The ZAR abruptly weakened this week after strengthening from R14.32/$ to R14.56.$. It was widely noted that the ZAR was the best-performing currency, which we thought was mainly related to SA specific factors. This included a record high current account surplus in Q2 21 of 5.9% of GDP (previously 4.3% of GDP), owing to a massive merchandise trade surplus as exports accelerated and growth in imports remained muted. The USD was also on the backfoot as the ECB announced a slight reduction in bond purchases and stated that it is not viewed as tapering.

However, this week, a confluence of factors removed some of the support for EM currencies and the ZAR. Following the strong rally in the ZAR, the market was short USD (long ZAR), which implied volatility when positions were reduced. Some of the catalysts were in China, where growth sentiment is weakening. This follows a slowdown in Chinese retail sales in August, where the spread of Covid-19 reduced demand for services such as catering. High corporate indebtedness has now again become more of a concern. A real estate company, Evergrande, with $300bn of liabilities and links to banks, has raised contagion risk. And the question is whether the company is too big to fail with concern that a bailout condones reckless borrowing. Further, the dynamics in China and debates about how investable China has become because of the regulatory crackdown and free markets are adding to the uncertainty.

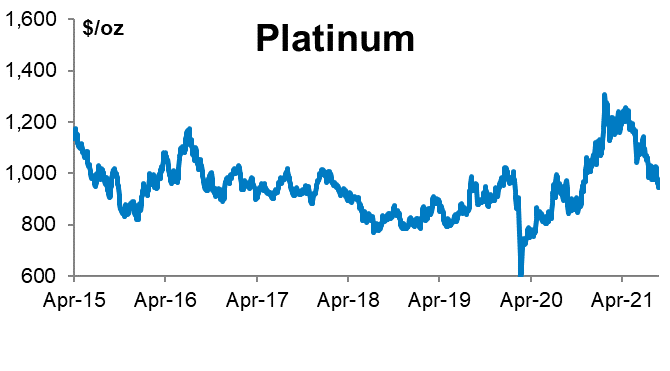

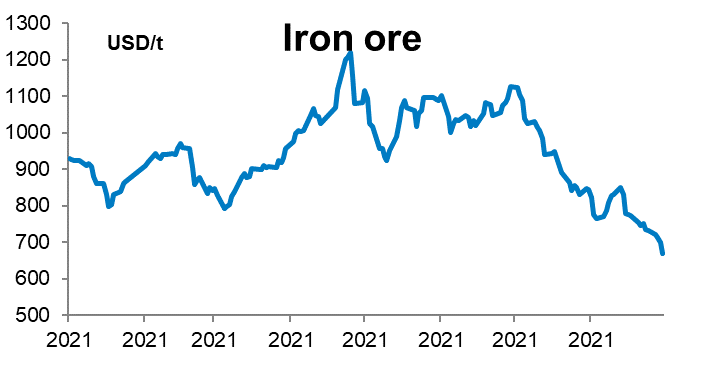

Added to this is a decline in PGM prices, with platinum and rhodium losing significant ground, leading to a battering of SA’s platinum stocks. The shortage of microchips has lowered auto production. At the same time, iron prices have tumbled, whereas oil prices have been rising, leading to a decline in South Africa’s terms of trade (export prices/import prices). However, we expect exports to continue to exceed imports (recording a trade surplus) which could cap a selloff in the ZAR. However, the ZAR would otherwise have been very vulnerable as net foreign portfolio flows are negative.

Next week’s FOMC meeting will be closely monitored for direction on tapering and the Fed’s rate hike forecast (the dot plot). Incoming data for August have been mixed. Payrolls were weaker because of the spread of the Covid-19 infection rate, but retail sales came in strong. Balance sheets of US households are strong as savings have increased during the Covid-19 pandemic and the improvement in the labour market over the past year (although slower than expected, leading to a supply shortage). While CPI inflation appears to have peaked, rising by 5.3% in August from 5.4%, it remains at elevated levels. Inflation in the UK and Canada also surprised on the upside, so the concern of stagflation has not dissipated. We see the fair value of R14.50/$.

The markets are unsettled with undercurrents from weaker than expected growth in China and the US (although it is important to note that levels remain high), inflation and Central Bank. On next week’s calendar we will be watching for further developments around Evergrande and potential contagion to real estate and commodity prices, SA’s CPI (22/9), the FOMC (22/9) and the SARB’s interesting rate meeting (23/9).

PGM prices are falling due to chip shortages that are undermining (eg. Auto production)