This month’s report discusses the key drivers of South Africa’s fixed income and FX markets in January. We reflect on the key risks in the context of current valuations, and flag February’s heavy calendar of event risks. The drivers of the SAGB yield curve are analysed in the wake of the MPC’s decision to dial down the pace of rate hikes, as inflation has turned the corner. Fiscal risks, however, are likely to become more pronounced in F23/24, as the growth outlook has deteriorated. We discuss dynamics around the SARB and ICIB’s GDP growth forecast with reference to the impact of different stages of load shedding and Eskom diesel requirement.

International market drivers: Global macro drivers provided a strong start to the year. Main catalysts:

- Expectations of an earlier pause in the Fed’s rate hiking cycle, as headline inflation prints surprised on the downside (even though the labour market remained strong)

- China’s abrupt decision to reopen the economy

- A milder winter in Europe which saw gasoline price retreat to pre-Russian invasion levels

- Expectations of Europe avoiding a recession

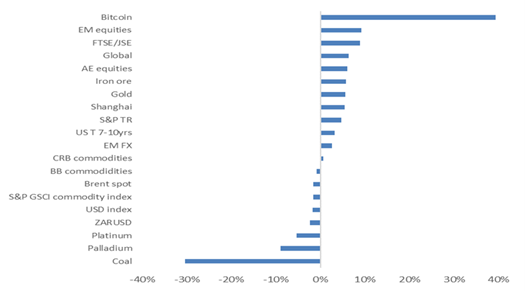

The macro catalysts in January caused a strong risk on rally in AE equity markets (MSCI World +6.0%) and EM equities (MSCI EM +9.2%); volatility in bond markets declined and yield curves flattened (with a deeper inversion in the US T curve bolstering the return in 7-10 yrs by 3.2%); Bitcoin surged (+38.2%) and EM FX rallied (+2.5%). Risk on sentiment, flared up in the final days of January. The catalyst was a surprise acceleration in Spain’s headline CPI inflation rate to 5.8% (from 5.7%) and above consensus expectations of 5.0%, partly owing to a reweighting of the inflation basket.

This triggered concern that European inflation could prove stickier, with preliminary January readings (except for Germany), published on February 1. A rise in peripheral European bond yields spilled over to the rest of the world. Added to this was a better than expected performance of the Eurozone economy in 4Q 22. Contrary to expectations of a contraction of 0.1%q/q, the region posted positive growth of 0.1%q/q (1.9% y/y). Incoming US data provided some comfort of a moderation in wage increases, as the employment cost index increased by 1.0% in 4Q22, which was below consensus expectations of 1.1% and 1.2% in the previous quarter.

Figure 1 | Selective asset class global returns – January 2023

The month ahead: Market dynamics in February may switch from inflation to growth, as the moderation in inflation is widely anticipated. Internationally, Central Bank meetings in the advanced economies will be the key focus. The Fed is expected to dial back on rate hikes, by raising the Fed funds rate by 25bps, whereas the ECB and BOE will continue with 50bps rate hikes, after slowing the pace of rate hikes from 75bps to 50bps at the December meetings. But the dynamic between the Fed’s tolerance of easier US financial conditions and the ECB terminal rate, are sources of uncertainty. Recently, the economic surprises indices have shown a divergence between the US and Europe, as incoming data in the US such as retail sales have surprised on the downside. In China, the reopening of the economy as Chinese return from the Lunar holidays, will be closely monitored as the reopening recovery could have an uneven start.

In South Africa, the FATF announcement and government’s February 2023 Budget Review are key events in the context of ongoing load shedding. Developments in dealing with the energy crisis will include a press conference by President Ramaphosa, where he is expected to announce an energy support package to households and SME’s, and diesel financial for Eskom. (Eskom has approached banks for diesel financing backed by a government guarantee.)

Incoming high frequency real economic indicators such as manufacturing and mining production for December will reveal the intensification of load shedding. The merchandise trade surplus for January will provide insight into export performance, as global growth slows down, and the effect of the infrastructure crisis on local production challenges. Headline CPI inflation is anticipated to recede below 7.0% for the first time since May 2022.