Presenting a Medium Term Budget Policy Statement (MTBPS) ahead of the ANC elective conference in December, was always going to be challenging. Key focus points were therefore the allocation of the expected revenue overrun, and policy announcements around a permanent income grant.

While there are considerable uncertainties around spending pressures, not only in the current fiscal year, but also over the MTEF period, a primary surplus is nonetheless expected to be achieved in F23/24.This is one year earlier than the previous forecast. The partial allocation of the revenue windfall to reduce debt in 2021 and 2022 has gone a long way in lowering fiscal risks.

The sovereign credit rating stabilized in early 2022. Moody’s changed the negative outlook to stable (Ba2, stable) and S&P’s revised outlook from stable to positive (BB-). Both agencies are reviewing current credit ratings in November. We think the return to a primary surplus could be a development that would not go unnoticed.

The MTBPS directed more spending to infrastructure spending, to support a challenging operational environment.

Key focus points

Balancing the revenue overrun between spending pressures and debt reduction

Material allocation to SOCs at the center of logistics: The net increase in additional spending appropriations amounts to R32.7bn. State Owned Corporations (SOCs) featured prominently, and even more so than we anticipated, in the allocation of additional spending appropriations of R30bn.The long outstanding non-payment of e-tolls of GFIP impacting SANRAL and the logistics crisis at Transnet, required financial assistance to mitigate operational and financial risks facing these entities. E-tolls have effectively come to an end. SANRAL receives R23.7bn to settle maturing government-guaranteed debt and service debt. With a moratorium on borrowing, SANRAL has run down cash balances to redeem debt in the current fiscal year. Transnet is allocated R5.8bn to repair infrastructure damaged by KZN floods and maintain freight rail locomotives. Denel is set to receive another R3.4bn to complete its turn around plan, if set conditions are met. KZN disaster relief of nearly R7.0bn was announced.

Planning for inevitable spending pressures over the MTEF period

The baseline spending forecast over the MTEF period has lost credibility, as National Treasury has been unable to adhere to its self-imposed expenditure ceiling. Unforeseen events have persistently required additional financial assistance

• July 2020 unrest (with allocations to Sasria of more than R20bn)

• KZN disaster flood relief in 2022 (R6.0bn)

• The social relief of distress grant (Covid-19 pandemic in 2020 and extended to 2023)

To deal with the uncertainty and inevitable increase in spending, National Treasury has started to make provisions, not allocated to votes, in the outer years of the MTEF framework. For example, R41.3bn and R47.3bn have been penciled in for in F24/25 and F25/26.

However, there remain several outstanding issues that could only receive closure in the February 2023 and February 2024 budgets:

Politics and the public sector wage bill: As always, the MTBPS carries forecast risk associated with the increase in the public sector wage bill. The baseline forecast has been revised by R14.7bn, to assume an annual increase of 4.4% from 2.1%. This has been rejected by the Public Servants Association of South Africa (PSA). The outcome holds implications for the baseline MTEF forecast:

• There could be base effects as the cost of living increase currently under consideration is pensionable

• The cash gratuity of R20.5bn will be discontinued from next year

• The projected growth rate of a decline of 1.1% is not realistic (the decision was taken that negotiations have to be concluded)

Social protection: The social distress of relief grant will be extended into F23/24, financed from the spillover effect from of higher revenue receipts in the current fiscal year. A permanent income grant is only expected to be finalized in the February 2024 budget. Inflation adjusted increases in other social programmes are expected to be announced in the February 2023 Budget.

Eskom debt transfer: The MTBPS provided no additional information about the pending debt transfer of a portion of Eskom’s R400bn debt burden to government’s balance sheet. While the net effect on spending could be limited, as current liquidity injections of R23bn p.a. could be redirected into servicing debt, there are implications for government’s debt maturity profile and the financing strategy. Details of the programme will be announced in the February 2023 budget.

