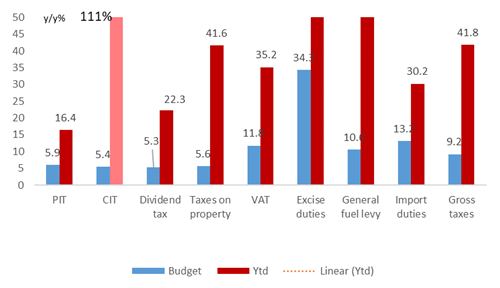

Revenue receipts in August remained ahead of the budget target. The overrun in revenue receipts could be closer to R100bn than our previous estimate of R85bn.

Expenditure has accelerated mainly as Eskom received the total cash injection of R31.7bn. Current spending is expected to accelerate in the coming months with the implementation of the public sector wage increase of R20bn and social distress grants of R26.8bn.

The cumulative budget deficit reached R195.2bn, which is 40% less than the shortfall over the same period in F20/21.

Analysis of revenue receipts

The exchequer data for August 2021 reveals that revenue receipts continued to surprise on the upside. A breakdown of the various income taxes showed that most taxes are well ahead of target.

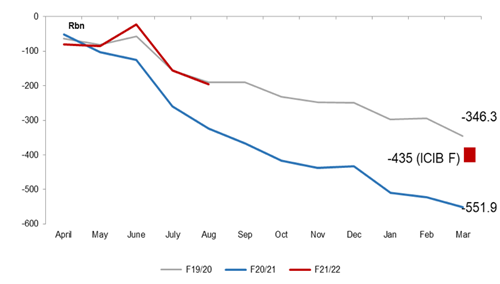

- Corporate income tax (CIT) is 111.5% higher than the same period in F20/21, buoyed by solid earnings growth from mining and financial companies.

- Personal income tax (PIT) continued to perform well. This can probably be ascribed to higher wage increases in sectors where economic activity and profitability have rebounded compared to the previous year. PIT receipts have increased by 16.4% compared to a target of 5.9%.

- VAT receipts have increased by 35.2% compared to a target of 11.8%. However, the momentum has started to moderate as base effects are fading and refunds are accelerating.

- The risk to our forecast of R85bn is to the upside on account of the strong performance from PIT.

The MTBPS will be tabled on Thursday, 4 November 2021

Figure 1 Revenue receipts: April – Aug 21 % change over the corresponding period in 2020

Figure 2 Cumulative budget deficit for FY21/22 40% better than in the same period last year