The first month of 2022 is behind us and there is mixed sentiment in the market as to what we can expect for the remainder of the year. The shipping lines have been publishing record profits for 2021 and the expectation for 2022 is to better this.

It begs the question on how they will achieve even higher profits. Besides keeping rates elevated, some shipping lines have been expanding their service and product offerings to landslides logistics services, airfreight and acquisitions of logistics and e-commerce businesses. No doubt that the shipping lines will continue to expand their businesses’ interests and look to drive new revenue streams.

Severe bottlenecks across the USA and port congestion in key ports for example will continue to hinder global supply chains returning to a stable state soon. We should all be prepared for the unexpected and remain open minded to change and adapt to local and global influences.

Sea freight update

It may be too early to conclusively determine if the Chinese New Year period has allowed ports and shipping lines a window of opportunity to partially recover from congestion and unstable sailing schedules.

Early indications show that recovery has not been possible and shipping lines are using blank sailings and routing adjustments as a continued method to address their erratic schedules. Time will tell how effective this will be, but one thing we need to brace ourselves for is unpredictability. There are too many factors outside of the shipping lines’ control that have a counter-productive outcome on the shipping lines’ intended outcomes.

Capacity constraints

Capacity has been impeded by congestion, vessel re-deployments and blank sailings across the globe. South Africa and Intra-Asia have unfortunately been severely impacted as shipping lines continued to favour the Asia – USA and Asia – Europe trade routes by deploying additional vessels to these trades to accommodate growing demand as well as compensating for capacity lost due to port congestion.

It comes as no surprise that capacity into South Africa for February will be significantly down due to the blank sailings imposed ex-Far East for February.

Some shipping lines have opted to blank out three sailings which means demand for the existing sailings could exceed available supply. Port omissions and routing amendments on the other trades has also negatively impacted capacity.

Space ex-Europe, Americas and Middle East remains under pressure with some shipping lines being fully booked for weeks in advance. Booking in advance (four to six weeks) is essential given the current and anticipated future conditions.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded international partnerships, we have gained access to additional capacity which strengthens our service offering to our clients.

We recommend making bookings as far as possible in advance of your required sailing dates for all trades.

Equipment imbalance

Equipment availability in Asia, Europe and the Mediterranean has been inconsistent across the various container types from time to time. However, the situation is not nearly as severe as it was 12 months ago and thankfully there have been large volumes of new builds released into the market over the past few months.

Sailing schedules

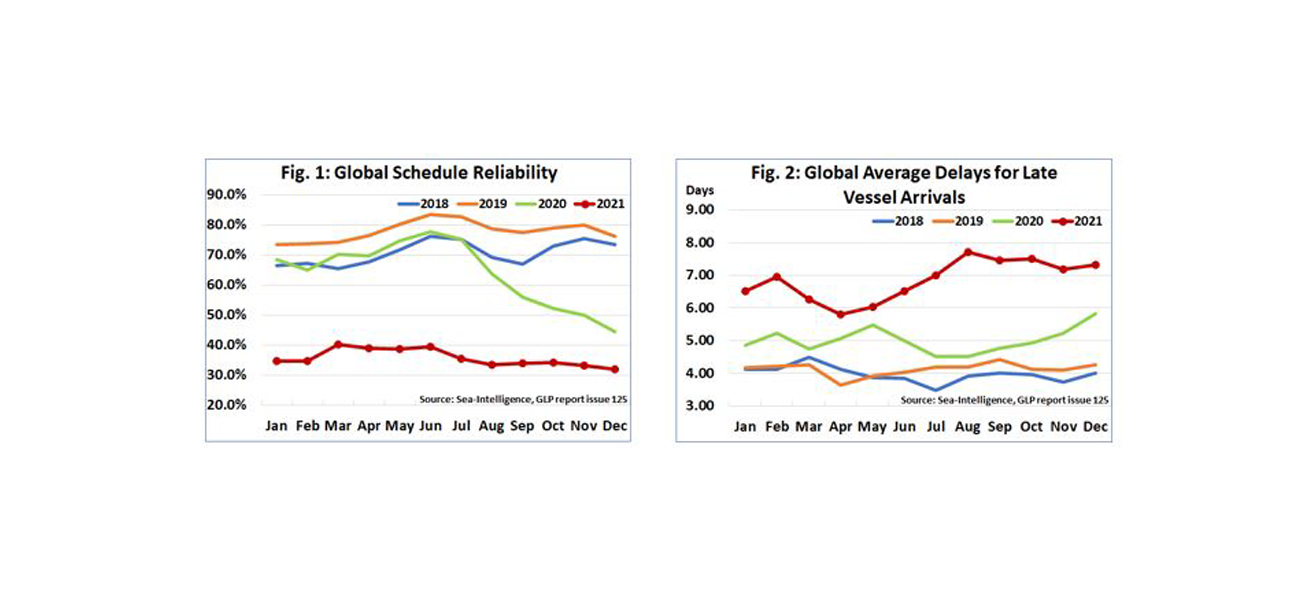

Schedule reliability hit an all-time low of 32% and on average, late vessel arrivals increased to 7.33 days according to the latest Sea-Intelligence report (see graphs below).

Congestion and backlogs in the main transshipment hubs (three to five weeks) also contribute to shipping lines being forced to adjust their schedules. This obviously has a severe impact on lead times and capacity.