Macro economic outlook and tax buoyancy forecast

The macro economic forecasts have been revised as the macro economic outlook has deteriorated since the February 2022 Budget Review. Real GDP growth at 1.9% and 1.4% in 2022 and 2023 is more aligned with the SARB’s forecast at 2.0% and 1.3% respectively. National Treasury sees improved prospects for fixed investment, raising it to 3.6% in 2024 from 1.9% in 2023, as the privates sector participates in some of the infrastructure initiative and renewable energy.

The nominal GDP forecast has been raised to 5.8%, 6.2% and 6.6% and is below ICIBs forecast of 8.1%, 7.2% and 5.9%. The tax buoyancy assumption for F23/24 at 1.03 times is below the projection of 2.07 times in the current fiscal year. This assumes a material reduction in corporate income tax (CIT) from 6.29 times to 0.06 times, in view of high base effects and the volatile pattern of the performance of mining taxes.

Figure 1 Upward revision to nominal GDP growth

Source: National Treasury, ICIB

CIT remains an important driver of revenue receipts

Revenues are projected to be R106.3bn ahead of target (ICIB F: R110bn). This consists of R83.5bn in gross tax receipts, non-tax revenues of R19.1bn (including the proceeds of the spectrum auction of R12bn) and departmental revenues of R3.7bn. Corporate income tax (CIT) remains an important and volatile driver of revenue receipts. The target for CIT was raised by R62.8b and dividend tax by R5.7bn. Mining tax payments remain high by historical standards, and the economic recovery has broadened to the financial services and manufacturing industries.

Whilst employment growth remains weak, personal income tax (PIT) was expected to increase by R8.2bn, on the back of higher earnings and bonuses in the financial sector. Excise duties and imported VAT have been revised higher by R11.8bn, owing to higher imports.

The fuel levy and VAT receipt target have been revised down by R4.8bn and R8.5bn respectively. VAT refunds are expected to increase because of higher fixed investment in the finance sector and increased manufactured exports.

The carry over effect of the higher revenue base in the next two fiscal years amount to a total of R193bn (R110bn and R101bn respectively), which is in line with ICIBs forecast.

Fiscal risks remain contained

The main budget deficit for FY21/22 and FY22/23 shows an improvement, relative to the February 2022 forecast to 5.1% (F5.5%) and 4.9% (F: 6.0%) of GDP, respectively. The forecasts for debt servicing costs and gross-debt-to-GDP ratios remain uncertain, as discussed above. The gross-debt-to-GDP trajectory, over the MTEF period, shows a peak of 71.4% of GDP in F22/23. This, however, excludes Eskom's debt transfer, which could add 2.9% of GDP if R200bn is added to government’s balance sheet. With more spending pressures to be released in coming years, we think an assumption of 75% of GDP is more realistic.

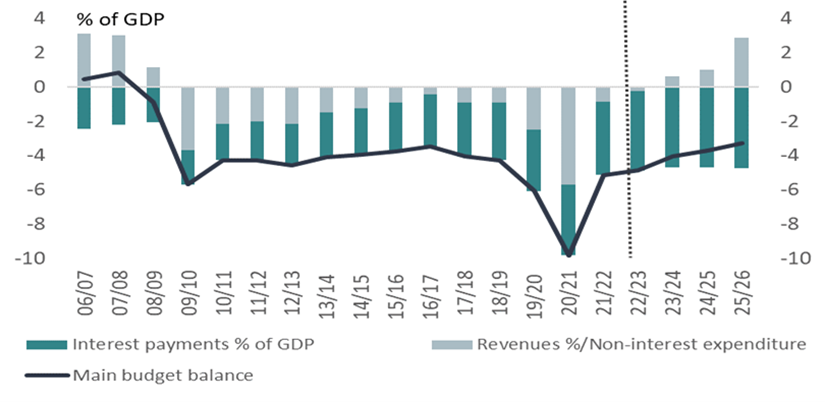

Figure 2 First primary budget surplus expected in 15 years

Source: National Treasury, ICIB

In spite of a primary surplus, the acceleration in debt servicing costs is not moderating. Debt servicing costs (excluding Eskom debt) is forecast to rise from 15.2% to 16.8% of total spending by FY25.26. Several developments are required to reduce debt servicing costs on a sustainable basis:

- A reduction in the country risk premium

- A return of marginal buyers into the bond market

- An increase in GDP growth

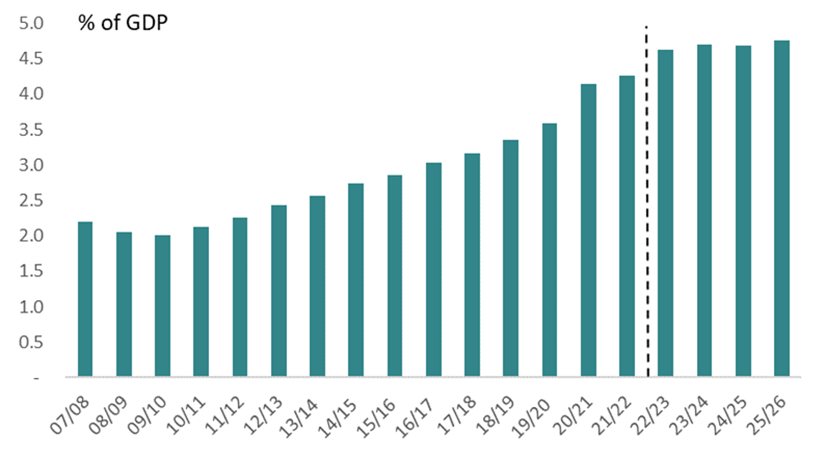

Figure 3 Debt servicing costs continue to rise

Source: National Treasury, ICIB

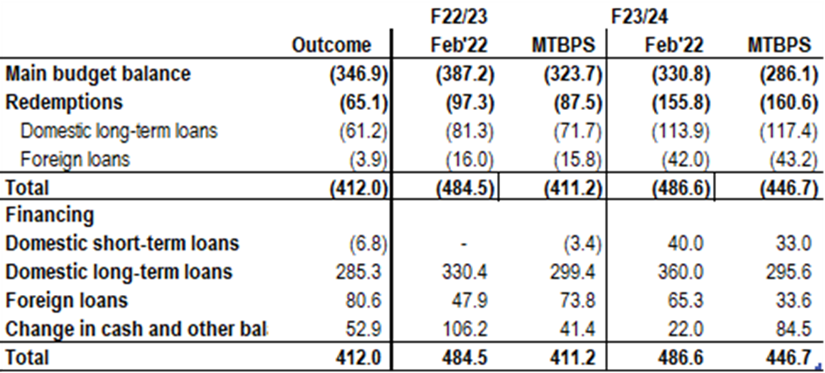

Bond supply – FRN auction to end and keeping SAGB/ILB auctions the same

A decline in the main budget deficit and increase in cash balances have reduced the total financing requirement from R484.4bn to R411.7bn in F22/23. This allows National Treasury to reduce net T-bill issuance from nil to -R3.4bn, domestic long-term loans from R330.4bn to R299.4bn and drawdown R41.4bn in cash balances. The reduction in long-term loans of R30bn will be achieved by ending the auction of FRNs, of which R45.4bn has been issued to date. However, the current funding pace of SAGBs/ILBs indicates that approximately R285bn of cash can be raised. Added to this cash raised from the FRN issue, suggests higher closing cash balances, depending on the wage settlement.

The financing requirement for F23/24 has been reduced from R487.6bn to R446.7bn. The forecast assumes a more significant drawn down in cash balances of R84.5bn, and projects total long-term bond issuance of R295.6bn. While there is upside risk to the supply forecast, it is conceivable that FRN auctions could be revived if the current pace of SAGB/ILB funding is maintained in the new fiscal year.

Figure 4 Financing of the main borrowing requirement

Source: National Treasury, ICIB