Who has been buying SAGBs in June?

In June, government raised R46.6bn in the domestic capital markets, comprising a net increase of R12.0bn in short-term loans (R11.8bn of Treasury bills and R0.2bn from the CPD) and R43.3bn in net domestic long-term loans (gross loan issuance of R49.6bn). The quantum of weekly nominal bond auctions was raised in mid-May from R4.5bn to R6.1bn and inflation linked bond auctions from R1.0bn to R1.4bn.

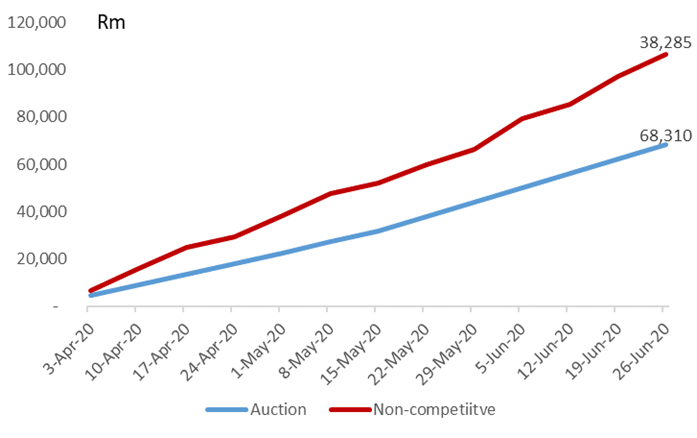

Total government bond issuance: Government bond issuance in the domestic market raised R37.7bn in SAGBs, R5.6bn in ILBs and approximately R3.4bn in retail bonds. Non-competitive bond auctions have accounted for 39% of the nominal monthly issuance (R15.7bn).

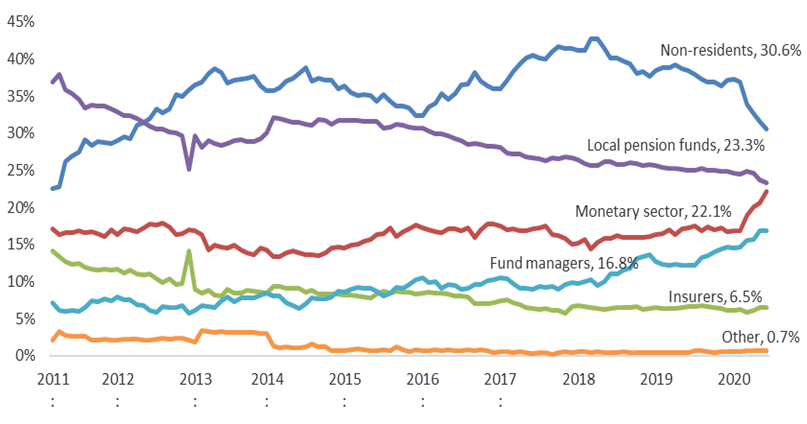

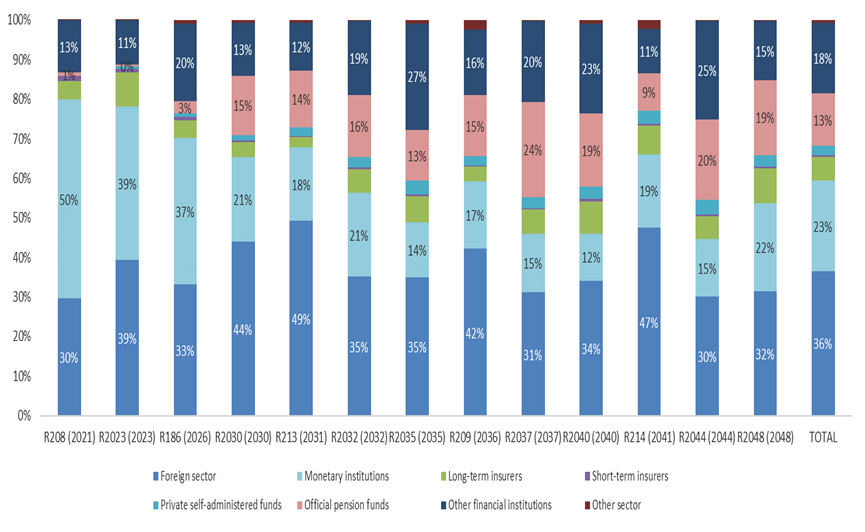

Ownership of holdings of government bonds showed non-residents continued to reduce exposure to South African government bonds, declining to 30.6% of total outstanding bonds from 31.5% in the previous month and 37.3% in January 2020. Local pension fund holdings decreased from 23.7% to 23.3%. The main sources of funding was from banks and “other” (which consists of unit trusts and hedge funds) which absorbed the increased supply of bonds from government and selling of bonds in the secondary market. Ownership by the monetary sector increased from 20.6% to 22.21%.

