What is NFT artwork and how does it work?

08 March 2023

A jpeg selling for the same price as an original Van Gogh? A cat meme worth more than a Boeing? Welcome to the Wild West of NFTs.

17 min read

Last year, the world was introduced to a new crypto craze: one-of-a-kind, blockchain-based assets called non-fungible tokens (NFTs). Everybody was talking about NFTs, yet few people understood them.

Maybe the pandemic — and society’s newfound comfort with digitised life – led to the NFT craze currently sweeping the collectibles market. And if you thought NFTs were hard to wrap your head around, some of them are getting even more interesting and bizarre. They could be a GIF made by Grimes of a flying baby or a video clip of LeBron executing a single-handed dunk.

So what are NFTs? Simply put, they are non-interchangeable units of data stored on a blockchain, a form of digital ledger that can be sold and traded. NFTs are therefore essentially certificates of ownership of a digital asset.

Types of NFT data units may be associated with digital files such as photos, videos and audio. Because each token is uniquely identifiable, NFTs differ from blockchain cryptocurrencies, such as Bitcoin.

NFT ledgers claim to provide a public certificate of authenticity or proof of ownership, but the legal rights conveyed by an NFT can be uncertain. NFTs do not restrict the sharing or copying of the underlying digital files, do not necessarily convey the copyright of the digital files, and do not prevent the creation of NFTs with identical associated files.

NFTs have been used as a speculative asset, and they have drawn increasing criticism for the energy cost and carbon footprint associated with validating blockchain transactions. Critics have also highlighted their frequent use in art scams and claimed that the structure of the NFT market was a Ponzi scheme.

While all bitcoins are equal, each NFT may represent a different underlying asset and thus may have a different value. NFTs are created when blockchains string records of cryptographic hash, a set of characters identifying a set of data, onto previous records therefore creating a chain of identifiable data blocks. This cryptographic transaction process ensures the authentication of each digital file by providing a digital signature that is used to track NFT ownership. However, data links that point to details such as where the art is stored can be affected by “link rot” (whereby links point to pages or resources that have expired).

NFTs function like cryptographic tokens, but, unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs are not mutually interchangeable, hence not fungible.

The answer lies in the technology that underpins them. The data units cannot easily be erased or modified once imputed. This is especially crucial when purchasing items such as artwork, limited-edition media etc. Because they are difficult to copy, they provide a certain amount of assurance – they offer a unique quality. Artists typically issue a small number of limited NFTs for sale, and consumers are willing to pay more for limited edition items.

The first known "NFT", Quantum, was created by Kevin McCoy and Anil Dash in May 2014, consisting of a video clip made by McCoy's wife, Jennifer. McCoy registered the video on the Namecoin blockchain and sold it to Dash for $4, during a live presentation for the Seven on Seven conference at the New Museum in New York City. McCoy and Dash referred to the technology as "monetised graphics". A non-fungible, tradable blockchain marker was explicitly linked to a work of art, via on-chain metadata.

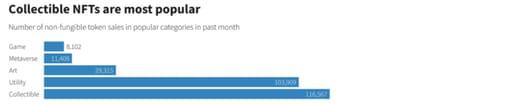

The market capitalisation of the NFT market has developed rapidly, growing nearly ten-fold between 2018 and 2020. The volatile nature of this new market can also be seen in the transaction volume of NFTs for various segments. For example, as transactions declined for gaming, values grew for art.

The first popular example of an NFT was CryptoKittie, in October 2017, a collection of artistic images representing virtual cats that are used in a game on Ethereum that allows players to purchase, collect, breed, and sell them. CryptoKitties remained the only popular example of NFTs for almost two years.

A defining moment came in March last year, when the artist known as Beeple sold an NFT of his work for $69.3 million at Christie’s, a sale that put NFTs on the map and brought them to the attention of the general public. The profitability of NFTs has motivated celebrities to create their own, with collectibles of NBA and famous football players getting sold for hundreds of thousands of dollars.

NFTs are purchased with cryptocurrency. Most of the transactions are via a platform OpenSea, the dominant marketplace. The competitors are SuperRare, Nifty Gateway and Rarible. Once you’ve browsed through the marketplace, you place an offer to the owner. Once the price has been agreed and accepted – the exchange is complete – and the NFT is transferred into your wallet and appears under the Collected tab on your profile page.

High-profile auctions of NFTs linked to digital art have received considerable public attention, with the work "Merge" by artist Pak being the most expensive NFT with a price of $91.8 million and Everydays: The First 5000 Days, by artist Mike Winkelmann (known professionally as Beeple), the second most expensive auction at US$69.3 million in 2021.

