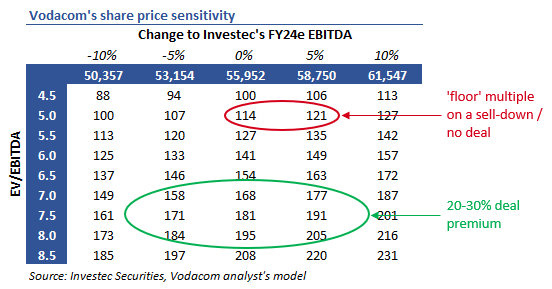

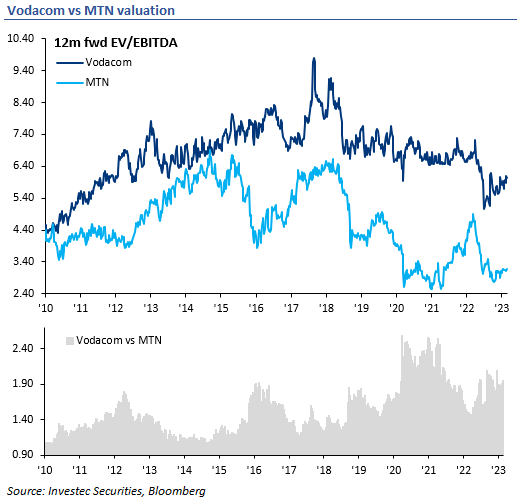

Bottom-line: We’ve tested the impact of M&A scenarios for Vodacom’s share price given recent newsflow on Etisalat & Vodafone. Etisalat has USD7bn / ZAR127bn of M&A firepower on our rough calculations, before hitting its 1.5x net debt/EBITDA covenant. This would be sufficient to buy a ~40-45% stake in Vodacom at a 20-30% deal premium (7-8x EV/EBITDA vs. Vodacom’s recent Egypt deal at 8.5x), or a ~15-20% additional stake in Vodafone at a 20-40% premium (taking its stake in Vodafone to 25-30%). This implies a ZAR170-200 share price range for Vodacom. Both of these scenarios also open doors to rationalisation of overlapping portfolios further down the line. For completeness, we include a scenario where Vodafone sells down its Vodacom stake in a similar manner to Barclays / Absa; we use this to set an EV/EBITDA floor of 5x (~ZAR120 share price; also relevant in a ‘no deal’ scenario). See below for indicative derivative pricing on Vodacom / Vodafone

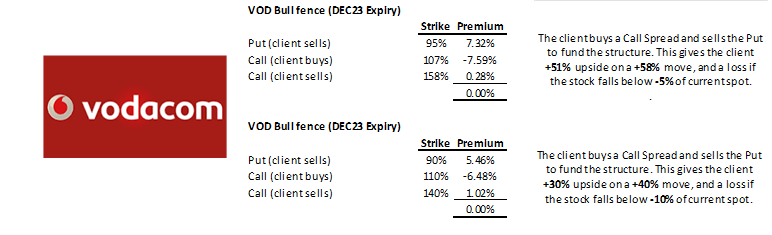

Trades:

- Bull fence on Vodacom out to Dec’23 with strikes at 95 / 107 / 158 or 90 / 110 / 140 (both indicatively priced at zero-cost)

- IDX future on Vodafone with 18 Dec’23 expiry offered at 107.83%

(indicative pricing only; edpricing@investec.co.za for updated pricing / other iterations)

Scenario 1: Vodafone sells Vodacom – placement in tranches or in one go

Under this scenario, Vodafone sells down its 65.1% stake in Vodacom, either in one go, or in tranches via placings. A max of 15% of Vodacom can be placed ex-SARB approval (approval required to sell below a 50% holding), or a max of 60% with SARB approval (the remaining 5% being locked up until Dec’23)

