With the global interest rate cycle in the process of peaking and South Africa’s inflation-adjusted policy rate turning positive, the tone of the MPC statement and Q&A session will be closely monitored. The MPC has been deliberately vague in drawing a line in the sand of where the terminal rate could be. This can be justified in the context of a myriad global and domestic uncertainties which render the inflation outlook highly uncertain. Indeed, several risks flagged in the SARB’s balance of risk assessment have materialised, and the disinflation trajectory was interrupted in February, when headline CPI inflation returned to 7.0%.

Forecast: ICIB forecasts a 25p rate hike to 7.50%, in a vote of 4-1 (25bpbs vs 0).

Global and domestic dynamics as drivers of the terminal rate

Recent developments highlight a tentative divergence in exogenous and domestic drivers of inflation.

Navigating an even more complex external backdrop:

Turmoil in the US banking sector could be more disinflationary if it leads to tightening lending standards and slower credit growth. The US credit impulse started to moderate towards the end of 2022 and could be amplified by tightening credit conditions. While this is unfolding, the Fed and the ECB remain focused on combating high inflation with interest rates, showing that it is differentiating its financial and price stability mandates. The two Central Banks delivered each a rate hike of 25bps and 50bps at their respective March interest rate meetings but the forward guidance was dovish.

G3 interest rates topping out: The ECB refrained from providing forward guidance and the FOMC’s median dot plot forecast was left unchanged at 5.12%, indicating one more 25bps rate hike. The Fed’s forward guidance will balance the uncertainty of how an expected tightening in credit conditions could impact the labour market, demand and inflation.

It is “anticipate(d) that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time”. The pricing of the implied Fed funds forward curve diverges from the Fed’s forecast, which indicates repricing risk and potential volatility in coming months. The May 2023 implied Fed funds figures rate assigns a 44% probability to a 25bps rate hike before a deep inversion that discounts nearly 75bps of rate cuts by December 2023. Chair Powell stated at the FOMC meeting that no rate cuts are expected in 2023. A more dovish outlook for the G3 interest rates could remove some pressure on the SARB’s reaction function.

The pricing of the FRA curve shows that the market anticipates a peak in the rate hiking cycle in March/May in response to the changing US rate expectations. A probability of 100% is attached to a 25bps rate at Thursday’s MPC meeting, followed by a 20% probability of 25bps in May. However, the debate is shifting as to when the first rate cut could materialise, with the 12x15 FRAs (March 2024) trading at 7.46%.

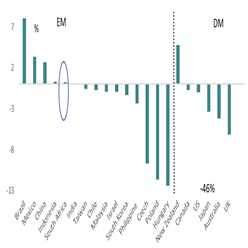

Weaker ZAR: The R/$ exchange rate and trade-weighted index (TWI) have depreciated by ~7.0% since the January MPC meeting, with the starting point in the SARB’s QPM model R16.92/$ (currently R18.29/$). Several SA specific factors have weighed on the ZAR’s performance in addition to the global risk-off sentiment. Many of the dynamics flagged below are expected to prevail in the coming months:

- The deterioration in South Africa’s fundamentals from 4Q22 when load shedding intensified and the rail/port logistics crisis became more apparent, has resulted in the ZAR underperforming many of its peer currencies such as the MXN (which has been on a winning streak until this month), BRL, PLN and IDR.

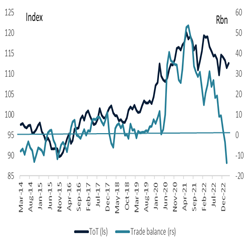

- This has been exacerbated by a deterioration in the terms of trade, which recently rebounded on account of a decline in the oil price and a higher gold price. Although this has likely contributed to the ZAR trading in a range of R18/10.$ to R18/50/$. Added to this has been the balance on the merchandise trade account which has turned into a deficit.

- Non-residents have been net sellers of SAGBs with ownership decreasing to a low of 25.4% of the total outstanding amount.