In March 2021, the blockchain company Injective Protocol bought a $95,000 original screen print entitled Morons (White) from English graffiti artist Banksy, and filmed somebody burning it with a cigarette lighter, with the video being minted and sold as an NFT. The person who destroyed the artwork, who called themselves "Burnt Banksy", described the act as a means of transferring a physical work of art to the NFT space.

NFTs can be used to represent in-game assets, such as digital plots of land, which some commentators describe as being controlled "by the user" instead of the game developer by allowing assets to be traded on third-party marketplaces without permission from the game developer.

In February 2021, NFTs reportedly generated around US$25 million within the music industry, with artists selling artwork and music as NFT tokens.

In November 2021, film director Quentin Tarantino released seven NFTs based on uncut scenes of Pulp Fiction. Miramax subsequently filed a lawsuit claiming that their film rights were violated.

The NFT buying surge has been called an economic bubble by experts, who also compared it to the Dot-com bubble.

NFTs, as with other blockchain securities and traditional art sales, can potentially be utilised for money laundering. Auction platforms for NFT sales may potentially face regulatory pressure for compliance with existing anti-money laundering legislation.

NFT purchases and sales are embroiled in a controversy regarding the high energy usage, and consequent greenhouse gas emissions, associated with blockchain transactions.

The computing power needed to support the underlying Bitcoin network, for example, uses nearly as much energy in a year as the entire country of Argentina.

There have been cases of artists having their work sold by others as an NFT, without permission. After the artist Qing Han died in 2020, her identity was assumed by a fraudster and several of her works became available for purchase as NFTs. Similarly, a seller posing as Banksy succeeded in selling an NFT supposedly made by the artist for $336,000 in 2021 – with the seller in this case refunding the money after the case drew media attention.

NFT trading is an unregulated market, with no legal recourse for such abuses.

The structure of the NFT market has been seen by some as being like a pyramid or Ponzi scheme, where early adopters profit at the expense of those buying in later. Financial theorist William J. Bernstein has compared the NFT market to 17th century tulip mania, saying how any speculative bubble requires a technological advance for people to "get excited about", with part of that enthusiasm coming from the extreme predictions being made about the product.

Beeple – Everydays: The first 5000 Days sold for US$69.3m. The piece represented the lifetime work of Beeple (real name is Mike Winkelmann), who created a new digital picture every day for 5,000 days straight from 2007 through to day 5,000 in January 2021.

The sale marked the third-most-expensive work ever by a living artist and introduced the world to NFTs on a grand scale – leading to the start of an incredible year for NFTs.

On 3 March 2021, masked men set fire to a Banksy print somewhere in Brooklyn and livestreamed it on Twitter. Why? To turn the work into an NFT and quadruple its value. A company called Injective Protocol bought the screen-print, titled Morons (White), for $95,000 for the express purpose of destroying it and replacing it with a digital copy. Their stunt paid off, literally, when the new work sold for $382,336. “We specifically chose a Banksy piece since he has previously shredded one of his own artworks at an auction,” Injective Protocol executive Mirza Uddin told The Guardian.

It turns out that digital perfume is a must-have in the metaverse. Berlin-based Look Labs used near-infrared spectroscopy (NIRS) to record no less than the microscopic, molecular vibrations emanated by its new perfume, along with the associated bottle and label. They took the associated data and created an NFT artwork from it. They called it a digital reflection of a physical scent.

Some people donate blood or even hair. Some people sell their plasma. Now, a Russian tennis player is introducing a new body part to monetize: the arm. Oleksandra Oliynykova - the world’s 658th-ranked women’s tennis player—recently auctioned the portion of her right arm between her shoulder and elbow to a buyer on the OpenSea marketplace.

There’s a lot of talk regarding whether NFTs are in a bubble. That question is still up for debate, but what weird NFTs demonstrate is that the market will test our limits. Anything you can think of – portaloos, toilet paper, perfume for the metaverse, and even a part of someone’s body – can and will be NFT’d.

Will the future of NFTs continue to be dictated by artists, brands etc? Or will the future be less strange, with utility NFTs with applications in business and industry? Only time will tell.

From cartoon apes to video clips, sales of NFTs reached $25 billion in 2021 as the speculative crypto asset exploded in popularity, data from market tracker DappRadar shows, although there were signs of growth slowing towards the end of the year.

This means the money spent on NFTs in 2021 is roughly equivalent to the amount pledged at COP26 to help countries phase out coal, or the funding made available by the World Bank to buy and deploy Covid-19 vaccines.

Note: Data for the month up to January 10, 2022. Data only shows transactions on the ethereum blockchain and excludes "off-chain" sales.

Source: NonFungible.com

The former First Lady, Melania Trump, minted her first NFT, Head of State Collection, on 11 January, and put it up for auction, where it sold for $180,000. A month later, it looks as if she has bought it herself.

Receive Focus insights straight to your inbox