Figure 1 Ownership of government bonds (SAGBs and ILBs)

Source: National Treasury, ICIB

Who has been selling and buying SAGBs

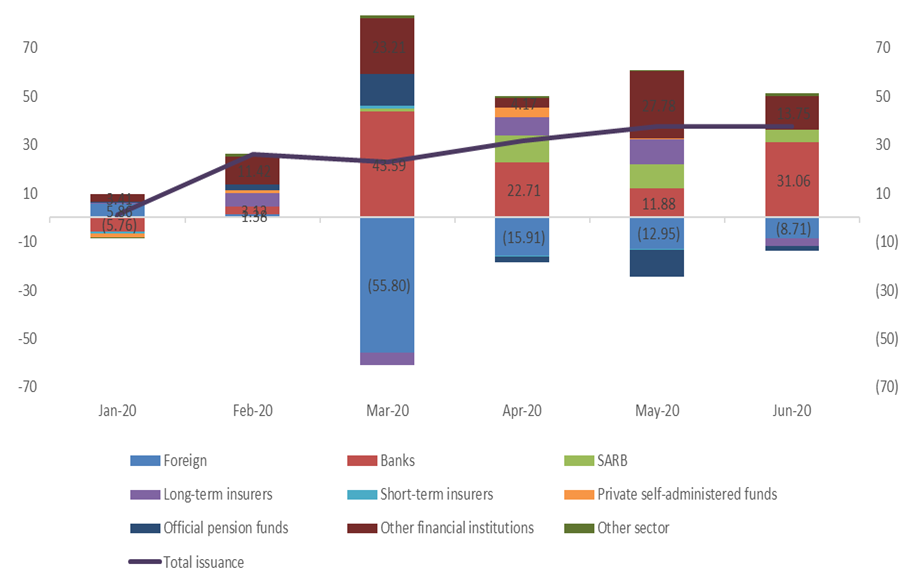

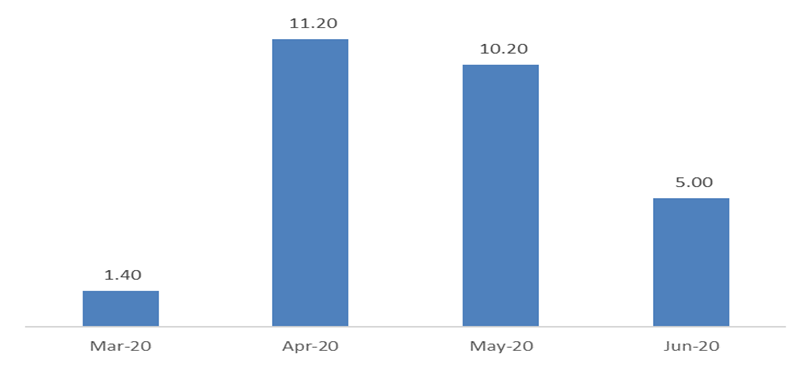

In addition to new SAGB supply of R37.7bn issued in the primary market, the secondary market had to absorb additional supply from non-residents that sold R8.7bn, official pension funds of R2.1bn and long-term insurers of R2.9bn of SAGBs in the secondary market. The banks (+R31.1bn) and fund managers (+R13.8bn) accumulated a total of R49.8bn of SAGBs with the SARB buying R5.0bn mainly to provide liquidity to the bond market.

Figure 2 Monthly changes in SAGB ownership and SAGB issuance in the primary market (Rbn)

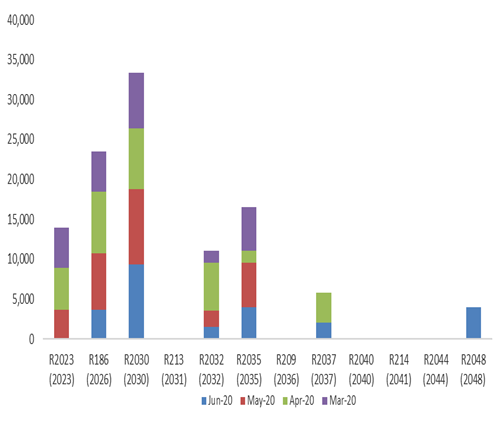

Figure 3 SAGB issuance (auctions and non-competitive take up)

Source: National Treasury, ICIB

Figure 4 SARB accumulated R26.8bn (market value) of SAGBs since end March 2020 (Rbn)

