Key focus points

• In a triple split decision (1-3-1 of 50bp, 75bp and 100bp), the MPC raised the repo rate by 75bps to 5.5%.

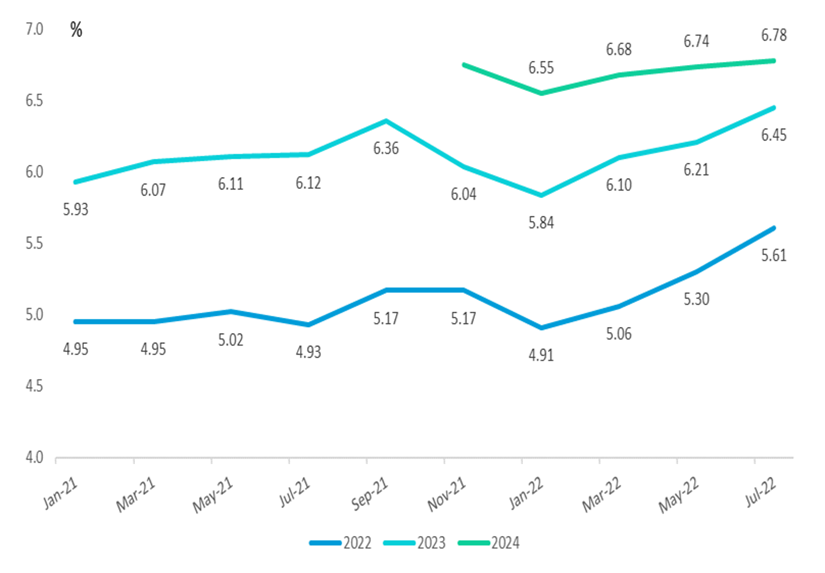

• The interest rate path in the QPM shows a more frontloaded hike trajectory, with the neutral policy rate unchanged at 6.78% at the end of 2024.

• The tone of the MPC statement, discussion in the Q&A and size of the rate hike revealed a more hawkish stance than expected by ICIB and Bloomberg consensus expectations.

• The MPC statement was perceived as more hawkish by the market, the main driving factor being the vote, with one member in favour of 100bps.

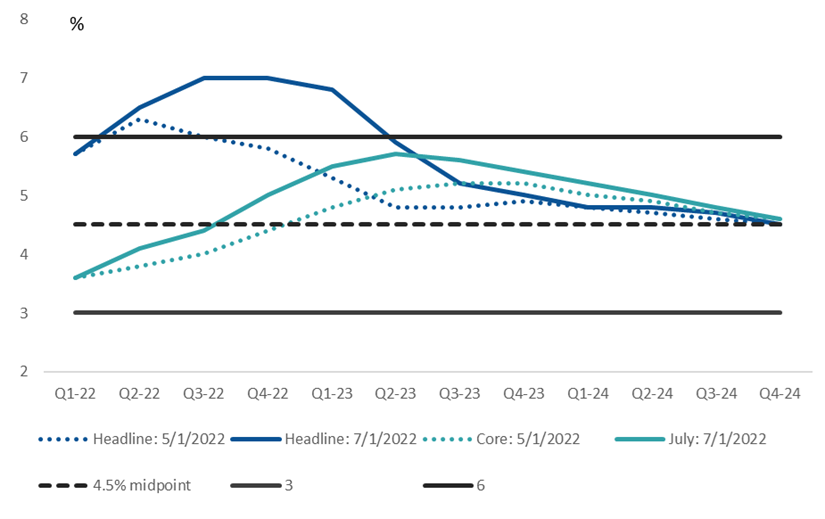

• The inflation forecast underwent a material upgrade to 6.3% (5.9%) and 5.7% (5.0%) in 2022 and 2023 before returning to 4.7% in 2024. The real inflation adjusted repo rate would have become more negative in 2023 with a smaller rate hike.

• Inflation expectations deteriorated in the short-term, rising to 6.0% (5.1%) in 2022.

• The balance of risks to the inflation outlook remains to the upside.

Market backdrop

The MPC meeting took place in the context of a further rise in global inflation, e.g. the US and South Africa’s CPI inflation rates at 9.6% and 7.4%, respectively, in June. More central banks are accelerating policy normalisation by implementing larger rate hikes, e.g., BoC +100bp, RBA +50bp, RBNZ +50bp, ECB +50bp and a second successive rate hike of 75bp expected from the FOMC on 27 July).

