The first quarter of 2022 is behind us, but unfortunately, we carry forward the impacts of the Russia and Ukraine conflict and face fresh Covid lockdown disruptions in China. The full effect on manufacturing and supply chains amongst other themes is yet to be realised.

Based on the past two years, we can confidently conclude that we are in for an unpredictable couple of months and the hope of global supply chains returning to some sort of stability within 2022 fades away.

We are seeing an increase in the number of cargo ready dates shifting out due to manufacturing delays as well as extended air and sea lead times across all trade routes.

Shanghai lockdown

25mil

130k

28Mar

Sea freight update

The sea freight environment remains unpredictable and port congestion is still a reality across the globe. The European trade, including the Mediterranean region, has been exceptionally challenging the past few weeks and capacity across all shipping lines has been negatively impacted. The same can be said for the North and South American trades.

Inland trucking and rail have also become more of a headache in the above-mentioned regions and as anticipated with the recent lockdowns imposed across China, trucking capacity has been severely hindered. Shipments are now being delayed because of the trucking situation.

Capacity constraints

Quarter two is traditionally the period where capacity demand declines on the Far East trade. This remains true and demand over the coming weeks is expected to be relatively weak as manufacturing activity and output slows down in China. We can expect demand to accelerate once the lockdowns in China are lifted.

Port congestion and berthing delays have increased. Shanghai and the surrounding manufacturing hubs have been significantly impacted by the strict lockdown regulations and trucking challenges which is leading shippers to make use of the inland barge services to get cargo moved to the main ports such as Shanghai.

LCL cargo is being routed to ports such as Ningbo as numerous cargo consolidation freight stations (CFS) are not accepting cargo until further notice.

Demand from Europe remains strong, and vessels are booked out weeks in advance. Some shipping lines are fully booked six to eight weeks in advance. We have noticed an increase in shipping delays and container rollings because of the capacity pressures on both vessels and trucking.

The USA East Coast has similarly been under pressure. Securing trucking capacity is problem and this has resulted in cargo collection lead times extending.

We encourage bookings to be made well in advance of the required shipment dates and factor in longer lead times.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded global network, we have gained access to additional capacity which strengthens our service offering to our clients.

Equipment imbalance

The availability of equipment types is relatively stable across most trades with a few exceptions in Europe.

Sailing schedules

Schedules are erratic and on time performance remains below 40%. Departure delays on all trades can be expected because of port congestion at origin and transshipment ports. Port congestion has increased sharply on the USA East Coast.

A relatively high number of vessels have bypassed Cape Town because of berthing delays and extended dwell times.

Freight rates

Freight rates from the Far East have declined further despite the increasing bunker levels. Rate levels on the European and USA trades have increased as demand for capacity remains strong. There has also been an increase in the bunker rates which the lines have passed on.

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

SCFI (Shanghai Container Freight Index)

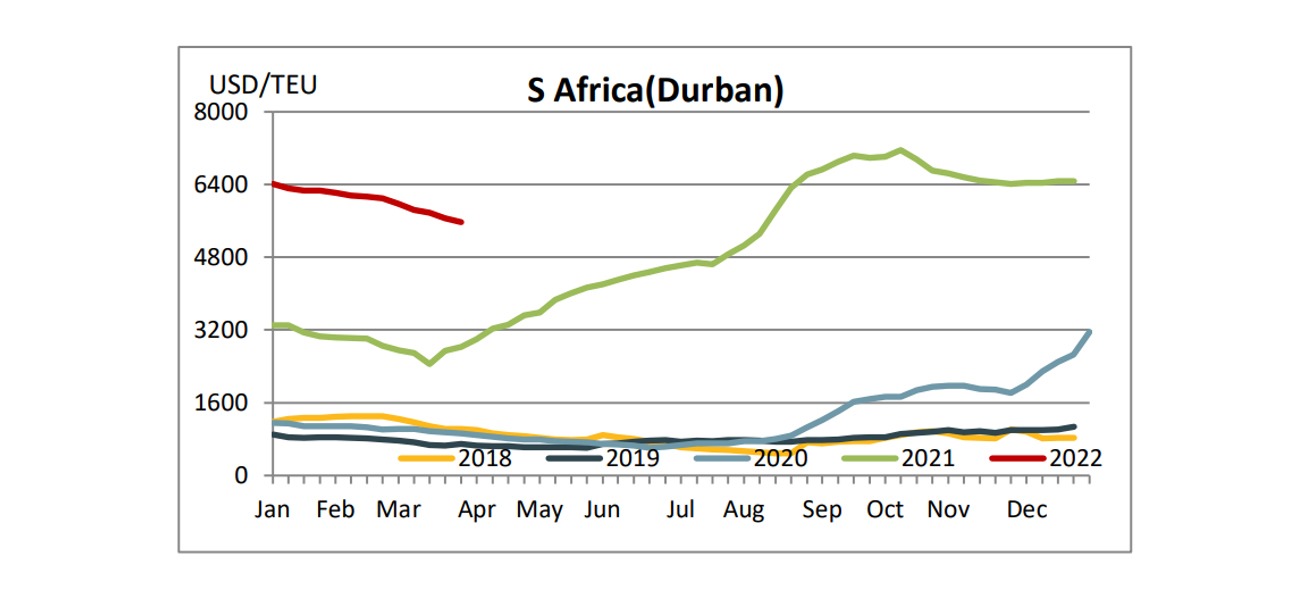

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa.

Air freight update

The impacts of the Russia and Ukraine conflicts and the current Covid lockdowns and restrictions in China and Hong Kong are being felt in the market. Though demand has not necessarily spiked, capacity has been reduced and delays in various forms have created problems for the market.

China’s Shanghai Pudong International Airport (PVG) has arguably experienced the most significant disruptions with flight cancellations and cargo handling facilities being short staffed and not accepting cargo.

Capacity

War, sanctions, and lockdowns have added to the mess faced by global supply chains. Global air cargo volumes were down 4.5% in March compared to a year ago and down 6.5% in 2019 as the world deals with war in Ukraine, sanctions, and the closure of Russian airspace, and Covid lockdowns in China according to a recent report published by Xeneta.

Large volumes of cargo are being diverted from Shanghai Pudong International Airport (PVG) to Zhengzhou Xinzheng International Airport (CGO) to avoid shipment delays and cargo backlogs.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times

Total door-to-door transit times are in general increasing as the airfreight market contends with ongoing supply chain disruptions.

Freight rates

Rate levels have been driven upwards because of the fuel increases, higher inland trucking, and handling costs as well as the reduction in capacity. Rate levels have increased across all trades and most carriers have reverted to only offering short-term spot rates.

With our expanded network we are well positioned to offer a variety of options to meet our clients airfreight requirements.

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.