Long queues at fuel forecourts in the UK have been a timely reminder of how serious supply chain disruption can be to an economy. At Investec we think carefully about supply chain risks when we make investment decisions on behalf of our clients. As long term investors, we evaluate the strategic planning and resilience of companies, and look for both an ability to weather short term disruption and to adapt to long term structural changes.

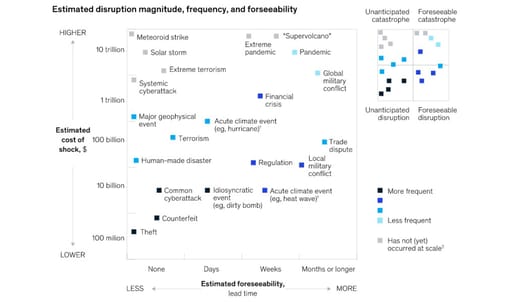

Before Covid-19, many companies’ supply chains were geared towards “just-in-time” inventory levels: carrying too much stock is a drain on working capital, tying up cash that could be used elsewhere in the business. But disruptions to the movement of goods and provision of services, caused by Covid-19 restrictions, exposed a weakness in this model. McKinsey’s recent report on the pharmaceutical industry is a timely reminder that not all supply chain shocks are created equal in either timing or impact.

Disruptions to the pharmaceutical industry vary in their severity, frequency, and lead time - and they occur with regularity

Source: McKinsey, September 2021

The best businesses have been able not just to survive, but to adapt and emerge stronger from this crisis.

Adaptation took many forms. Whereas, historically, the cheapest supplier usually won the business, the emphasis moved to local or regional supply; many companies moved to multiple sourcing to spread the risk, rather than relying on perhaps as few as one or two suppliers. Some inefficiency was deliberately reintroduced into the supply chain, with higher inventory levels seen as a sensible price to pay to ensure business continuity.

Unfortunately not all companies, or indeed whole sectors, have been able to make these changes. Many Western clothing companies, some of which source almost all of their product from Asia, have been unable to switch quickly when their existing suppliers have been forced to close by government mandate, in Vietnam for example. Other structural impediments can be longer term, the shortage of truck drivers being a case in point – while capacity constraints in (for example) the semiconductor industry have been exacerbated by Covid-19 and will take time to resolve, with clearly negative implications for the automotive and computing industries. And some resources simply cannot be increased to match rising demand: rare earth minerals are clearly in finite supply.

The consequences reach far beyond companies’ bottom lines: some go out of business altogether. For consumers, fuel or food shortages can go beyond the merely inconvenient, while inflation can be stoked up in situations such as this, when demand outstrips supply. If sustained, prices rise and deliver a further blow to these consumers’ lifestyles. We have written elsewhere about inflation and will not labour the point here. So how do we factor these risks into our investment process?

We look for companies that have strong pricing power or that can pass through inflationary pressures – or, in some cases, both.

As stewards of our clients’ capital, we play the long game. We look for companies that have strong pricing power or that can pass through inflationary pressures – or, in some cases, both. There are many facets to this. Such companies typically have multiple suppliers and so are not price-takers. Global supply chains and multiple production facilities mean that constraints in one market may be compensated for by increasing production elsewhere. Furthermore, for many attractive companies, their competitive advantage lies in their intellectual property and proprietary processes. This means that the critical parts of the value chain are almost entirely within their control. Factors such as these can demonstrate the resilience of a company’s supply chain – but what of its sustainability?

Companies with strong long term relationships with their suppliers tend to have a sustainable competitive advantage. This frequently involves significant investment, in many forms, in their supply chain. This can include building local infrastructure, such as roads, schools or hospitals where suppliers are located. Or, in the case of several major food companies, it may take the form of providing loans to farmers to help them become a part of the supply chain in the first place. Greater oversight of the supply chain and close relationships with suppliers mean that the best companies have a greater chance of securing supplies at times when there are shortages. Importantly, we look for companies which have a firm eye on the future, which can help ensure supplies long into the future. Again this can take many forms – responsible land use, reduction in deforestation, reducing plastics usage, sustainable farming and fishing to name but a few.

Greater oversight of the supply chain and close relationships with suppliers mean that the best companies have a greater chance of securing supplies at times when there are shortages.

The companies we seek to invest in continuously innovate to improve the efficiency of both their supply chains and their production processes. Technologies such as artificial intelligence and data analytics are being deployed to predict and, as far as possible, match demand with supply – often in near-real time. Cutting waste has an important role to play and a particular focus for us in this regard is the concept of a circular economy – where waste is reduced through the reuse and repurposing of materials. This naturally reduces pressure on supply chains.

The biopharmaceutical sector provides a good example of this, against a background of the world producing some 380m tonnes of plastic every year, 80% of which are simply thrown away. According to a Circularity Gap report, committing to a circular economy could cut greenhouse gas emissions by 39% and ease the pressure on virgin materials by 28%. Biopharmaceutical companies have embraced these concepts through the 3R Initiative (Replace, Reduce, Refine) to improve animal welfare. 3R extends to all aspects of the supply chain and product consumption, with the benefits extending far beyond easing supply chain pressures. 3R has spawned several new business models, while simultaneously tackling climate change and biodiversity loss.

Covid-19 has changed our lives in many ways. It has forced businesses to rethink the way they operate, with far-reaching adaptations to their supply chains. The best, which we seek to invest in, are able to thrive where their competitors struggle and to do so in a sustainable fashion. At Investec, we actively engage with management teams and boards of directors to challenge them to balance profit with purpose; we see value creation for shareholders as an output from a sustainable approach benefiting all stakeholders, which creates enduring worth – living in society, not off it. We are therefore able to look beyond the short term vagaries of the market, and indeed the supply chain, to focus on the long term while also being willing to take advantage of any short-sightedness in the market. We can therefore tailor financial solutions to our clients, whether they aim to actively grow their wealth or to seek optimal returns on their capital.

1 Four ways pharma companies can make their supply chains more resilient | McKinsey

2 Weekly Digest: Solving the Inflation Equation (investec.com)

3 The mining value chain: A hidden gem | McKinsey

4 PowerPoint Presentation (unilever.com)

5 What is a circular economy? | Ellen MacArthur Foundation

6 100+ Plastic in the Ocean Statistics & Facts (2020-2021) (condorferries.co.uk)

8 Investec accepted as a signatory of the UK Stewardship Code

Get Focus insights straight to your inbox