14 Oct 2022

Aiming to protect against inflation

With inflation almost hitting double digits, we look at what that means for your cash savings.

Inflation in the UK has been above 9% since April 2022 – levels not seen since the early 1980s. We’ve all noticed the direct impact that’s had on our household budgets, but the impact on savings (while not as immediately evident) can be far more harmful in the long term.

Inflation dramatically reduces spending power over time

We all know that inflation reduces the amount of goods and services we can buy with a given amount of money. Still, many don’t realise just how detrimental inflation can be over periods of many years.

To put it in perspective, in the US, goods and services costing one dollar in the year 1975 would cost around five dollars today.

Source - Inflation Calculator

What is the impact of 9% inflation on your savings?

A hypothetical example recently published in mainstream media stated that with a 9% headline rate of inflation, £1,000,000 would be worth:

- £910,000 in 1 year

- £500,000 in 8 years

With a 50% loss of spending power in just 8 years, it is perhaps little wonder that economist Milton Friedman famously stated “inflation is taxation without legislation”. However, it is important to note that it is unlikely that inflation will be at 9% for a period of 8 years.

How can you protect your wealth from this constant erosion?

First, it’s crucial to acknowledge the cost that comes with keeping cash.

While it’s important to keep an emergency ‘rainy day’ fund tucked away in cash, it’s equally important to limit it to what is truly necessary. An excess of cash on the sidelines won’t provide any additional short-term security, but it will ensure that the effects of inflation are much more harmful.

It is important to remember that the value of investments and any income from them is not guaranteed and may go down as well as up. Therefore provided that it fits in with the investor’s overall risk appetite and is in keeping with their individual investment objectives, it may be useful to consider making additional contributions to their investment portfolio in an attempt to preserve the real value of their capital.

3 reasons for holding excess cash

- transactional (near-term spending needs)

- precautionary (low risk tolerance)

- speculative (trying to ‘time the market’)

When is the right time to start investing?

Those with large amounts of cash in savings accounts might well ask themselves whether now is really a good time to invest it, with many markets experiencing strong volatility amid geopolitical and interest-rate/inflation uncertainties.

As the old saying goes: “It’s not about timing the market, but about time in the market.”

The market moves in cycles. Over the long run, investors will undoubtedly experience both good times and tough times. However, investing in a balanced portfolio, by definition, aims to protect you against these fluctuations and maintain the real value of your assets over the long term.

Long-term investors tend to see the strongest returns

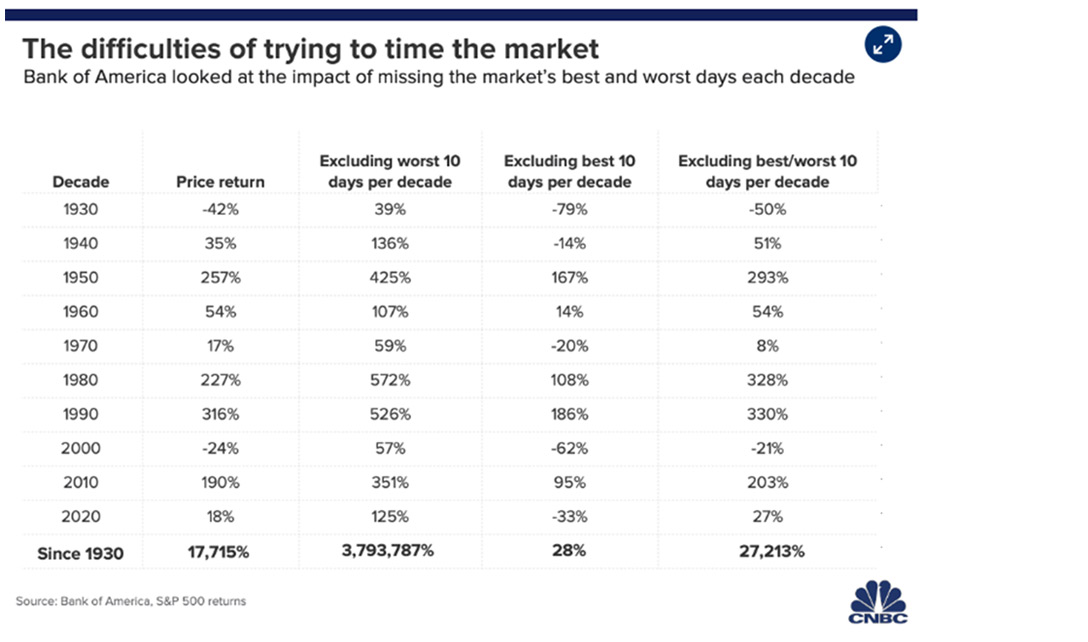

It is important to remember that investors often miss a great part of the market’s longer-term rise while they wait for lower price levels. Research shows that this ‘timing’ approach rarely pays off.

Many studies have shown that missing out on just a handful of the market’s strongest days can have a seriously detrimental effect on an investor’s long-term returns.

One such example, looking at data going back to 1930, found that if an investor sat out the S&P 500′s 10 best days per decade, total returns would be significantly lower than the return for investors who had remained invested and waited it out.

Source:

Final thoughts to discuss with your wealth manager

This article does not intend to suggest that all excess cash should be invested immediately, however.

The key takeaway is that there is an implicit cost to keeping funds on the sidelines. Investors should have a deliberate strategy to put their excess cash to work that is in keeping with their overall investment strategy and individual risk tolerance.

This thought process is an important part of an overall wealth planning strategy to preserve and grow wealth over time. It is a conversation that we at Investec have with our clients regularly, so if you would like to discuss any aspect of the topics covered above, please do reach out.

About the author

To contact or read more about Ryan Cornett, visit his biography here.

Find out more

Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Belfast today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.