There is no doubt that the first half of 2021 has been exceptionally challenging and operational disruptions across all trade routes have been unprecedented. As vaccination programmes are gaining momentum across the globe there is a belief that increased economic activity and trade will continue with its recovery path.

While this should be seen in a positive light, it will bring an additional set of challenges for manufacturers, suppliers, importers, ports and carriers alike.

Supply chains continue to be disrupted by unforeseen incidents, like the Covid outbreak in the Yantian terminal, which have a significant operational and financial ripple effect.

Importers are faced with the predicament of weighing up the cost of shipping at a premium rate to meet on-time deadlines versus the cost of not having stock in time and either facing lost sales or having to discount product. In some cases, importers are also pushing to ship orders earlier to mitigate the risk of receiving orders late.

The impact of the following key factors needs to be continually assessed and considered:

- Port congestion, blank sailings and omissions

- Black Friday

- Equipment imbalance

- Capacity constraints across trades

- Increased lead times on air and sea

- Freight rate increases and surcharges

Sea freight experiencing "worst disruptions in history"

June has been an exceptionally challenging time across all trade lanes. The disruptions to operations have arguably been the worst in recorded history.

Yantian International Container Terminal in Shenzhen, for example, was operating at a 30% productivity level for most of June. Many carriers were forced to omit Yantian and amend routings mid-voyage, therefore adding pressure to capacity and equipment availability for exports, as well as creating congestion pressures on other ports, as they needed to accommodate the additional volumes that could not be handled by Yantian port.

At one point in June there were more than 300 vessels globally waiting to berth, which equated to 5.5% of global vessel capacity. Asia accounted for 57% of the awaiting vessels.

Transshipment delays in ports like Singapore have been recorded at between 2 to 5 weeks and it is anticipated that the Yantian backlog will take up to a month to clear.

Global schedule reliability over the past few months has been between 35% to 40%, compared to the long-term average of around 75%, according to Sea-Intelligence’s latest report. The average number of days for late arrivals hovers around six days.

Unfortunately, these types of disruptions have hindered shipping lines' ability to restore reliability to their services and equipment balancing.

It is being widely reported that global maritime trade will continue to be disrupted until mid-2022. This is a major concern as we approach the traditional peak shipping period.

Capacity constraints

There has been a noticeable impact on available capacity to South Africa due to the increase in blank (cancelled) sailings, port congestion, over-bookings, and re-routing of vessels.

Additional capacity for South Africa imports is unlikely to be introduced soon. The above-mentioned factors are now common across all trades, though the Far East and India sub-continent trades remain the most heavily impacted at this stage.

There have also been pockets of capacity constraints from certain European ports. Shipping lines have placed new ship build orders equating to an approximate capacity of 3m teu (twenty-foot equivalent unit). The bulk of this capacity is forecasted to phase in over the next two to three years.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. We have recently expanded our Far East network giving us access to additional capacity which strengthens our service offering to our clients. We recommend making bookings as far as possible in advance of your required sailing dates for all trades.

Equipment imbalance

Container availability is still a cause for concern, especially 40HQ and in some regions, such as India, 20ft shortages are also common. Bottlenecks in regions like the USA, Europe and Asia prevent reliable container circulation.

Longer sailing lead times and vessel re-routings have also been contributing factors to container shortages for certain trades. Container depots are releasing containers as late as possible to manage carrier’s’ container stocks relevant to priority.

Global shipping demand is set to increase over the coming months thereby placing further pressure on equipment availability. It is no secret that shipping lines have been prioritising equipment at a premium for trades such as the USA and Europe.

We encourage you to consider converting 40GP/HQ into 20ft containers or 40ft non-operating reefers (NOR) to secure space and equipment for urgent shipments.

Sailing schedules

Shipping lines are constantly adjusting their services, lead times and routings. We have seen an increase in shipping lines adjusting routings mid-voyage without prior notice to either avoid congested ports or to meet strategic port calls on time.

This behaviour has a negative impact on both lead time and visibility. There has been a spike in blank sailings and port omissions over the past month. Blank sailings globally were up 300% for the first half of June equating to over 3 million teu in vessel capacity.

Shipping lines have also warned that schedules will remain unstable. soon. Some shipping alliances have extended their suspension of sailings from regions such as ex-South America, Mauritius and Madagascar. Decisions by shipping lines to omit ports or suspend services are beyond our control.

Port congestion

All major transshipment ports like Singapore (pictured), Colombo, Port Kelang and Tanjung Pelepas continue to struggle with congestion and backlogs. This is having a catastrophic impact on transshipment predictability, container rollovers, increased vessel dwell time and longer lead times.

There has also been an increase in port congestion in ports such as Hamburg and Rotterdam in addition to previously reported main ports in the USA and India.

Where possible, we will continue to book shipments on alternative routings to avoid congested ports, however, please keep in mind that this is not always possible due to the limited sailing options on certain routes.

Shanghai port has suspended most hazardous cargo shipments until the 2nd of July. Locally, we have also seen operations being negatively impacted.

Freight rates

Rate levels and predictability have been a major cause for concern, most notably on the Far East trade. Rate levels continue to soar to new highs which is concerning leading into Q3 which is the start of the peak season.

Overweight surcharges on 20ft containers are being enforced on various trades. Shipping lines are likely to pass through additional surcharges in the form of peak season surcharges (PSS) for example.

Another frustration has been the short rate validities and it has become common practice across shipping lines to only hold rates for seven to 14 days, alternatively forcing agents to make spot bookings that attract a higher premium. This applies mainly to the Far East and India sub-continent trades. General rate increases (GRI’s) of between $150 to $500/teu will be effective from the 1st of July.

