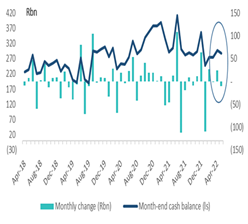

Provisional data for government’s month-end cash balances showed a decline of R10.0bn to R287.7bn at the end of May. This can mainly be ascribed to a $1bn foreign loan repayment. We estimate the main budget deficit of ~R20.0bn since May is seasonally not a significant month for tax payments.

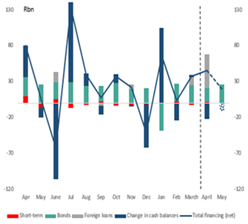

• The main budget deficit financing consisted of net bond issuance of R25.5bn and a drawdown in cash balances of R10.0bn. There was a net decline in T-bill issuance of R0.6bn and the value of the foreign loan redemption was R15.8bn.

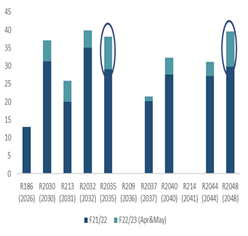

• SAGBs issued at the weekly auctions amounted to R19.5bn, with non-competitive auctions taking up R4.9bn. Primary issuance consisted of 41.4% and 58.6% in the 7-12 year and 12+ year buckets of the ALBI. The R2035 and R2048s have been the main funding bonds, comprising 21% each of new issuance.

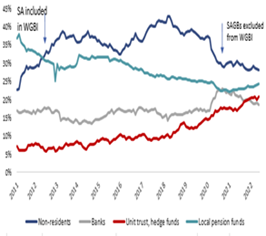

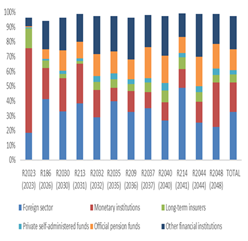

• “Other financial institutions” (mainly unit trusts and hedge funds) accumulated SAGBs to the value of R27.7, which covered new SAGB supply and net selling by non-residents and banks of R7.1bn and R2.3bn, respectively.

• Non-resident ownership of government bonds declined to 28.1% from a recent high of 29.1% in February. “Other” financial institutions remained a significant funder of the budget deficit, owning 20.8% of outstanding government bonds (20.0% in April). Bank ownership has stabilised between 18.6% (in May) to 19.4% in January. The PIC owned 24.2% of bonds, which accelerated from 23.4% in January.

• Monthly switch auctions conducted in the R2023 have reduced the outstanding amount to R65bn in June. The most recent auction was relatively weak at R1.25bn, switched mostly into R2030s. Banks are the largest holders of R2023s and 57.3%, followed by non-residents (18.2%) and “other” financial institutions (5.8%).

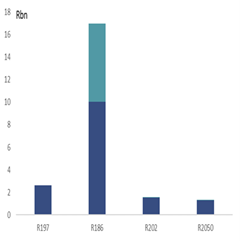

• Coupon payments scheduled for June amount to ~R26.0bn, 2.5bn, of which R17.0bn constitutes the R186 and the balance on ILBs (R197, R202 and I2050.

• Since the Minister of Finance tabled the February 2022 Budget Review, there have been developments that could have a bearing on the funding assumptions for FY22/23. These include higher cash balances arising from (1) a higher closing cash balance of R24.3bn for F21/22 and (2) ongoing R2023 switch auctions, which have decreased the outstanding amount by nearly R20.0bn to R65.6bn. Added to this is the likelihood that revenue receipts can again be ahead of target. However, as always, the expenditure outlook remains uncertain.

Figure 1

Source: National Treasury, ICIB

Figure 2

Source: National Treasury, ICIB

Figure 3

Source: National Treasury, ICIB

Figure 4

Source: National Treasury, ICIB

Figure 5

Source: National Treasury, ICIB

Figure 6

Source: National Treasury, ICIB