Drivers of more persistent inflation risks

The needle for a larger rate hike was shifted by a higher risk of inflation becoming more persistent over the medium. This was reflected in a deterioration in the SARB’s core CPI inflation forecast over the next 12 months, with goods and services inflation accelerating faster. The forecast was raised to 4.3% (3.9%), 5.6% (5.1%) and 4.9% (4.8%) in 2022, 2023 and 2024. However, the balance of inflation risks remains to the upside.

These include the following:

• Global producer and food price inflation. (Investec Securities’ food price analyst warns that food price inflation could continue to accelerate in 3Q 22 before moderating in 4Q 22. The risk is that price increases could be stickier even as soft commodity prices are receding due to higher input costs such as transport, fertilizer, a weaker rand and labour costs).

• Russia’s war in Ukraine continues, creating a high level of uncertainty about commodity prices and the European growth outlook.

• The outlook for the oil price is also uncertain. The forecast of Brent spot is raised to an average of $108/bbl ($103/bbl) and $92/bbl ($90/bbl) in 2022 and 2023.

• Electricity tariff increases relative to the SARB’s forecast of 9.2% and 10.0% in 2023 and 2024.

• A weaker rand exchange rate as sharp rate hikes by major central banks lead to tighter global financial conditions, constrain foreign capital inflows to emerging economies and elevated market volatility.

• Nominal wage increases.

Potential growth declines further

The upgrade to the SARB’s GDP growth forecast to 2.0% from 1.7% in 2022 was expected, following the better than expected outcome of growth in 1Q 22 (2.2%q/q). However, a moderation in global growth and domestic spending could lower growth to 1.3% from 1.9% in 2023. The intensification of load shedding was emphasised with more downgrades to potential growth 0.5% (0.6%), 0.8% (0.9%) and 1.1% in 2022, 2023 and 2024. We are awaiting President Ramaphosa’s emergency plan to fast-track the supply of new energy.

Market reaction

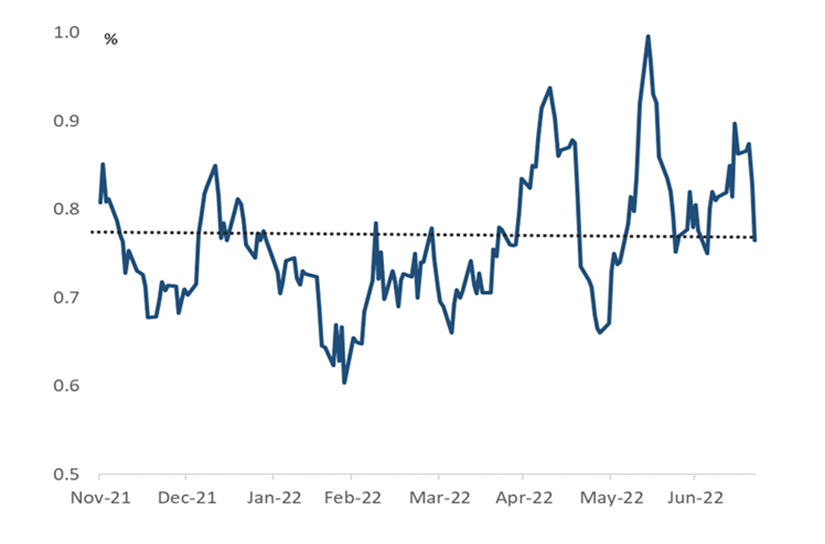

The MPC statement was perceived as more hawkish by the market, with the main driving factor being the split votes. The surprise was one member favouring a 100bp rate hike. However, the decision to hike the policy rate by 75bp is interpreted as showing a willingness’ on the part of the SARB to front load rate hikes to contain inflation expectations.

The curve consequently flattened in the 1v2 yr segment, with the expected terminal rate in the market at 8.0%, well above (and expected to be reached earlier than) the QPM’s forecast of nearly 7.0% by end 2024.

Figure 1 Headline CPI and core CPI inflation forecasts upgraded for 2022 and 2023

Source: SARB, ICIB

Figure 2 SARB’s QPM repo rate forecast revision shows sharper rate hiking cycle with 2024 unchanged

Source: SARB, ICIB

Figure 3 Swap curve: Flattening in 1vs2yr spread

Source: Bloomberg, ICIB