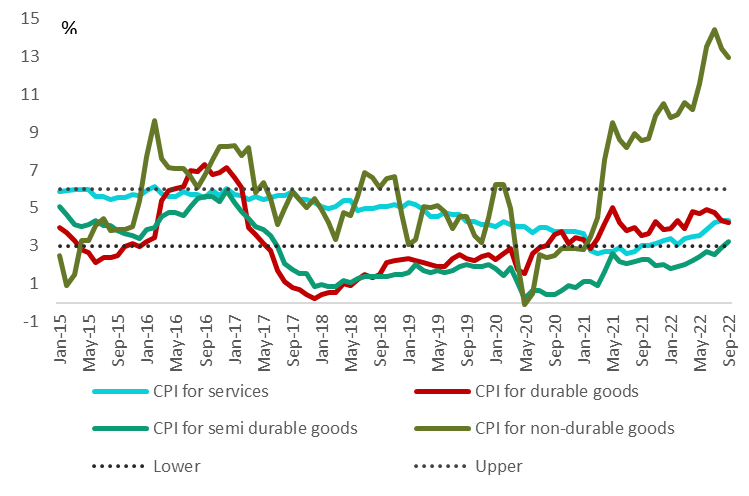

In September 2022, South Africa’s headline CPI inflation moderated from 7.6% to 7.5%. The outcome was below Bloomberg consensus expectations (ICIB 7.5%). Core CPI inflation, however, accelerated to 4.7% from 4.4%, the highest since July 2017 (62 months). The outcome was in line with market expectations in anticipation of a high survey month compounded by broad-based price increases.

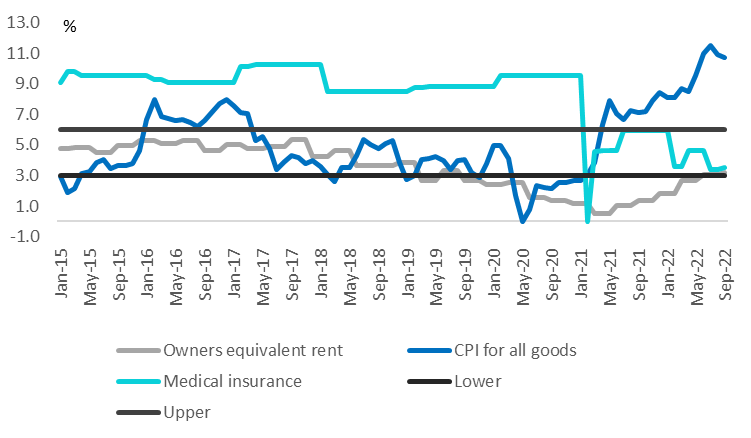

Over the month, headline CPI prices rose by 0.1%. The main contributor was a material decline in the fuel price (R2.04/cl which subtracted 0.3ppt). Fuel price inflation has moderated from a high of 56.2% in July to 34.1% in September. Private sector transport operations have passed on the lower fuel price (28.7% vs 35.7%) but public transport was mostly unchanged (22.1% from 23.6%). Food price inflation, however, has not yet moderated and has increased by 12.3% (P 11.5%). Whereas prices of fats and oil have declined as expected, owing to lower international palm oil prices (29.0%y/y vs 37.6%), prices of grain and meat continued to accelerate (19.3% vs 17.8% and 9.9% vs 9.2%).

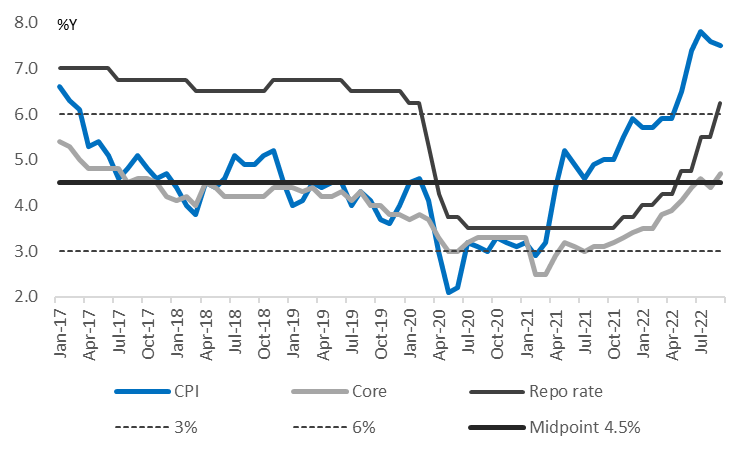

The key focus in September was on the core inflation trajectory. This followed a downside surprise to August’s outcome when core remained unchanged at 4.4%. The acceleration to 4.7% in September was driven by higher services inflation related to rental (2.8% vs 2.4%), owner’s equivalent rent (3.2% vs 3.0%) and domestic wage increases (3.8% vs 3.5%). Sectors sensitive to the rand, such as books and newspapers (5.7% vs 4.9%), hotel accommodation (10.5% vs 3.6%) and packaged holidays (4.9% vs 3.0%), recorded higher price increases. A repricing of US interest rate expectations in August and September caused the rand to lose nearly 9.0% of its value.

Inflation forecast: Previously, we were of the view that headline CPI inflation is likely to have peaked at 7.8% in July. The decision by OPEC+ to cut oil production by 2m b/d, however, together with a weaker ZAR, is likely to reverse the decline in the petrol price of the past two months. The average underrecovery for the month-to-date is running at 43.7c/l and for diesel at R1.65c/l). Consequently, we expect October’s CPI inflation to rise by 7.7% and we have revised our year-end forecast to 7.2%.

SARB’s inflation forecast: The implication for the SARB’s inflation forecast is an upward revision at the November MPC meeting because of the higher September core CPI reading and a renewed increase in the fuel price. The key concern for the SARB is the pass through of higher elevated headline inflation (driven by fuel and food, which constitute a large portion of South Africa’s spending basket) to core CPI inflation via an acceleration in inflation expectations and wage increases. Several industries have reached multi-year wage agreements of 6.0%+. The 75bp rate hike in September was driven by (1) upside risks to the inflation forecast (which appears to be playing out) and (2) US/ZAR interest rate differentials (SARB’s starting point for the ZAR forecast was R16.90/$).

The SARB’s rhetoric is expected to remain hawkish. While we are close to the end of the rate hiking cycle, with the current repo rate at 6.25%, there are more rate hikes in the pipeline. We have also revised our terminal rate from 6.50% to 7.0%. The MPC is looking to get the real policy rate away from negative to flat, whereafter more measured and smaller rate hikes can follow. As for the size of the November rate hike, we think the SARB can tone down the quantum to 50bps even as the Fed continues with a possible 75bps at each of the November and December MPC meetings. The key issues for South Africa are that the SARB is not behind the curve and South Africa’s inflation remains relatively contained compared to advanced economies.

Figure 1: Headline, core CPI vs repo rate

Figure 2: Rental inflation is rising vs goods inflation that has stabilised

Figure 3: Breakdown of CPI inflation: Durables, non-durables, semi-durables and goods