The MPC’s decision to raise the repo rate by 75bps to 7.0%, elicited very little reaction in the market, as it was fully discounted. The unanimous decision was also anticipated, with three members in favour of a 75bp rate hike and two members for 50bps.

We deem the rate hike as very hawkish in view of the following dynamics: The September MPC decision to hike by 75bp, was driven by external factors, i.e. aggressive rate hikes by foreign central banks, and specifically the Fed that impacted interest rate differentials. This lead to an appreciation of the USD (the rand was trading at the time at R17.75/$, compared to the SARB’s starting point of R16.91/$ in the inflation forecast).

The November decision to hike the repo rate was premised not only on an upward revision of the inflation forecast, as expected, but the balance of risk assessment also remained to the upside.

The MPC focused on the following drivers:

• A higher than expected rise in core CPI inflation in October (5.0% from 4.7%). This after the BER’s Q3 22 inflation expectation survey showed a deterioration in September, and reiterated in the November MPC statement. With the SARB’s headline CPI inflation rate forecast staying above the target band in Q1 and Q2 23, the anchoring of inflation expectations is a major concern (ICIB expects headline CPI inflation to return below 6.0% in June 2023).

• A higher expected terminal rate by the US FOMC as the SEP dot plot forecast to be presented at the 14th December FOMC meeting, is likely to be raised from 4.60% to 5.0%. The SARB’s QPM assumptions raised the G3 policy rate from 3.1% to 3.6% in 2023.

The combination of factors trumped an improvement in inflation indicators such as the rand (currently at R16.99/$), as the global markets are pricing in a moderation in the pace of rate hikes by central banks in advanced economies.

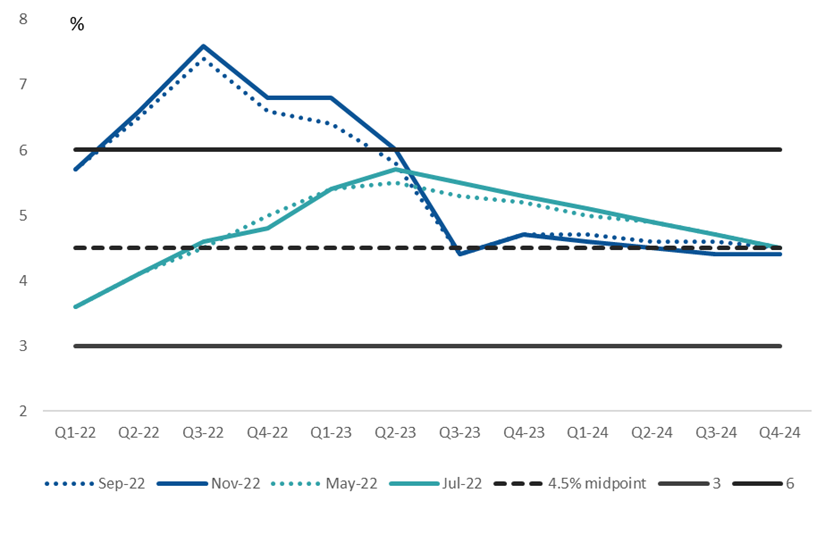

The headline CPI inflation forecast has been raised to 6.8% (6.5%) and 5.4% (5.3%) in 2022 and 2023, but unchanged at 4.7% in 4Q 23. Nersa is expected to announce Eskom’s F23/24 tariff increase in December. The SARB’s forecast pencilled in an increase of 9.0% in July 2023.

The SARB made a material downward revision to its 2023 GDP forecast, from 1.4% to 1.1%, with 2022 marginally lower at 1.8% from 1.9%. Load shedding could shave off 0.6% of growth in 2023. The concern of the SARB is that the negative output gap could disappear in late 2023, as potential growth has also been revised down to 0.4% (0.5%) and 0.5% (0.8%) in 2022 and 2023.

Balance of risks to inflation remains to the upside: In addition to external factors, such as some of the consequences from the ongoing Russian war in Ukraine, more domestic factors were added. In addition to the propagation risk from high petrol and food price inflation into average salary increases, high tariff increases from public sector institutions such as freight rates from Transnet, electricity tariffs from Eskom and rates and taxes from local authorities.

Looking ahead: The MPC will see the repo rate as accommodative for as long as the current real policy rate remains negative. The conviction rate in the 12-month forward inflation forecast at 4.7%, appears to be low considering the balance of risk assessment.

With two of the five MPC members in favour of a 50bp rate hike, the acknowledgement of downside risks to the growth outlook, and in anticipation of a moderation in the pace of rate hikes by the Federal Reserve at the December and January FOMC meetings, we think the SARB could dial down the size of its rate hike at the January MPC meeting to 25bp, where after it could pause as inflation starts to moderate.

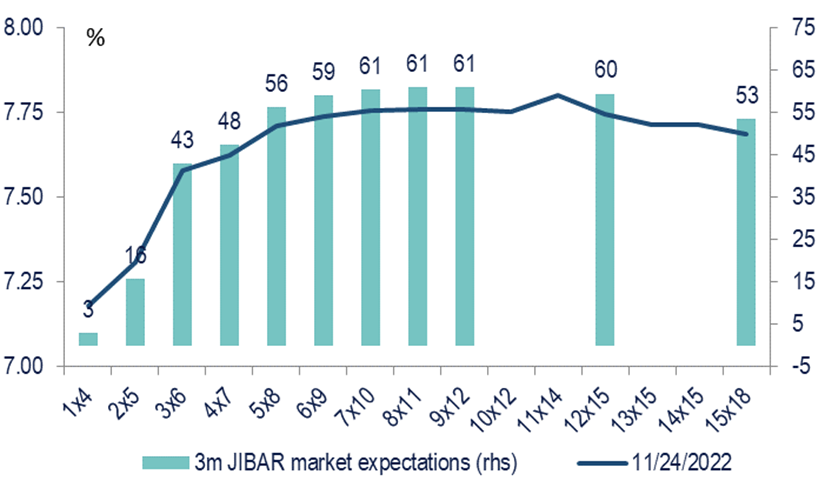

We have revised our terminal rate forecast from 7.0% to 7.25%. The FRA curve remains focused on external drivers, i.e. a slowdown in the pace of Fed rate hikes, pricing in a terminal rate of 7.75% in mid-2022. The curve is flattening/inverted from 12 months.

Figure 1 - Headline CPI and core CPI inflation forecasts upgraded for 2022 and 2023

Source: SARB, ICIB

Figure 2 - FRA curve has flattened/inverted from mid-2023

Source: Bloomberg, ICIB