We have started 2023 on a positive note when considering the market conditions. Freight rates continue to soften, the rand is strengthening, fuel prices have come down and inflation is trending downwards again. Global supply chains are in a far better space now. China has also recently adjusted its Covid-19 policies, moving away from the previous zero-Covid stance. We will still need to monitor the impact on production and volume output post the Chinese New Year, as China is likely to face Covid-19 outbreaks in the coming weeks and months.

We will continue to work very closely with all our partners and service providers, to ensure that all your shipments are delivered as efficiently as possible.

The impact of the following key factors needs to be continually assessed and considered:

- Rate declines

- Subdued demand

- Improved schedule reliability

- Routing changes

- Blank sailings

Let's talk

Discover how we can simplify and improve your global trade transactions to optimise your cash flow and lower your supply chain risks.

Sea freight update

The market is more favourable for importers than a few months ago. Shipping lines on the other hand are having a harder time now as profits are declining and new capacity is being added to the market. They need to drive efficiencies, products and service levels to realise profitable returns and can no longer rely on exorbitant freight rates. We can expect carriers to make organisational changes as well as capacity and routing changes.

Capacity

There is sufficient capacity in the Far East trade and demand leading up to the Chinese New Year has been relatively subdued. There will be a temporary reduction in capacity availability post the Chinese New Year as carriers have scheduled blank sailings. The Middle East and India trade remains relatively stable from a capacity point of view. The Europe trade route is expected to remain stable, and conditions have been improving, most notably when it comes to port congestion. The North and South America trades are more volatile and capacity for January has been impacted by fewer sailings.

Port congestion has been improving globally, which has reduced the amount of unavailable capacity. The market is expecting additional capacity to be introduced in 2023, including new ship build capacity especially in the second half of 2023 and throughout 2024.

Despite the challenging environment, we will endeavour to provide solutions to keep your cargo moving. With our expanded global network, we have access to additional capacity and alternative routings, which strengthens our service offering to our clients.

