GDP maintained momentum in Q2 21 but implementation of infrastructure critical to lift the growth trajectory out of a low growth trap

- GDP outcome for Q2 21: The revised and re-benchmarked GDP levels published last week implied volatility risk to Q2 21’s GDP reading as StatsSA refrained from publishing data for Q1 21. Mining production for June was imputed but was submitted for inclusion by the DMRE at the last minute. StatsSA revised the GDP growth rate for Q1 21 marginally lower from 1.1%QoQ to 1.0%, mainly owing to revisions to the transport sector (which contracted by 1.1%QoQ vs. a previous expansion of +1.2%).

- The outcome of Q2 21 GDP data revealed a mixed picture. Encouragingly, the economy maintained momentum, growing by 1.2%QoQ sa compared to +1.0% (Q1 21) and 2.5% (Q4 20) previously. However, support has mainly been provided by monetary and fiscal policy and high commodity prices. However, growth in Q3 21 is likely to suffer a renew setback, stemming from the adverse direct and indirect effects of the looting in July, the cyber attack on Transnet, ongoing electricity constraints, and mobility restrictions. However, Q4 is likely to witness a strong rebound.

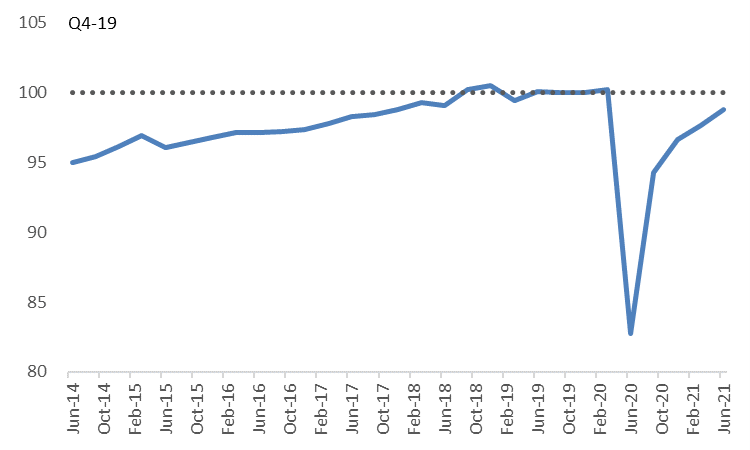

- Base effects accounted for a considerable rebound in the annual growth rate in Q2 21, with activity levels 19.3%YoY higher than the same period in 2020 when mobility restrictions ranging from Level 5 to 4 were imposed. However, economic levels remained 1.2%YoY below pre-pandemic levels in Q4 19.

- Nominal GDP increased by 26.6% YoY in Q2 21 compared to the same quarter in 2021 and 14.0% YoY in H1 21. The increase in the terms of trade owing to a surge in commodity prices was an important contributor to base effects.

- GDP forecast: Following the revision and rebenchmarking of GDP data, we are looking for real GDP growth of 4.8% in 2021, owing to the GDP revisions, and 2.0% in 2022. The economy could return to pre-pandemic levels by Q4 22, which is earlier than our previous forecast of 2023. However, without a faster implementation of the infrastructure plan and easier labour restrictions, the economy will remain in a low growth trap with immense spending pressures on the fiscus.

- What we are watching in SA: BER business confidence (8/9), Current account % of GDP (9/9) and July mining production (14/9), and the MPC (23/9).

Figure 1 Real GDP growth

Source: StatsSA, ICIB