04 Jan 2024

Investing in a property: is it time to diversify?

As it becomes harder to generate an incomefrom residential property, is it time to retire the viewthat “my property is my pension”?

Property ownership is a staple of British culture. Around 63% of Brits own their own home (compared to less than 50% in countries including Germany and Switzerland), and more than one in 10 own multiple properties.1

It’s common to hear these property owners use the phrase, “my property is my pension”, reflecting their expectation that the income they derive from property, and the potential capital gains, will sustain them in retirement.

However, the reputation we’ve given property as a good investment is largely built on several decades of declining interest rates, which made it very easy to borrow money, and profitable to invest it. As we enter a new era of higher interest rates and it becomes far harder to generate a healthy return, it may be time to reconsider this view.

High mortgage rates are squeezing property profit margins

From the start of 2021 until today, the Bank Rate of interest has risen from 0.25% to 5.25%, and mortgage rates have shot up as a result.2 Estate agents and mortgage brokers would say that this is a temporary blip. However, the Central Banks are telling us that rates will be higher for longer and that we will not see the return of the 0% interest rate environment of the past. We believe it is far more likely we will revert to the long-term normal of 3-5%.

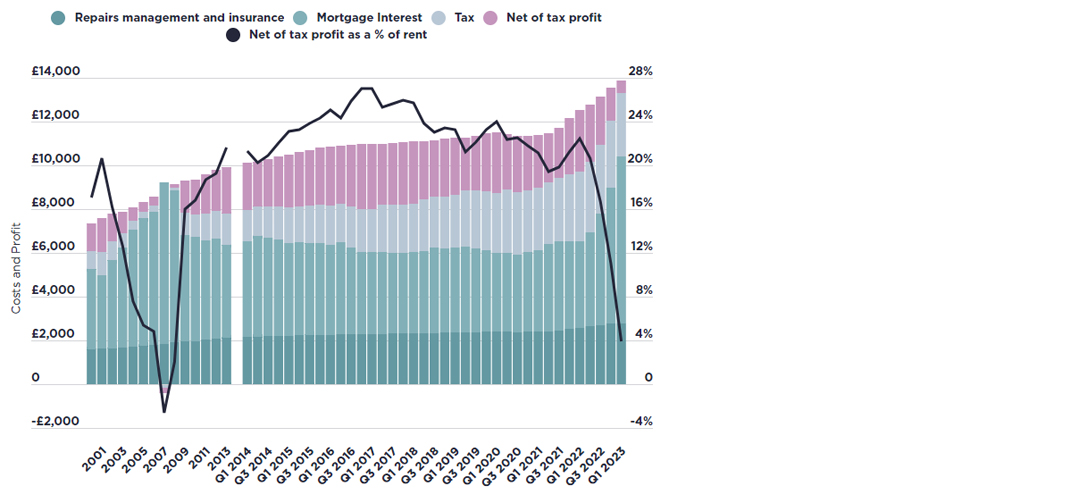

The graph below, from Savills, highlights the erosion of profit margins on rental properties financed using debt/mortgage since interest rates have increased.

Finances for the average mortgaged Buy to Let Investment on a 70% LTV, Interest-only mortgage held personally by a higher-rate tax payer

Source: Savills Research

When we speak to Landlords it is becoming increasingly obvious that increasing mortgage rates, solicitor fees, and maintenance costs are drastically squeezing profit margins to the point where, in some cases, they are losing money each month. The number of landlords in mortgage arrears has doubled year on year, and landlords are now more than twice as likely to sell properties than they are to purchase them.

Residential property investments are not protected from taxes

Unlike commercial property (which can be held in a self-invested personal pension or a small self-administered scheme), residential property cannot be held within a pension wrapper, meaning that the returns it generates cannot be shielded from income tax and capital gains tax. While pension investments grow free from capital gains, the tax on capital gains from a property sale can be up to 28%.

Pension assets also fall outside of your estate for inheritance tax purposes. Holding property outside of a pension can leave your beneficiaries with a nasty surprise. They may have to sell up – and pay estate agent and legal fees – to foot a large inheritance tax bill.

