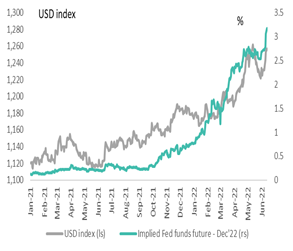

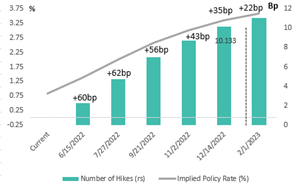

Fed funds futures repriced after Friday’s CPI print to add another 50bp rate hike. The Dec implied rate is pricing in a total of 256bp with the Dec rate at 3.16%. The market debate has shifted to a rate hike of 50bp to 75bp with 100bp also flagged. The USD is on the front foot, having appreciated by 1.15% from Thursday afternoon. G10 and EM FX (except for the RUB) have depreciated, with the ZAR currently trading at R15.96/$. SA’s FIC market is in a reactive mode, with the yield on the R186 trading at 8.71% from Thursday’s close of 8.49%. The FOMC communication on Wednesday is going to be critical after May’s inflation showing inflationary pressures are even stronger than expected and the repricing of rate expectations, in the context of an inflation/growth trade off and risk of stagflation.