risk. Any sale might trigger a capital gain. While paying tax is never fun, investors must be mindful that the reluctance to make changes to portfolios because of crystalizing a capital gain carries associated risk.

Although, as investment managers, we are cognisant of the tax environment, there must also be an investment case for maintaining positions and not solely a preference for keeping the tax bill low. Keeping hold of a particular stock purely for reasons of avoiding CGT can result in significant stock-specific risk, whereby investors can be overexposed to one particular investment and the associated risk. Diversification is key in mitigating unnecessary risk.

How can you help clients to stay ahead of changes to CGT?

One of the many advantages of using a discretionary investment manager to manage your investment portfolio is that our thorough understanding of our clients’ circumstances and requirements allows us to factor in tax saving efficiencies whilst managing portfolios on a day-to-day basis. We can act swiftly on our clients’ behalf to changes in markets and legislation, to ensure the best possible outcomes.

What are your initial thoughts on the OTS report?

On reading the report, the key points that catch my eye are:

- consider more closely aligning capital gains tax rates with income tax rates

- consider reducing the annual exempt amount (which is £12,300 in the 2020/21 tax year)

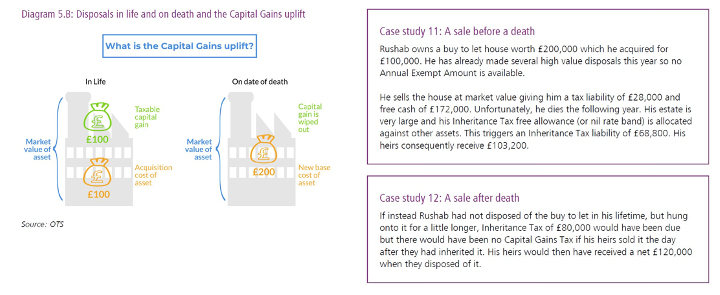

- consider removing the capital gains uplift on death

How can you help clients to stay ahead of changes to CGT?

My role as a financial planner is to help clients explore and understand their aims and objectives and ensure they are on track to meet them. I will ask questions such as:

- Are you clear as to what your aims are, your hopes, aspirations, and dreams?

- What are your objectives and how do you intend to reach them?

- When did you last sit down and talk about your personal and financial goals, your needs, and priorities?

- Have you assessed where you are on your financial road map?

Whilst we wouldn’t suggest you make decisions based on proposed changes, this could be a good time to review your financial plan and to see if you need to adjust the sails. For anyone with questions about CGT, I would ask if you are:

- regularly reviewing your finances

- using your exemptions

- looking to the future or just focusing on the now

- holding onto investments that have significant capital gains

- fully diversified in both your underlying assets and the wrappers (ISAs, pensions, investment bonds)

Find out more

Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Bournemouth today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.