We continue to see shipping lines make last-minute adjustments to their schedules and routings on all trades which leads to a greater level of unpredictability and makes lead time planning exceptionally difficult.

One way of countering this is to buffer additional time into your total lead time and where possible to increase inventory holding which is becoming more common amongst importers. We would also advise to adjust lead times based on seasonality and peak shipping periods. For example, buffer in an additional two weeks or ship orders earlier that are planned to ship around the European summer holidays or the Chinese Golden Week in October.

Schedule reliability drops to record-low in December 2021

Source: Sea-Intelligence

Freight rates

Rates ex-Far East continued to soften with further reductions for the first half of February. Unfortunately, the market has not been able to take advantage due to the Chinese New Year and the subsequent implementation of numerous blank sailings.

We expect shipping lines to try push through increases again from mid-February should the demand justify this. There is no doubt that shipping lines will keep rates elevated throughout 2022 and further upward adjustments will be made with rising fuel prices.

It will come as no surprise if additional surcharges are passed across the various trades as shipping lines continue to battle with operational inefficiencies through the global supply chain.

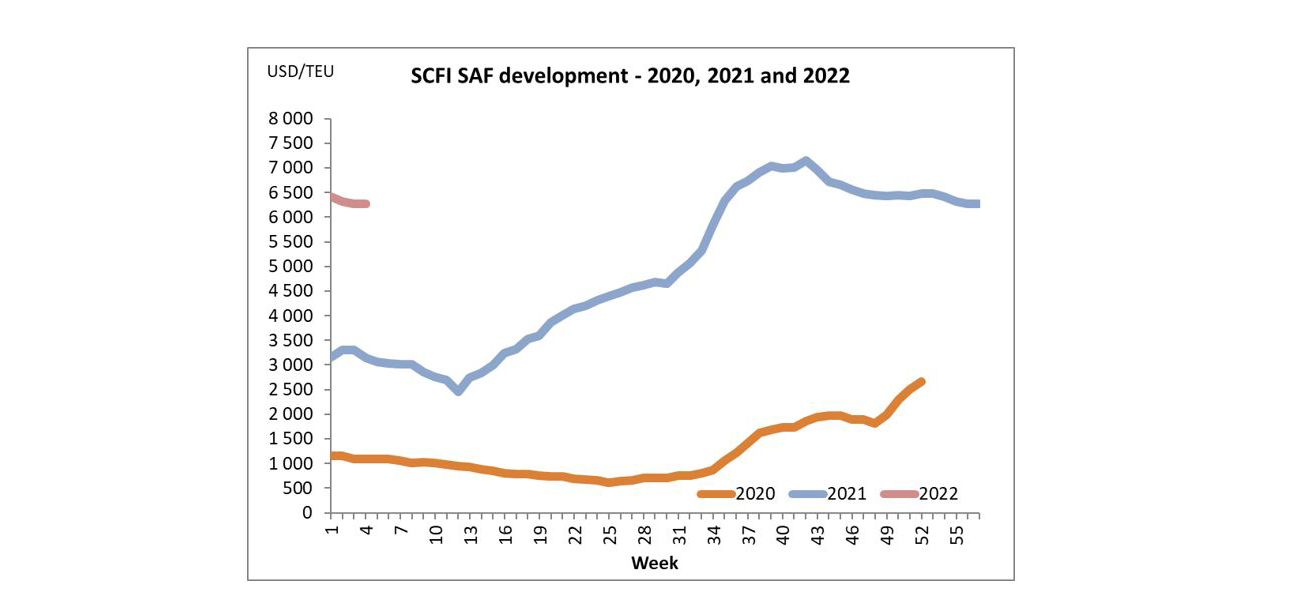

SCFI (Shanghai Container Freight Index)

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa.

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

Air freight update

The USA continues to be battered by severe weather conditions, labour shortages and bottlenecks which has caused flight delays and flight cancellations. Europe continues to struggle with trucking and labour shortages.

There could be a surge in demand post Chinese New Year as a result of orders becoming critical due to not moving pre-Chinese New Year and due to the higher number of blank sailings being implemented for sea freight.

As countries recover from the impacts of Omicron, we expect additional capacity to be phased into South Africa. The market also sees more shipping lines entering and strengthening their position within the airfreight market through aircraft and freight forwarding acquisitions.

Capacity

Capacity remains constrained now due to a combination of factors, but we expect the situation to stabilise in the coming weeks once backlogs have been cleared. Frankfurt gateway has been impacted due to the affects of an increase in the number of Covid cases.

We can expect the main hubs servicing the various trades to remain under pressure from a capacity and terminal handling perspective and one should expect a few days delays over the next few weeks.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times

Transit times remain relatively stable with no major disruptions or delays. It is still important to factor in a few extra days for the pre-departure leg due to collection and handling backlogs in the USA and Europe. The same is expected ex-China post Chinese New Year.

Freight rates

Airlines will factor in the increasing fuel prices to their rates. Rate levels should remain relatively stable with pockets of increases from regions such as the USA. We anticipate rates to remain at elevated levels ex-Far East and China for the immediate period post Chinese New Year and expect rates to start softening thereafter. Origin handling and trucking charges have however increased. Spot freight pricing will remain a common practice.

With our expanded network we are well positioned to offer a variety of options to meet our clients’ airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.