Key take aways:

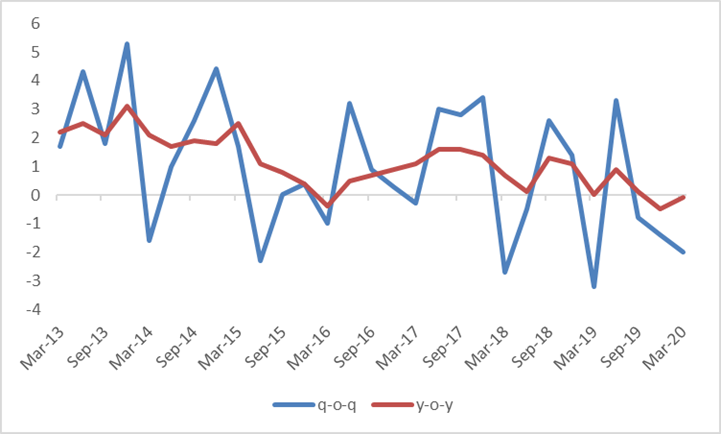

GDP outcome for Q1 20: The contraction in GDP growth in 1Q 20 was better than Bloomberg consensus forecasts, declining by 2.0% q-o-q (Bloomberg consensus estimate at -4.0%), following a -1.4% q-o-q contraction in the previous quarter. However, this was the third consecutive quarter that the economy contracted. Output was -0.9% lower than the corresponding quarter in 2019. The weakness of Q1 20 GDP growth data emphasised the weakness of the economy prior to lockdown, with Stage 5 implemented on 27 March 2020.

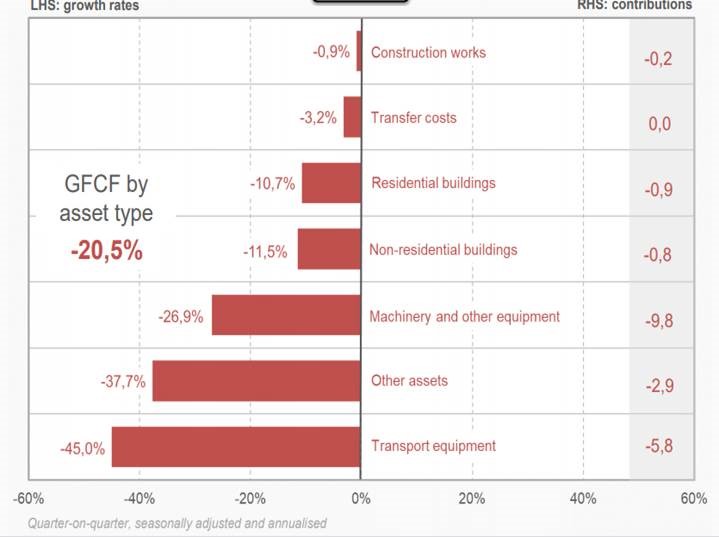

On the expenditure side, domestic demand contracted by 2.3%q-o-q which can be ascribed to a decline in inventories (mining and manufacturing production contracted and imports declined) and fixed investment. Positive contributions were made by consumption spending by households (+0.7% q-o-q vs 0.2% q-o-q) related to pre-Covid spending and government spending (+0.7% q-o-q vs +0.4%q-o-q). Large negative contribution came from fixed investment (-20.5%q-o-q) and exports (-2.3% q-o-q).

On the production side, the supply-side remained under considerable pressure with a decline in gross value added from mining, manufacturing, electricity and construction - the primary and secondary industries contracted by 11.8%q-o-q and 7.5% q-o-q respectively. Output in the services sector increased by 1.3% q-o-q (with finances, government spending, transport and communication, retail trade and personal services registering positive growth).

The better than expected outcome of 1Q 20 GDP outcome is unlikely to lead to a meaningful upward adjustment to our 2020 GDP growth forecast of -7.4%, in view of the high level of uncertainty. South Africa’s lockdown started end the of March but the effect of Covid-19 was already evident in the fall of export volumes with lockdowns in China and Europe impacting global trade and tourism. In Q2 20, the South African economy will bear the brunt of both the global and local lockdowns. We forecast a contraction in GDP growth in Q2 20 of around 37%q-o-q and a mild rebound of around 6.3% q-o-q in Q3 20. Incoming indicators suggest that the Stage 3 lockdown in June has not yet seen a meaningful recovery in economic activity such as retail, recreation and mobility trends to pre-Covid levels (Source: Google community reports).

The gross operating surplus (a proxy for the profitability of the corporate sector) increased by 5.1%y-o-y (previously 4.0%). Compensation remained under pressure, rising by 4.4%y-o-y from 4.0%y-o-y previously.

The deficit on the current account (published next Thursday) is expected around -1% of GDP from -1.3% of GDP.

Key numbers:

GDP growth: -2.0%q-o-q, from -1.4%q-o-q in the previous quarter; -0.9%Y

Household consumption: +0.2%q-o-q from 0.7%q-o-q.

Fixed investment: -20.5%q-o-q from -10.0%q-o-q (All sub-sectors were negative with transport equipment (-45.0%, machinery and equipment -26.9%,, non-residential -11.5%, residential -10.7%). Private sector investment contracted by -25.3%q-o-q (previously -10.3%q-o-q) and public corporations by -20.9%q-o-q (previously -0.3 q-o-q).

Exports: -3.5% q-o-q from +2.3% q-o-q

Imports: -16.7%q-o-q from -8.5%q-o-q

Inventories (contribution to GDP contraction): -3.4ppt from -3.3ppt

Figure 1 GDP (%)

Figure 2: Production side of the economy – Q1 2020