Average year-on-year percentage rate increase from selected ports (June 2020 vs June 2021)

| POL | Indicative % increase per TEU to South Africa |

| Hamburg | 31% |

| Istanbul | 24% |

| New York | 0% |

| Nhava Sheva | 275% |

| Shanghai | 575% |

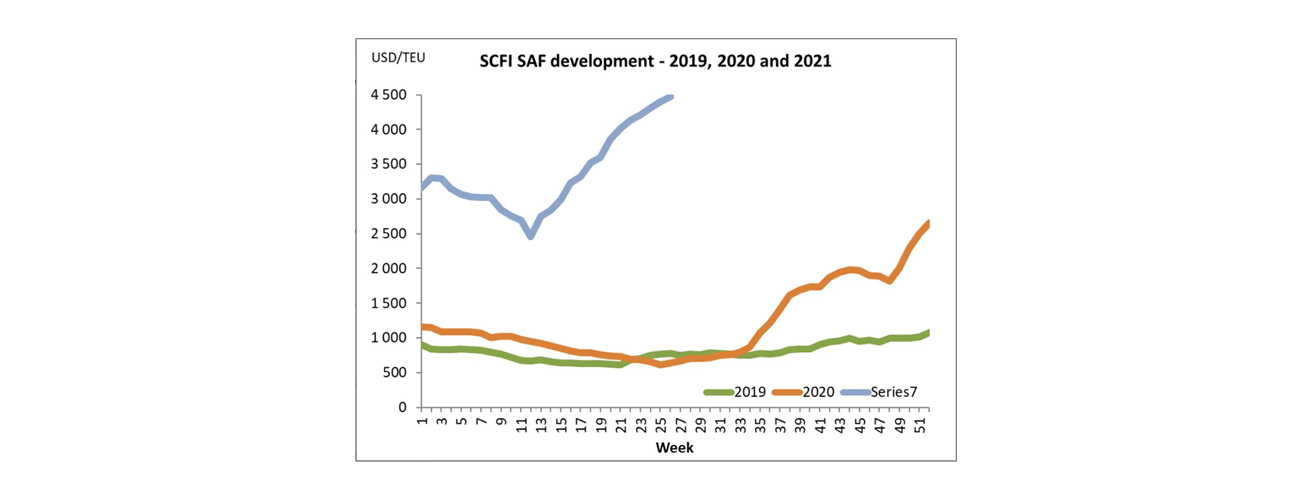

SCFI (Shanghai Container Freight Index)

The below graph demonstrates the freight rate increases per TEU ex-China to South Africa. (Series 7 = 2021).

Air transport disruptions

Capacity

We anticipate demand for capacity to naturally gain momentum throughout Q3 and into Q4. Additional demand can be expected because of the bottlenecks being experienced in the sea freight market.

Orders that would usually ship via sea freight could be converted to airfreight as shippers and importers alike get desperate to meet their deadlines. This is especially prevalent across the automotive, healthcare, mining and electronics verticals. Backlogs are prevalent across certain countries in Asia as demand exceeds available capacity.

Flights into South Africa are still limited due to numerous carriers not operating their passenger flights and carriers diverting freighter capacity to higher volume trades. We are seeing a few more carriers like Emirates announcing that they will add passenger flights to the South Africa route which will add capacity. Hopefully more carriers will be resuming or adding flights as the vaccination programme gains further traction.

Despite these challenges we do have various options at our disposal, including access to space on charter flights, to ensure we secure space at very competitive rates.

Transit times

Transit times have been relatively stable across our network, but certain routes remain unpredictable. As demand picks over Q3 we anticipate that lead times could become a little more unpredictable.

Higher global volumes could create sporadic bottlenecks and an increase in cargo being bumped onto a later flight and thus increasing transit times.

Airlines have also reported disruptions to their services due to crew and operational staff having tested positive for Covid.

Hazardous cargo shipments are always subject to longer lead times and carrier acceptance, therefore we suggest you make provision for a few extra days for such shipments.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Freight rates

An increase in demand for capacity and increasing fuel prices will drive rate levels upwards. Freighter capacity is already stressed which affords carriers the opportunity to drive rates upwards and demand a premium for priority or back-to-back bookings.

We have recently expanded our network and are well positioned to offer a variety of options to meet your airfreight requirements.

Black Friday

November Black Friday is a very important sales period for many retailers and planning to receive orders in time has never been more critical. Last year some retailers ran their Black Friday campaign for the entire month of November, therefore we anticipate more retailers to follow suit this year.

In saying that, the shipping window is wider and therefore the demand for capacity and equipment will start earlier in Q3 this year. Below is a shipping guideline for your reference.

| Year | 2021 | 2021 | 2021 | 2021 | 2021 | 2021 |

| Dates | 30 Aug to 19 Sep | 20-30 Sep | 1-7 Oct | 8-17 Oct | 18-31 Oct | 1 -30 Nov |

| Notes | Black Friday shipping window | Capacity and equipment constraints across sea, air and truckers. Pre-Golden Week rush. Ppossible increases in freight rates. | Golden Week in China: Little or no communication with Asian freight forwarders and suppliers. | Capacity and equipment constraints across sea, air and truckers. Possible increases in freight rates. Possible blank sailings. | Capacity and equipment constraints across sea, air and truckers. Possible increases in freight rates. Possible blank sailings. | Black Friday sales start |

Please contact your logistics controller should you have specific queries or require any further information and guidance.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.