Following a more hawkish ECB yesterday that sparked a selloff in peripheral EA bonds and a weaker EUR, the US CPI amplified negative risk sentiment. Many of the inflation measures continued to ascend, reaching record high levels instead of reaching a peak.

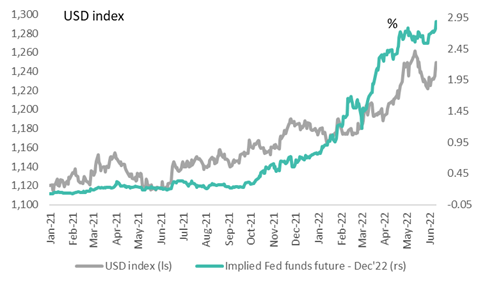

US CPI inflation increased by 8.6% in May from 8.3% in the previous. The outcome was well above market expectations of 8.3% and the highest annual rate of increase since December 1981. Over the month, prices accelerated y1.0% (0.3% previously). Of concern is that the increase in consumer prices was broad-based. The main contributors were shelter, gasoline and food. The gasoline index rose by 4.1%m/m and the food index by 1.2%. Over 12 months, energy price inflation was 34.6% higher and reached the highest level since September 2005. Food price inflation increased by 10.1%y/y. This is the first double digit increase since March 1981.

Core CPI, excluding food and energy, rose by 0.6%m/m and 6.0%y/y (previously 6.2%). There were material increases in airline fares (+12.6%m/m from 18.6% previously), used cars and trucks accelerated by 1.8%), and shelter by 0.6% which is the highest increase since March 2004.

The rand has recorded an abrupt reversal over the past two days. On Thursday, the USDZAR traded as low as R15.29/$ the most substantial level since mid-April and outperforming most EM currencies, except for the RUB. Since yesterday, risk off sentiment has pushed the ZAR to R15.70/$ post the US CPI print. It is possible that the ZAR rally earlier in the week could have been supported by better Q1 GDP data (+1.9%q/q from 1.4% previously). However, high frequency data for April showed a sharp contraction in mining and manufacturing production. Mining was hit by a decline in gold output (owing to the prolonged strike at Sibanye), PGM and iron ore, whereas manufacturing output took a hit in the wake of KZN floods. The outlook for 2Q 22 is currently very challenging. Retail sales for April were published on June 15 and could provide more information on rising inflation's effect on spending.

FRA rates continue to price in an aggressive frontloaded rate hiking trajectory of 50bp at each of the following four MPC meetings. With upside risk to inflation and many Central Banks hiking rates by 50bp and more over the past few weeks, the debate in the FRA market is if the SARB could deliver a 50bp or 75bp rate hike. The concern is that even though supply-side shocks cause inflation in South Africa, an elevated inflation rate could lead to an un-anchoring of inflation expectations and a wage/price spiral. The rate hike trajectory embedded in the FRA curve is too steep, as we think the MPC could start toning down rate hikes by November as inflation could moderate for mechanical reasons from Q4 22.

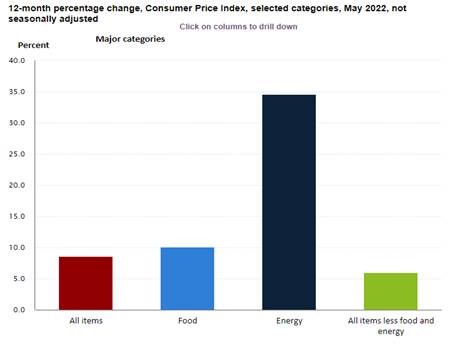

The week ahead: The key event next week is the FOMC meeting on 15/6. A rate hike of 50bp is widely expected. The Fed also updated its SEP forecasts and the DOT plot interest rate projection of the various Fed members. The forward guidance from the FOMC has been that aggressive rate hikes will continue until there has been a turn in inflation. The outcome of today's print shows that the Fed will continue to deliver a very hawkish message. The uncertainty stems from how much the Fed funds target rate has to be raised above the neutral rate to cool down inflation and whether this can be achieved with a soft landing or a recession.

Figure 1 US CPI inflation – All items, food, energy and core CPI (y/y%)

Figure 2 Dec' 2 implied Fed funds futures: 2.95% is well above neutral rate of 2.5% USD supported by risk off sentiment and more aggressive rate hike expectations