The domestic macroeconomic setting of the MPC’s interest rate decision this week has become more complicated. Added to this is the US debt ceiling standoff, with X-Date approaching. Several developments since the March MPC meeting are likely to keep the balance of inflation risks to the upside. The MPC’s rate decisions have been influenced by the risk assessment, which has taken the policy rate 75bps over the QPM forecast. Indeed, some of the risks flagged in the assessment have materialised and have become even more elevated. The needle has again moved in the direction of another hike at the May MPC meeting. The context is that inflation is reaching an inflection point (with base effects kicking in from May onwards), but the deceleration to the midpoint of the target could be slower (as SA-specific factors inhibit the disinflationary trend), and a marking down of growth forecasts (SARB 0.2%, ICIB 0.2%, Bloomberg consensus 0.4%). The dilemma for the SARB is how to conduct monetary policy in a stagflation environment. The Governor of the Reserve Bank, Lesetja Kganyago, stated that “the challenging part now is that we must do this in a context where many of the drivers of both inflation and growth are outside of our control”. Source: Public lecture at the University of Johannesburg, 10 May 2023.

Investec Corporate and Institutional Banking (ICIB) is of the view that the SARB has nearly exhausted its capacity to use rate hikes to combat inflation, with the May rate hike the final. The focus could then turn to how long monetary policy could stay in more restrictive territory. However, we note that risk events remain elevated in the coming months, i.e., the BRICS summit in August.

Forecast: ICIB forecasts a 25bp rate hike (although we acknowledge a high risk of 50bps) in a split vote of 3-2 (50bps); Bloomberg consensus anticipates 50bps (only 3 out of 23 analysts expect 25bps) and the FRAs are biased towards 75bps.

Inflation outlook

The upside risks to the inflation outlook have worsened. The key concern is how elevated inflation feeds into core inflation through, inflation expectations, margin pressure arising from higher input costs related to the energy crisis, the weaker rand, higher utility rates and labour costs. In March, the SARB revised its inflation forecast from 5.4% to 6.0% in 2023 and marginally higher from 4.8% to 4.9% in 2024.

In addition, two dynamics could feature more prominently in the interest rate debate:

- Reasons for the depreciation of the ZAR and pass-through effect: The ZAR has depreciated by 6.7% against the USD since the March MPC meeting, with the SARB’s starting point of the currency at R18.06/$. The ZAR has underperformed in major and emerging market currencies since late 2022, with increased SA fundamental and political risks. The concern is that in this context, widening rate interest rate differentials with the rest of the world may provide a short-term reprieve before risk factors reassert themselves. The pass-through effect of a 10% depreciation of the ZARUSD was previously deemed to be ~1.6%, with the maximum impact four to five quarters ahead. Import volumes are anticipated to increase, which raises the risk of a more pronounced pass through. A small reprieve is that the direct effect of the recent currency depreciation on the fuel price has been negated by a fall in the dollar price of oil ($85/bbl. to $76/bbl). A petrol and diesel price reduction of ~R1.0/l is expected in June.

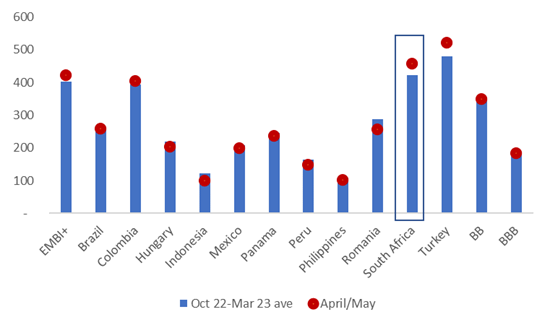

- Country risk premium: A steady flow of negative news in 2023 has hit foreign and domestic investor confidence. The country risk premium, measured by JP Morgan’s EMBI+ index, has increased to an average of 456bps in April and May 2023, 34bps higher than 422bps from October 2022 to March 2023. The average BB spread over the same time has increased from 3bps to 347bps. With fiscal risks likely to reassert themselves from a higher wage bill (government spending is set to rise by R37.4bn) and downside risks to revenue receipts, this could have a bearing on the SARB’s neutral real policy rate, estimated at ~2.3%.

Fig 1: Country risk premium – EMBI+ spread comparison

Source: Bloomberg, ICIB

Market dynamics

Key market movements in SA’s interest rate markets

SA interest rates rose materially after the South Africa/United States diplomatic fallout. The ALBI’s total return has yielded a negative return of 4.6% month-to-date, with the 12+ segment at -5.5%. While it is difficult to determine the fair value of SAGBs in the current environment, where political uncertainty, the concern of a further blowout in the rand, and immediate SA-specific catalysts are not expected to restore confidence, we focus on the pricing of the short-end of the curve in the context of monetary policy scenarios. The liquidity premium on the R186 has pushed the yield to nearly 10.0% (currently trading at 9.88%). The market is pricing aggressive rate hikes by the SARB in the event of a grid collapse and a further fallout in the ZAR. This is a bear case scenario in the current monetary policy framework, as the SARB does not use the interest rate to defend the ZAR, as in the 1990s. For this scenario to materialise, inflation has to reverse trend and accelerate to ~ 8.0+%. The SARB’s communication in the Q&A session will therefore be important.

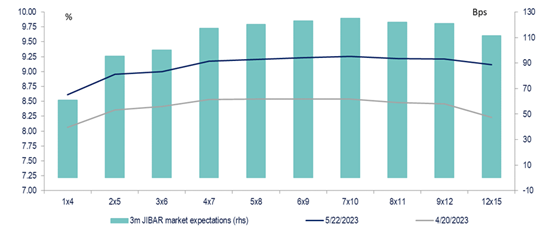

Fig 2: FRA rates are pricing in 75bps at May MPC meeting and a total of 125bps by November

Source: Bloomberg, ICIB

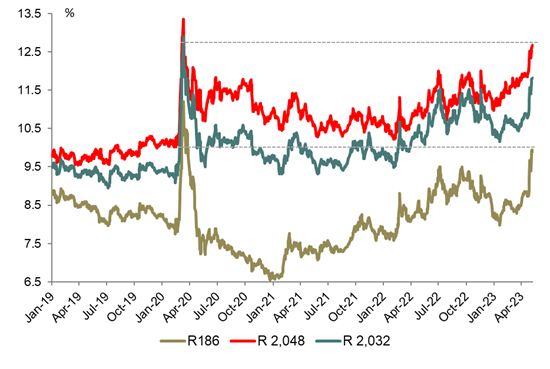

Fig 3: SAGB yields pricing in worst case scenario of grid failure and a further rand fallout

Source: Bloomberg, ICIB