MPC interest rate decision | Dialing down: 3 (+25bps) vs 2 (+50bps)

Key focus points

- The MPC hiked the repo rate by 25bps to 7.25% (ICIB: +25bps, consensus: +50bps).

- Minor changes were made to headline and core CPI inflation forecasts, but risks are deemed to be on the upside.

- GDP growth underwent a significant downward revision to 0.3% (1.2% and 0.7%) (1.4%) in 2023 and 2024. The intensification and lengthening of load shedding shaved 2.0ppt off 2023 GDP growth.

- The moderation in the pace of rate hikes considers the lagged impact of cumulative rate hikes of 350bps since November 2021 on growth.

- The MPC refrained from providing forward guidance as to a possible peak in the rate hiking cycle. The March MPC meeting will be data dependent.

- The balance of risks to the inflation outlook remains on the upside.

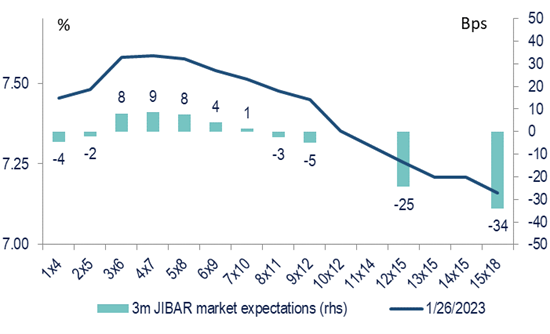

The MPC’s decision to raise the repo rate by 25bps saw a flattening in the FRA curve, as the market priced in a 48% probability of a 50bps rate hike. We expect the 3m JIBAR rate to rise 12bp to 7.50%, and a slight decline in the 12m JIBAR of ~5bp to 8.55%. We expected a close call between a 25/50bps rate hike and as it turned out, three members favoured a 25bps rate hike and two members 50bps.

The MPC refrained from providing forward guidance on the terminal rate. Decisions, going forward will be more data dependent. The moderation in the pace of rate hikes is similar to many other Central Banks, where the lagged effect of cumulative rate hikes in 2022 on the economy is taken into account.

Balance of risks to inflation remains to the upside

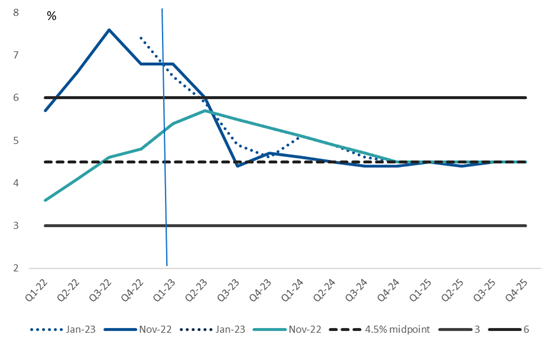

The inflation forecast for 2023 remained unchanged at 5.4%, returning to the midpoint of the target band only by 2H 24. Core CPI inflation has been revised lower in 2023 from 5.7% to 5.5% on account of more subdued increases in housing rental price inflation, owners’ equivalent rent and public transport services inflation. However, the MPC's statement about inflation dynamics remains hawkish. This is reflected in the balance of risks that remains to the upside, which could see a more gradual return of inflation to the midpoint of the target band and core CPI inflation potentially be stickier.

The risk drivers remain the same as in previous statements, i.e. a tight oil market, the double-digit electricity tariff increase (the SARB has pencilled in a rise of 12.9% for municipality tariffs vs Eskom’s increase of 18.6%), domestic food price inflation, and an increase in the cost of doing business brought on by load shedding.

Added to the risks is a possible deterioration in the fiscal position owing to lower commodity prices and SOEs requiring cash injections. In the context of an expected return of the current account from a surplus to a deficit, the rand remains vulnerable. (The starting point of the ZAR forecast was R16.92/$ vs. R17.68/$ previously). We also flag developments in the US, where the implied market rates are expecting a more dovish reaction function from the Fed, which has caused financial conditions to ease.

Looking ahead

The Governor remained emphatic that the stance of monetary policy remains accommodative. The measurement he applied is the current rate of inflation, at 7.2% and repo rate of 7.25%, which keeps the inflation adjusted policy rate at zero. However, on a 12 month forward view, with headline CPI inflation expected to recede to ~5.1%, the policy rate is more restrictive at 2.2%.

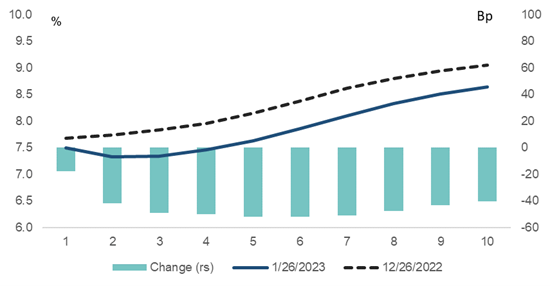

If the status quo prevails going into the March MPC meeting, ICIB believes that the interest rate cycle may have peaked. The moderation in inflation will lead to a more positive real policy rate. Incoming economic data is also expected to weaken as load shedding hits consumption and production. We think the interest rate debate will shift from where the terminal rate could peak (which we believe is at 7.25%) towards when rates could be reduced. The belly of the FRA curve has flattened to 7.55% (at the time of writing) with a slight inversion from 8x11s. The 1y2y swap spread is trading at -15bp. Our base case for rates to move sideways for longer before a moderate easing cycle could commence in 2024.

Figure 1 - SARB’s headline and core CPI inflation forecast: Changes in assumptions lead to minor changes

Source: SARB, ICIB

Figure 2 - FRA curve has flattened after the MPC’s decision to raise the repo rate by 25bps

Source: Bloomberg, ICIB

Figure 3 - Swap curve has inverted

Source: Bloomberg, ICIB