Source: SARB, ICIB

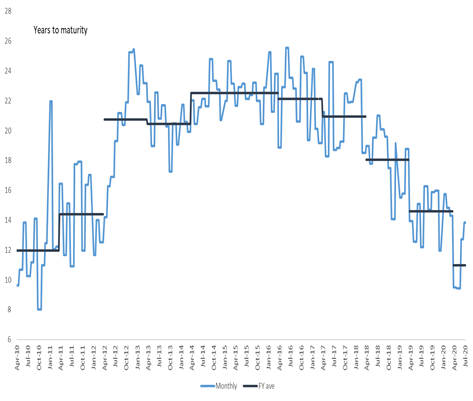

In June, the maturity of the funding bonds was extended to include R4.0bn (or 16.4% of issuance) of R2048s but with zero issuance of the R2023s. Issuance of R186’s to R2037’s comprised 68.9% of the total (see Figure 5) and the average maturity increased to 13.8 years (see Figure 6).

Figure 5 SAGB funding bonds

Source: National Treasury, ICIB

Figure 6 Average maturity of funding bonds

Source: National Treasury, ICIB

- Non-residents: The data provided by National Treasury showed that non-resident ownership of SAGBs declined by R8.7bn to R713.4bn (which is the opposite direction of JSE data that showed net purchases of R8.0bn). This is the fourth consecutive month of non-residents reducing exposure, totalling R93.4bn (March: -R55.8bn; April: -R15.9bn, May: – R13.0bn and April: -R8.7bn) although it looks like the pace of selling is moderating. Foreigners increased exposure to the R2030 and R2035 but were net sellers of R186s, R209s, R2040’s, R214s and R2048s.

- Official pension funds: We think the reduction in PIC ownership of SAGBs by R11.2bn could be ascribed to the PIC raising liquidity to pay UIF benefits. In the fiscal support package announced by President Ramaphosa in April 2020, about R40bn is available from money market and investments.

- Monetary sector: The monetary sector increased ownership by R31.6bn from R11.2bn in May and by a total of R109.2bn from March to June. The breakdown of bond holdings in June shows most of their bond buying has been in the 7-12 year segment (R2030’s of R7.7bn and R2032’s of R7.2bn) and the 12+ segment (Mostly R214’s and R2048’s of R7.9bn and R7.1bn respectively), as well as R186s of R7.9bn. Non-competitive auctions raised R1.8bn from the R186s, R5.0bn from the R2030s, R1.2bn from the R2032s, R4.0bn from the R2035s, R2.2bn from the R2037’s and R1.3bn and 3.7bn from R2030s, R1.5bn from the R2032s and R1.3bn form the R2048s.

- Other institutions: Unit trusts and hedge funds increased ownership by R13.7bn. However, compared to May where the steeper slope of the yield curve attracted duration buying, June has a shortening of duration with purchases of R186s (+R7.9bn), R213s (R2.3bn and R2035s (+R2.2bn).

Figure 7 Holdings of SAGBs

Source: National Treasury, ICIB

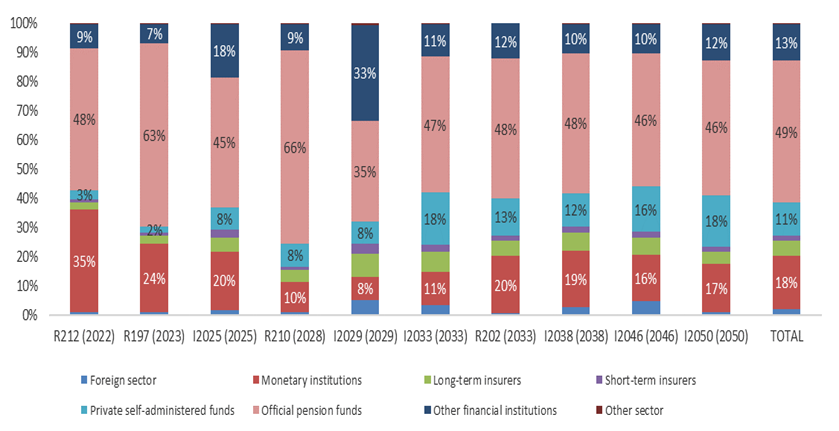

Inflation-linked bonds

In June, the amount raised from ILB auctions amounted to R5.6bn with additional supply of R8.4bn from net selling by fund managers of R8.4bn. Banks were the main buyers of ILBs to the amount of R9.5bn and long-term insurers accumulated R3.4bn.

Figure 8 Breakdown of ownership of ILBs

Source: National Treasury, ICIB