Sailing schedules

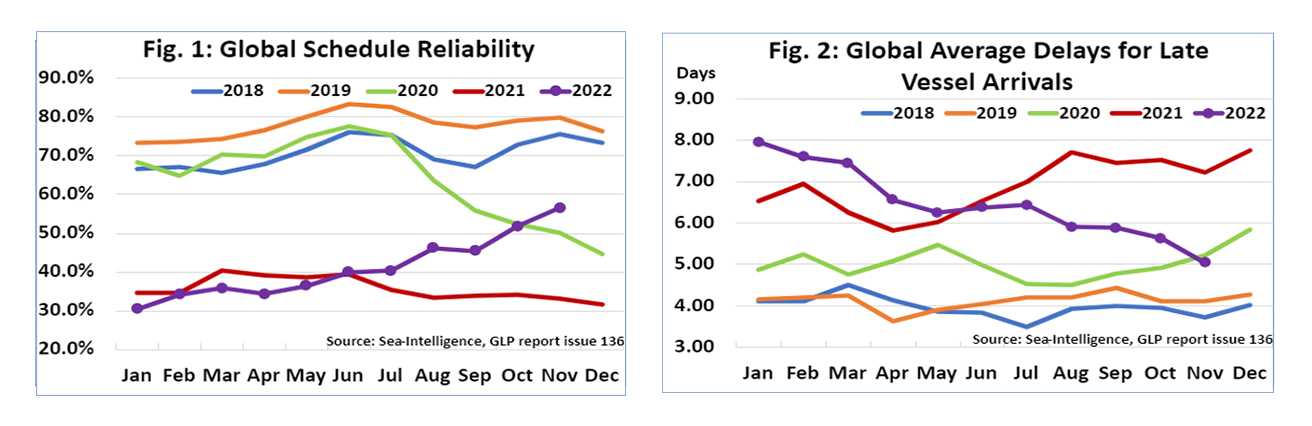

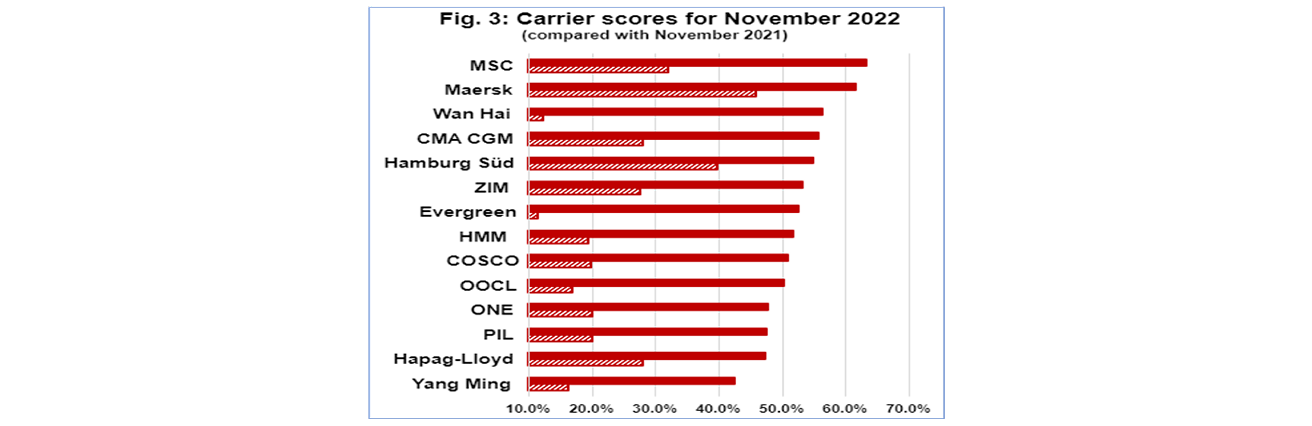

Schedule reliability continues to improve, which bodes well for global supply chains. The trends are positive for average number of days late and on-time performance of carriers. Carriers are placing focus on schedule reliability because it helps drive revenue and service levels. We expect the upward trend to continue throughout 2023.

MSC has recently announced a change to their port rotation on the Europe to South Africa trade. Coega will be their first port of call, followed by Durban. MSC will call Cape Town on their north bound voyage. This will extend the lead time for Cape Town imports, but will improve predictability and reduce the number of Cape Town port omissions.

According to the latest Sea Intelligence report, global schedule reliability has improved by 4.7% and the average number of days late has dropped to 5.04 compared to 7.95 days in January 2022. Please refer to the graphs below for annual comparisons.

Freight rates

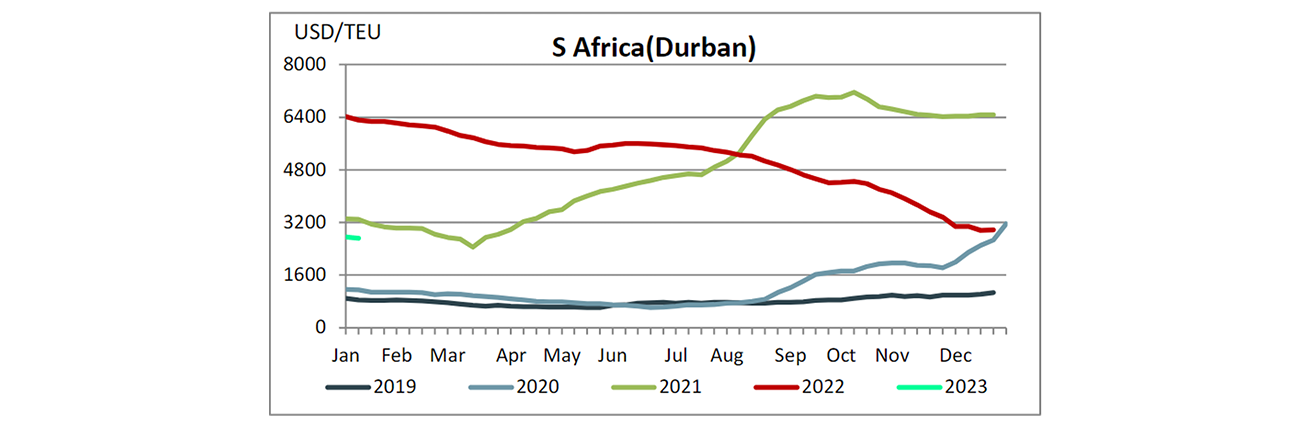

Rate levels on the Far East trade have been declining rapidly over the past few weeks. The average market rate from the main ports in China is comfortably below the $4000/40ft level. Rate levels on the rest of the trades have also been coming down and are far more stable now. We don’t anticipate major rate fluctuations this year given the global market outlook.

SCFI (Shanghai Container Freight Index)

The graph below demonstrates the freight rate movement per TEU ex-China to South Africa:

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

Air freight update

The market remains relatively flat with no major disruptions or bottlenecks. With the sea freight market becoming more stable, we expect less orders being converted from sea freight to air freight.

Capacity

Capacity remains stable and we have numerous carrier and service offerings across all trades. There is a possibility that demand may increase if there are major production and handling delays in China due to severe Covid waves that impact manufacturing output and causing orders to run late.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times

Transit times remain consistent, but we expect some pressure on trucking and handling services on the Far East trade as we approach the Chinese New Year.

We encourage you to provide your required arrival dates in advance so we can offer you optimal routings and rates to meet your requirements.

Freight rates

Rate levels remain stable, and we expect levels to soften further if demand remains subdued.

With our expanded network we are well positioned to offer a variety of options to meet our clients’ airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.