Surprise drivers relative to our forecast:

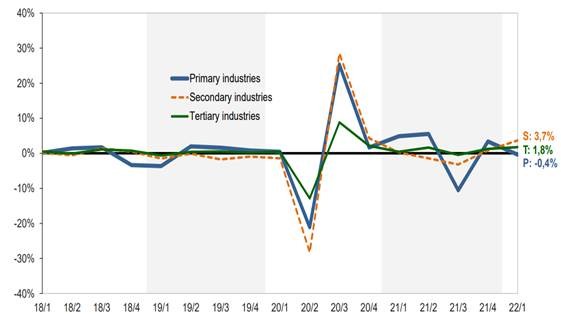

Production side:

- Positive growth in agriculture of 0.8% (ICIB -2.0%).

- Better outcome for tertiary/services sector:

o Trade, catering and accommodation 3.1% (ICIB 1.9% owing to softer increase in q/q increase in retail sales)

o Transport, storage and communication 1.8% (ICIB 1.0%) – land transport and communication.

o Personal services are better, owing to an increase in economic activity reported for the community and other producers.

In line with our forecast:

- Finance, real estate and business services (1.7%) – most driven by insurance & pension funding, auxiliary activities, real estate activities and business services.

- Manufacturing is in line with our forecast (4.9%) – driven by an increase in the production of petroleum & chemicals, food & beverages and iron & steel.

- Construction remains in the doldrums, declining by 0.7%q/q for the fourth consecutive quarter, as residential building and construction sector activity weak.

Figure 1 Services and secondary (manufacturing) behind firmer growth (q/q sa%)

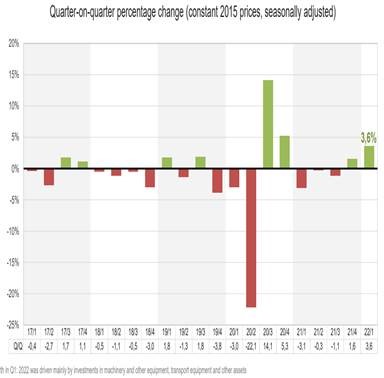

Expenditure side:

- Expenditure gained momentum in 1Q 22, rising to 1.9%q/q (SA) from 1.5%q/q and 2.6%y/y.

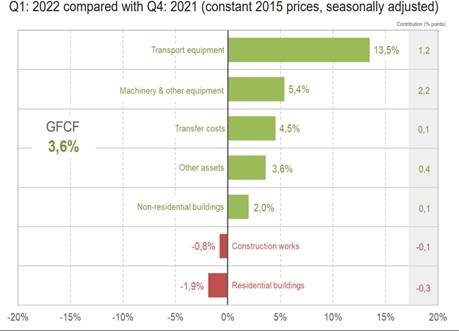

o The key driver was an encouraging increase in fixed investment +3.6%q/q from 1/6% (y/y 2.6%).

o Household consumption lost momentum, rising by 1.4%q/q from 3.0%q/q.

- The fastest growing subsectors were restaurants and hotels (+6.5%) and transport (2.8%) and food and non-alcohol beverages (+2.5%).

o Inventories continued to be depleted. This remains an import potential driver of growth going forward. However, inventories are also likely to carry a large import component, which implies higher inputs costs.

o Exports continued to increase (+3.9%) but at a slower rate compared to Q4 of 8.3%. Imports remained positive, rising by 4.9%q/q (8.4% previously).

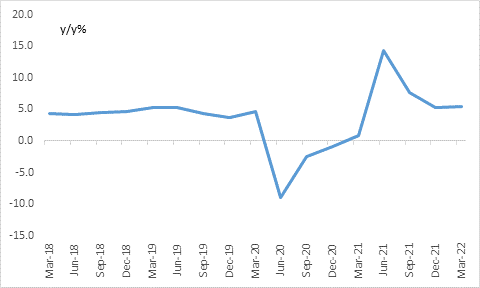

Figure 2 Compensation slightly higher at 5.5%y/y from 5.2%

Figure 3 Fixed investment is improving

Figure 4 Driven by transport equipment (higher imports) and machinery

Recovery in the services can be ascribed to the opening of the economy

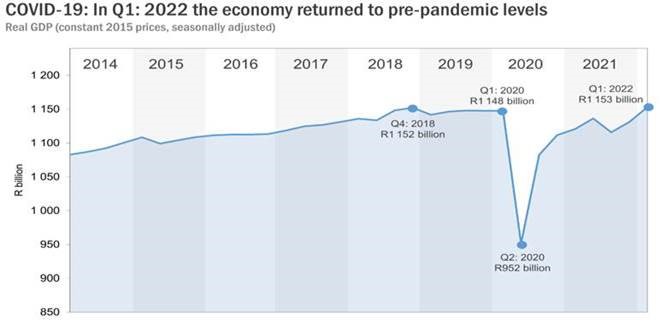

GDP has returned to pre-Covid levels in 1Q 22 – this is ahead of the SARBs forecast of this being realized towards the end of 2022. The combination of an upward revision to growth in Q4 21 (raised from 1.2% q/q to 1.4% (sa) and the rebound in 1Q 22 is behind the earlier return.