Get Focus insights straight to your inbox

There is reason to believe that the worst of the supply disruptions and rate hikes are behind us, but the recent past has taught us to be cautious and we never know when the next major event destabilises global supply chains resulting in catastrophic impacts.

The latest concern for many will be the political tensions between China and Taiwan and we will need to keep a very close eye on this topic. It has the potential to be very disruptive should tensions escalate with far reaching global implications.

Sea freight update

We are seeing a gradual improvement in the market which gives us renewed hope that we are heading closer to some form of stability. Bottlenecks and congestion remain a current headache, but there are positive signs proving that the worst is behind us. Global schedule reliability is slowly improving, fuel prices have started to decline, less capacity is being tied up in port congestion, investments are being made in logistics infrastructure and rate levels across the major trades continue to decline.

Capacity:

Demand for space on the Far East to South Africa trade has not been as strong as carriers would have anticipated at this time of the year. We can however expect a surge in demand as we approach the pre-Chinese Golden Week shipping window. Some carriers will implement blank sailings in the coming weeks which will negatively impact capacity availability.

Demand remains strong on the European and Middle East to South Africa trades. Port congestion, strike action and inland trucking, barge and rail constraints have hampered capacity and carriers’ ability to offer reliable services. The latest setback is the announcement of a planned strike by labour in Felixstowe port between 21 to 29 August. The European summer holiday period has also contributed to a reduction in trucking capacity as well as trucking restrictions in countries such as Italy.

The USA trade continues to be impeded by bottlenecks, chassis shortages and port congestion.

We encourage bookings to be made well in advance of the required shipment dates and factor in longer lead times.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded global network, we have gained access to additional capacity which strengthens our service offering to our clients.

Equipment imbalance:

Repositioning of equipment in Europe remains a constant challenge for carriers and there are reports of temporary shortages from time to time. Equipment availability across the various trades is relatively stable.

Sailing schedules:

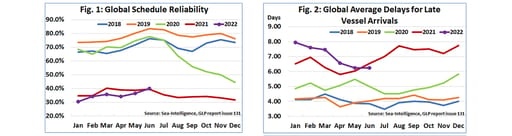

Global schedule reliability continues to improve according to the latest data published by Sea-Intelligence. Reliability remains well below the pre-Covid schedule performance and its still going to below par for a while. Sailing schedules across all trades are still being impacted by a plethora of factors resulting in port omissions, blank sailings and vessel arrival and departure delays.

Freight rates:

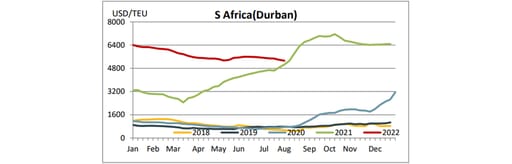

Rates continue to soften with the most noticeable reductions on the Far East to South Africa trade. Rate levels are down around 30% from their peaks. The general market consensus is for freight rates to continue steadily decreasing over time. We are not anticipating carriers to announce large quantum decreases, but instead to gradually adjust rates downwards.

Spot rates have also softened slightly on the Europe and Middle East trades.

SCFI (Shanghai Container Freight Index):

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

Air freight update

The market is relatively stable considering all the issues reported in July such as labour and trucking shortages in Europe and the USA. We are starting to approach the peak period, and this could bring about pressure on the airfreight market. The political tension between China and Taiwan is a cause for concern and some carriers cancelled flights during the recent military drills conducted by China.

Capacity:

Volumes across the trades remain high, but in general there is sufficient capacity to cater for the demand. We are seeing capacity pressures on the USA trade. Trucking capacity remains a challenge in the USA and parts of Europe. Larger shipments may need to be split over more than one flight especially where capacity or carrier options into South Africa is limited. We encourage you to make bookings as early as possible to secure space.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times:

Cargo booked on passenger flights is more susceptible to delays as passenger cargo gets priority. We could expect longer lead times for cargo transiting or moving via the Far East due to the current political tensions between China and Taiwan.

We encourage you to provide your required arrival dates in advance for us to offer you optimal routings and rates to meet your requirements.

Freight rates:

Rates remain relatively stable. There has been some relief with softening fuel prices. Rates are expected to increase once the peak period is upon us. Rates on the USA trade remain elevated due to capacity constraints.

With our expanded network we are well positioned to offer a variety of options to meet our clients airfreight requirements.

Infrastructure investments into South African ports:

Transnet has announced plans to invest into port and rain infrastructure which is very encouraging and welcomed. This will be a massive boost for South Africa as a whole.

READ MORE:

Transnet looks to private sector to help build new port in Northern Cape (businesslive.co.za)

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.