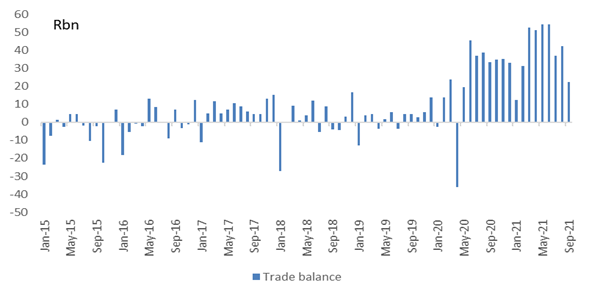

The merchandise trade surplus halved in September on the back of higher oil prices and lower commodity prices

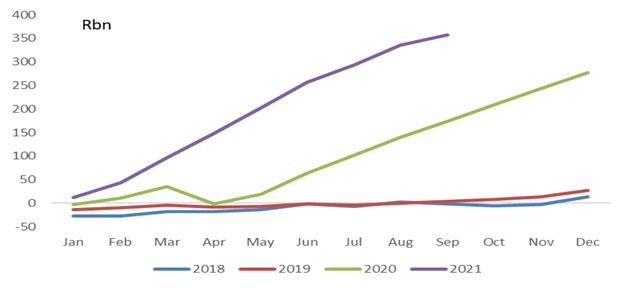

The trade surplus moderated to R22.2bn in September compared to an average of R49.7bn per month from April to August. In Q3 21, the trade surplus amounted to R101.5bn, which remains substantial but is nearly R50bn less than the significant surplus of R160.1bn. The latter resulted from an acceleration in the value of exports and muted growth in imports, which was instrumental in raising the current account surplus to 6.7% of GDP. The main reason behind the moderation in September’s trade surplus was an acceleration in the value of oil imports because of a rise in the oil price and possibly higher imports of refined products. The value of total imports accelerated by 15.9%m/m and 22.6%%y/y. The value of exports was slightly lower over the month ((down by 1%m/m) but remained at elevated levels compared to the same period in 2020 (+37.2%). The cumulative trade surplus from January to September remains large at R358bn vs. R173.7bn over the same period in 2020.

While the terms of trade remain at elevated levels, owing to an acceleration in the coal price on the back of the energy crisis in China, the decline in other key export prices such as iron ore, gold, platinum, and uranium and a commensurate increase in the price of oil, are likely to lower the trade surplus in coming months. Additionally, demand for imports may increase, owing to low inventory levels. We forecast a current account surplus of 3.8% of GDP and a deficit of -0.2% in 2021 and 2022.

Merchandise trade surplus

Cumulative trade surplus in September