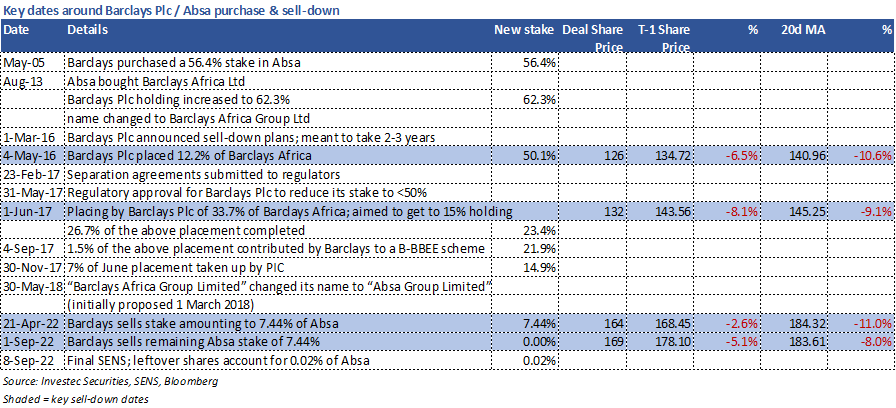

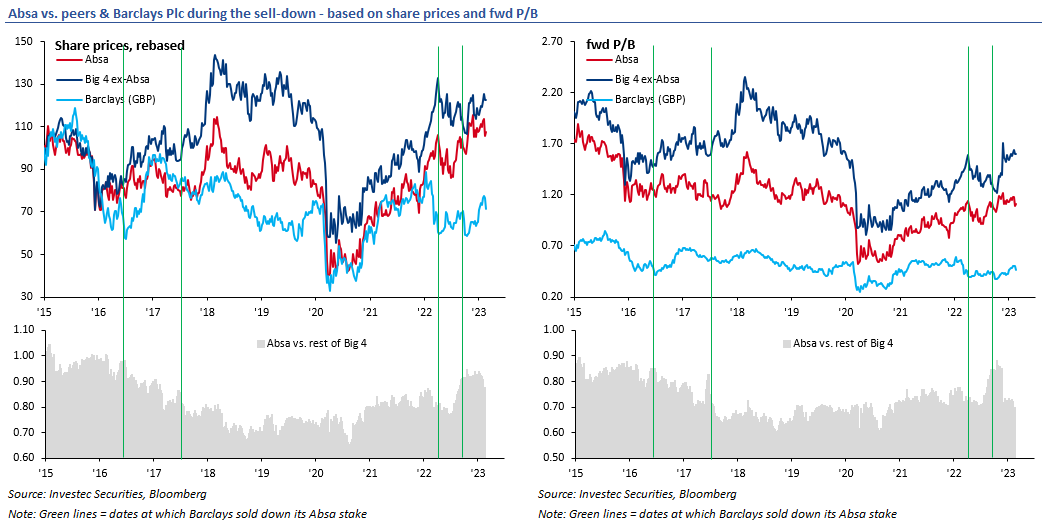

Barclays / Absa case study: Barclays Plc sold down its 62.3% Absa stake over a 6-year period in 4 tranches. The bulk of this took place within 18 months of Barclays’ initial decision. Absa underperformed the rest of the Big 4 banks by ~30% in share price terms, and its P/B discount to peers widened from 15% to 40%. This underperformance was exacerbated by stock-specific issues like management changes and operational performance at the time, so it’s more of a guide than a direct analogy for Vodacom. Timeline and charts below

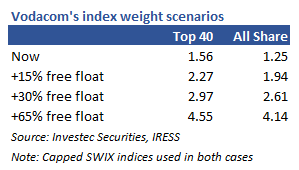

Read-through for Vodacom: A 15-20% discount to current valuation sees Vodacom at an EV/EBITDA of ~5x. Although the discount could be narrower if a large portion of this placing is taken up by Etisalat. Vodacom’s weight in the headline indices would also increase based on a higher free float – table below; after a full sell down of Vodafone’s 65% stake, Vodacom would be the 6th highest weighted stock in the Capped SWIX Top40 index

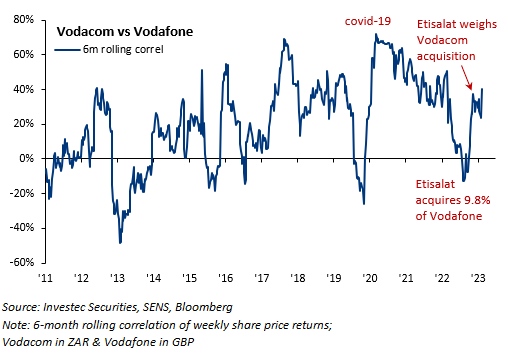

Scenario 2: Etisalat buys Vodafone with Vodacom; 20-40% premium

Some uplift to Vodacom given recently higher correlation with Vodafone’s share price. A 20% rally in Vodafone’s share price implies a ~10% rally in Vodacom. This also opens the doors to rationalisation of overlapping portfolios further down the line for Etisalat / Vodafone / Vodacom. Etisalat’s $7bn / ZAR127bn M&A firepower could see its stake in Vodafone increase to 25-30%

Scenario 3: Estisalat buys Vodacom at a 20-30% premium

This could happen either before or after an Etisalat / Vodafone deal. A 20-30% deal premium places Vodacom on a 7-8x EV/EBITDA (note Vodacom’s Egypt deal was done at 8.5x). With Etisalat’s c.ZAR127bn M&A firepower, they’d be able to buy a ~40-45% stake in Vodacom

Best,

Nadeem