- Finally, short-term SA/US interest rate differentials (3m at ~235bps) are low by historical standards and behind BRL, COP, MXN and CLP.

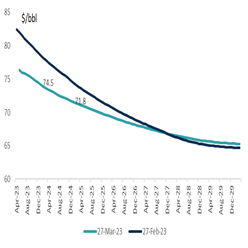

Oil price recedes but volatility risk remains: The decline in US interest rates signal that the market is anticipating a recession, although leveraged credit spreads are not sharing the view. The oil price, however, has tumbled in anticipation of weaker demand. The year-to-date average of Brent spot has receded to $82.3/bbl and the forward curve has flattened, with the current spot price at $75/bbl. This has turned the daily under-recovery on the slate from more than 30c/l in early March to an over-recovery of 14.3/cl, which could allow the petrol price to remain unchanged in April (but also highlighting volatility risk in coming months should the oil price bounce back). A bigger diesel price cut of at least 65/cl is expected with a large daily over-recovery of 151/cl.

Domestic dynamics

Inflation expectations and headline inflation: Domestic dynamics, however, will likely be more dominant in the March 2023 interest rate decision.

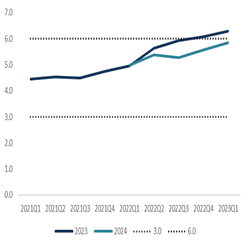

An acceleration in the BER’s 1Q23 inflation expectation survey for 2023 and the return of headline CPI inflation to 7.0% in February, are likely to be the dominant inputs in the SARB’s interest rate decision on Thursday. Bloomberg consensus forecasts are in complete agreement of a 25bps rate hike. Of interest will be any split in the rate decision and a possible shift in the number of members favouring a 25bps increase to 0. In January, there was a shift from

75bps – 50bps to 50bps – 25bps(2-3).

Response to supply-side shock: The supply-side shock, caused by the intensification of load shedding, has led to a supply response from companies and households by investing in more renewable energy. This however has an opportunity cost, as new capacity is not added. Added to this is the high cost of diesel to run generators, which could be passed on to consumers and/or lead to slower earnings growth. Food price inflation has remained stickier, rising to 14% in February. We forecast an annual average of 9.0% from 7.5%.

Wage settlements: The MPC is likely to sound more hawkish than what the reaction function could reveal. The concern is that inflation at around 7% could continue to keep inflation expectations elevated and translate into higher wage settlements. The public sector accepted government’s 7.5% wage increase for F24.

Upward revision to 2023 CPI inflation forecast: The SARB is likely to revise its 2023 inflation forecast (headline CPI inflation 5.4%; core CPI 5.2%) slightly higher owing to the depreciation of the ZAR, with upside risks prevailing. The GDP growth forecast of 0.3% could be revised lower; the IMF downgraded its forecast from 1.2% in January to 0.1% in March.

The policy rate has turned positive: Whereas the neutral rate is seen at 7.0%, monetary policy has become more restrictive as the policy rate was raised to 7.25% in January. The inflation-adjusted policy rate has turned positive as the positive real gap is likely to widen 2.0% - 2.5% in coming months, which is the real neutral rate deemed to contain inflation at the mid-point of the target band of 4.5%.

Figure 1 | US implied Fed funds rates signaling recession ahead

Source: Bloomberg, ICIB

Figure 2 | Brent crude futures curve has flattened

Source: Bloomberg, ICIB

Figure 3 | South Africa’s terms of trade and merchandise trade deficit (3m rolling ave)

Source: SARS, Bloomberg, ICIB

Figure 4 | Inflation expectations have not yet stabilised

Source: Bloomberg, ICIB

Figure 5 | FRA curve expectations (adjusted for repo rate)

Source: SARS, Bloomberg, ICIB

Figure 6 | Policy rates adjusted for current CPI inflation rates

Source: SARS, Bloomberg, ICIB