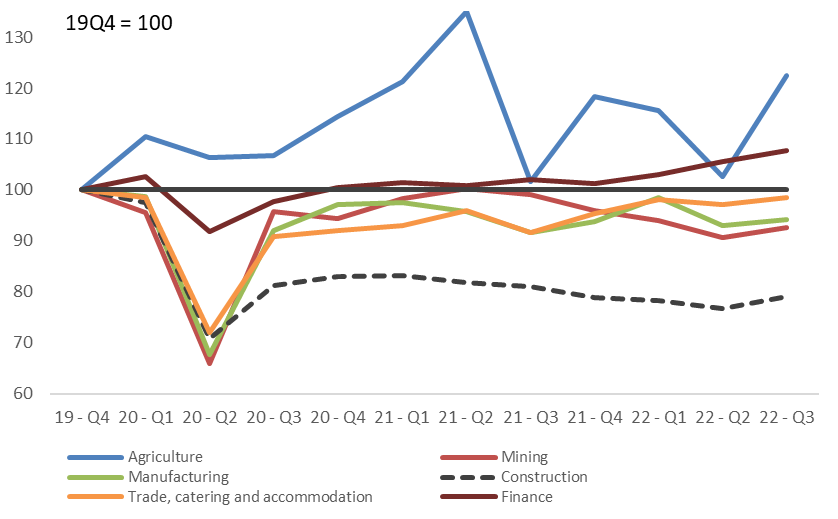

What happened: GDP growth recorded a strong and surprising rebound from -0.7%q/q in Q2 to 1.6%q/q in Q3. The outcome was well above ICIBs forecast of 0.2%q/q and Bloomberg consensus and the SARB’s forecast of 0.4%q/q. The upside surprise on the supply side can be ascribed to a material acceleration in agricultural production and services such as transport/communication and finance (reflected in strong credit growth in Q3). A rebound in mining and manufacturing production was expected after the KZN floods in Q2.

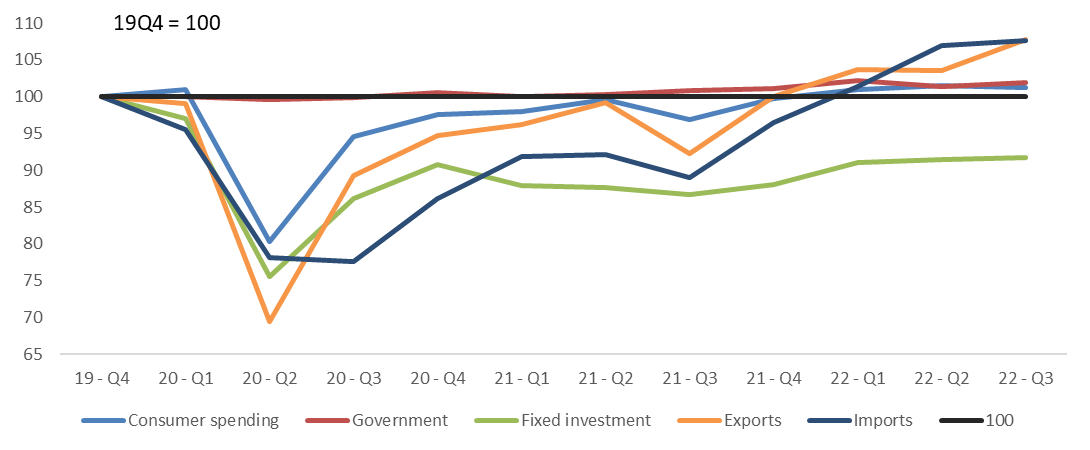

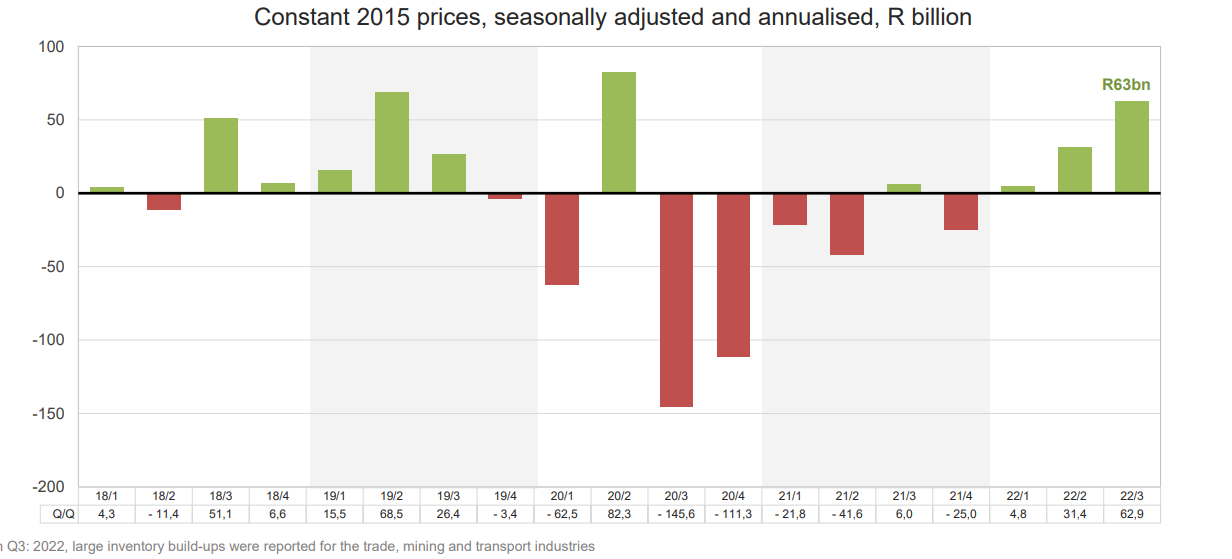

On the demand side, household spending continued to lose momentum and made a negative contribution to growth. But a healthy rise in inventories (trade; catering and accommodation, transport, storage and communication; and mining) and to a lesser extent net exports (as exports accelerated and import growth moderated) made a positive contribution. The better than expected outcome leads to an upward revision in our 2022 GDP forecast from 1.4% to 2.3%. GDP growth in Q4 is expected to be subdued at 0.1%q/q - 0.3% q/q but the risk is a contraction from a high base in Q4. The increase in net exports could see a smaller current account deficit on the balance of payments in Q3 from -1.3% of GDP to -0.2% in Q3.

Challenges remain: Notwithstanding the encouraging Q3 GDP print, the economy faces numerous challenges in 2023. Key dynamics are (1) the unfolding of recent political developments (next Tuesday’s National Assembly vote on the independent panel’s report on President Ramaphosa, which requires a 50% + 1% majority, the ANC leadership election on December 16 and President Ramaphosa’s petition to the constitutional court to set aside the report) hold implication for the business confidence and reform momentum, (2) the electricity and logistics crisis, (3) more rate hikes from the SARB, and (4) slower growth/gradual opening of the Chinese economy. The combination of these drivers could render 1H 23 challenging to navigate but 2H23 could be better (as inflation moderates, China’s economy regains momentum and the rate hiking cycle may have peaked).

Fig 1 Supply side: Strong growth in agriculture and finance

Source: StatsSA

Fig 2 Demand side: Rebound in exports (after KZN floods)

Source: StatsSA

Fig 3 Rebuilding of inventories provided further impetus to Q3 GDP

Source: StatsSA