Alternatives to property investment

If your goal is to receive an income that has the potential to beat bank rates (without all the hassle that comes with owning a property portfolio) you have several options, all of which can be held in tax-free wrappers, such as ISAs and pensions.

1. Real estate investment trusts (REITs)

REITs are publicly traded companies that own, operate, and/or finance income-generating real estate assets. They pool the capital of multiple investors, making it possible to invest and earn dividends from real estate markets without purchasing the property yourself.

Because you can buy and sell these companies on the stock exchange, you can exit your investment and have the money in your bank account in a matter of days.

Many of these companies are now trading at discounts between 10%-30% to their net asset values (meaning investors value them at less than the sum of the valuation of the properties and income streams within the company). Should investors’ appetite and sentiment change and they decide the property within the REIT is worth the same as the net asset value, shareholders would benefit from this 10%-30% differential in the form of capital appreciation.3

2. Listed infrastructure

Similar to REITs, listed infrastructure investments pool investors’ capital and invest in income-generating infrastructure assets such as toll roads, airports, wind turbines, solar panels and battery storage technology. These investments are highly liquid and can be purchased and sold on the stock exchange.

Depending on the company you purchase, these companies are offering yields between 6%-8% and again are trading at discounts of between 10%-30% of net asset value.4

3. Stocks and shares

Stocks and shares are the bread and butter of investment management. Capital gains can be earned when the share price increases, as investors become encouraged by growth of market share, profit margins, new products and services, and company efficiencies.

Mature companies, which already have a large market share and high profit margins, may choose to pay profits out to shareholders in the form of dividends. This can be an excellent source of income for investors.

Over the long term, shares have historically been the best driver of capital appreciation within a diversified investment portfolio and have also been proven as the best hedge against the impacts of inflation. They are highly liquid investments and can be purchased and sold on the stock exchange around the clock.

Please remember past performance is not necessarily a guide to the future and should not be relied upon.

4. Gilts

High interest rates may be bad for property investors, but they make gilts (fixed-interest government debt) far more attractive, particularly for higher or additional rate taxpayers.

Due to a very low Bank of England base rate, over the last 10 years the UK Government issued a lot of debt at historically low interest rates which pay interest as low as 0.125%. Given the base rate has now increased to over 5%, the debt issued at these low rates now looks very unattractive when you can access a 5% rate of interest in the bank.

However, as interest rates have risen, the trade price of this government debt paying interest of 0.125% has now fallen meaning the 4.875% differential can be made back through a capital return. (All government debt is issued at a par price of 100 pence and will mature at that same price, however the price will fluctuate in the interim so the government bond remains attractive relative to base rates.)

Capital returns on Government debt and some qualifying corporate debts is free of capital gains tax. This can be very attractive to investors, particularly in higher and additional rate brackets who would need a return of 8%-9% on their cash bank account to match the net return of investing in government debt.

To simplify this, if an additional rate tax payer were to invest in a cash account with the bank paying interest of 5%, 45% is taken by the taxman leaving you with a net 2.75% return. Investing the same amount in government debt would see the coupon of 0.125% taxed at 45% but the 4.875% capital return being free of tax making the net return significantly more attractive than cash in the bank.

Tax treatment depends on the individual circumstances of each client and may be subject to change in future. All statements concerning tax treatment are based upon our understanding of current tax law and HMRC practise and can be subject to change.

Time to diversify?

If you’re getting stressed out running a property portfolio while your margins are continually being squeezed, you may benefit from talking to a financial planner. They can talk through how to best structure your finances and reduce the tax burden for you and your family on the liquidation or partial sale of your portfolio.

An investment manager can then discuss investment strategies that can be tailored to your goals, objectives, and risk profile and invest on your behalf so that you can spend more time enjoying retirement and less time worrying about the health of the property market.

References:

1 Home ownership analytics - https://www.ethnicity-facts-figures.service.gov.uk/ - https://www.resolutionfoundation.org/

2 Official Bank Rate history - https://www.bankofengland.co.uk/

3 Factset, 15/11/2023

4 Factset, 15/11/2023

About the author

To contact or read more about James Neale in Cheltenham, visit his bio here.

Find out more

Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Cheltenham today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.