05 Oct 2020

Why do people save instead of investing?

The psychology of settling for poor returns.

A UCL Study invited volunteers to play a computer game in which they were tasked to turn over virtual stones which may, or may not, reveal a snake underneath. If a snake were found, the volunteer would receive a painful electric shock. Volunteer’s stress levels were measured throughout.

The experiment created differing levels of uncertainty by varying the chance of finding a snake. Surprisingly, the results showed that the most stressful scenario was an uncertain chance of receiving a shock – which was far more stressful than even a 100% chance of receiving a shock.

Lead Author Archy de Berker (UCL Institute of Neurology) concluded, "Our experiment allows us to draw conclusions about the effect of uncertainty on stress. It turns out that it's much worse not knowing you are going to get a shock than knowing you definitely will or won't.”

Uncertainty in investment

Investing in shares, bonds, property, gold, etc. involves an uncertainty that we label risk. These investments are likely to be subject to price variations in the short term, and the price can move up or down.

It’s this uncertainty that draws many savers back to the safety of cash accounts, though these may yield only very low interest rates. To put it in the terms of the above experiment: savers may find that it’s worse not knowing how high your return will be than knowing that it will definitely be low.

The trouble with saving

If it’s not immediately obvious how this attitude could cause savers to lose out, this example may help.

The popular Freddo Chocolate Bar cost 10p in 1999 and by 2017 it had risen to 30p – a 200% increase over 18 years. A quirky example, perhaps, but one that illustrates that inflation can have a swift and significant impact on the buying power of your savings.

In recent years, the interest offered by cash savings account has been far lower than the rate of inflation. So, if you’d put aside 10p in 1999, by 2017, you wouldn’t have saved the 30p necessary to buy that Freddo bar.

Redefining risk

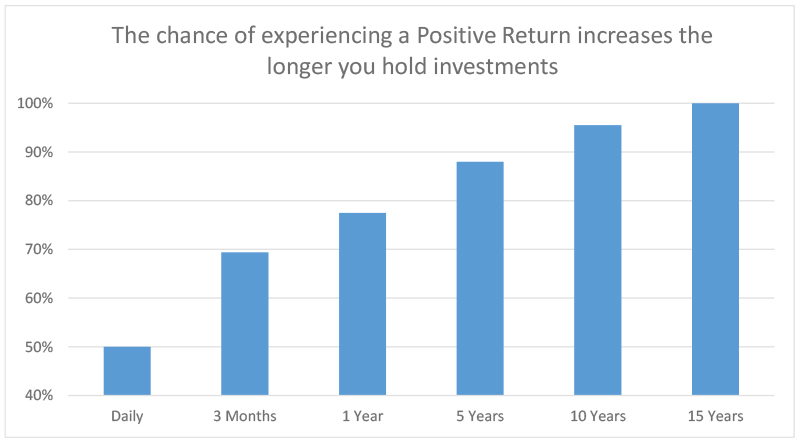

For predicting daily moves in the stock market, you may as well flip a coin as there is about a 50/50 chance of it being positive or negative. However - making no guarantees or predictions for the future of investments - over the last 50 years, the global stock market had a 77% chance of being positive over any one-year period (MSCI World Index).

Looking over any five-year period, there is a 88% chance of being positive. Over a 10-year period, the chance is 96%. Over 13+ years there has never been a loss!

Source: FactSet Data – MSCI World Total Return (Monthly, Dec 1970 – July 2020)

The average annualised return over any rolling one-year, five-year, 10-year, or 15-year period was around 10% per year (10%, 64%, 169%, 348% respectively).

Most importantly, over any 10-year period, investors would have beaten the Bank of England’s inflation target (2% per year) 94% of the time. Compare this to savers, who would have lost out to inflation 100% of the time. Which is the bigger risk?

Managing risk appropriately

Now that we’ve established that uncertainty - or investment risk - is essential if you want to beat inflation over the long term, it’s still necessary to address the psychological resistance to it by managing it appropriately.

There are four straightforward steps you can use to reduce uncertainty in investment:

- Ensure you invest for the medium to long-term (i.e. ten years)

- Consider adding some lower-risk investments to your portfolio to reduce short-term volatility (e.g. bonds)

- Have a professional manage your portfolio on your behalf

- Observe your portfolio less frequently (every 6-12 months is ample)

About the author

To contact or read more about Adam Brewer, visit his biography here.

Find out more

Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Exeter today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.