The MPC’s decision to raise the repo rate by 75bps was widely expected. The surprise, however, was that two of the five members favoured a 100bps rate hike, making the decision a hawkish one, similar to the Fed’s decision the previous evening.

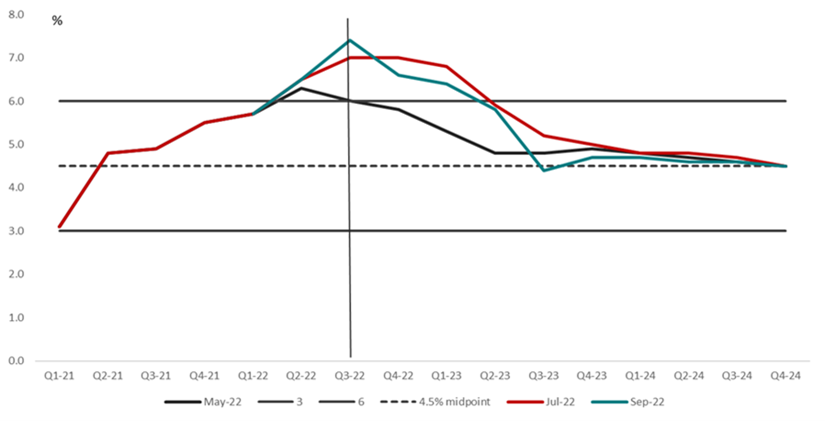

However, whereas the FOMC’s hawkishness was linked to an upward revision in the dot plot interest rate forecast and squashing market expectations of rate cuts as early as H2 23, the MPC’s hawkishness cannot be ascribed to a deterioration in the inflation outlook. Indeed, while the headline and core CPI inflation forecasts were left unchanged at 6.5% and 4.3% in 2022, the forecast for 2023 was revised to 5.3% (P: 5.7%) and 5.4% (P: 5.6%). Moreover, the BER’s inflation expectation survey for 3Q 22 presented mixed results. Near term and 2023 inflation expectations, sensitive to current inflation outcomes, accelerated to 6.5% (P: 6.0%) and 5.9% (5.6%) due to their sensitivity to current inflation outcomes. But medium and longer term inflation expectations remained contained, i.e. the average five-year inflation expectation rate moderated from 5.6% to 5.4% and 2023 from 5.4% to 5.3%.

Balance of risks to inflation remains to the upside: The balance of risk assessment stood out, remaining to the upside. The MPC statement noted that “the risks to inflation identified over the past year have been realised, pushing up South Africa’s headline rate and inflation expectations”. Because of a high level of uncertainty internationally, arising from the Russian/Ukraine war, the energy crisis in Europe, and China’s zero-tolerance Covid-19 policy, the oil price’s recent declines can be reversed abruptly. In South Africa, the public sector wage bill (of which the SARB has penciled in the February 2022 forecast of 2.6%) remains uncertain as trade unions have rejected the government’s offer of 3.0% on the extension of the cash gratuity of nearly R20.0bn. Further, the outlook for food and fuel price inflation remains uncertain. Over the medium term, electricity tariff increases (SARB assumption is 8.9% vs. Eskom’s application of 32.5%) and other administered price increases hold potential implications for the direction of inflation in 2H 23, when base effects could otherwise lead to a meaningful decline in inflation to below 5.0%.

Finally, the MPC noted the acceleration in the normalisation of policy rates by major central banks, with more rate hikes from the G3 central banks presenting additional risks to the rand. The starting point of the rand in the SARB’s inflation forecast was R16.90/$, while currently trading at R17.60/$. Foreign capital flows and market volatility risk remain elevated for currencies such as the ZAR, with risks to imported and core goods inflation.

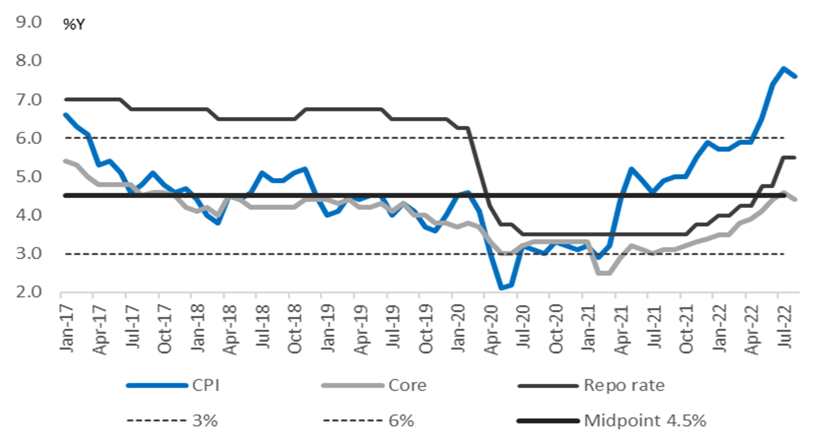

Looking ahead: We think that predicting the SARB’s reaction function, i.e. the magnitude and pace of rate hikes, could become more difficult as the policy rate approaches the neutral rate of 6.75%, as projected by the QPM. While FRA rates remain focused on the pace and size of Fed rate hikes, i.e. both pricing in a 75bps rate hike at the respective November interest rate meetings, approaching the neutral rate in South Africa could warrant a shift to a more gradual pace of rate hikes. The risk of continuing with an aggressive, front-loaded path of rate hikes could lead to a more restrictive policy stance for an economy not suffering from demand-pull pressures.

In this respect, ZAR movements, the unfolding of SA specific risk factors and the underlying trend in core CPI inflation will be closely monitored. Our base case interest rate view is that the rate hiking cycle could end in November 2022 or January 2023, with a 50bps rise in total, raising the repo rate to 6.75%.

Figure 1 Headline CPI inflation forecast revised lower but concern remains that upside balance of risk could be realised

Source: SARB, ICIB

Figure 2 Inflation and repo rate

Source: SARB, ICIB