Segments of global supply chains are improving and giving the market a sense of hope that things will be back to “normal” soon. Freight rates continue to soften, and capacity is more freely available compared to a few months ago which is very encouraging. However, other forces at play are negating these benefits for importers. It has been almost a year since Russia invaded Ukraine and the effects of this continue to plague the markets in various forms. Inflation and better-than-expected new employment numbers in the US continue to be a topic of concern for the Fed.

The latest inflation figure released (6.4%) is down, but it remains far higher than the 2% target for inflation. The strong labour market is likely to fuel demands for higher wages which will place pressure on inflation.

The Federal Reserve chair Jerome Powell has indicated that the central bank will continue to raise interest rates. The effects of this will fuel a stronger US dollar and conversely, the rand will remain under pressure. The weaker rand combined with expected fuel increases in March and the impacts of the current energy crisis will likely add to South Africa’s inflationary worries.

We will continue to work very closely with all our partners and service providers, to ensure that all your shipments are delivered as efficiently as possible.

The impact of the following key factors needs to be continually assessed and considered:

- Further freight rate reductions

- Weaker Rand

- Improved capacity availability

- Production delays

- Stable airfreight market

Sea freight update

The seas appear to be calmer relative to 2022 when one considers port congestion, bottlenecks, capacity, and freight levels. Shipping lines are in for a rougher year from an earnings perspective because demand and freight rates have declined. There is no doubt that supply chains will be confronted with new challenges and unpredictable events that could change the landscape at any time.

Capacity:

There is a clear contrast when comparing the capacity available for the Far East trade to that of Europe and the US. Capacity is more freely available in the Far East trade whereas carriers are operating their vessels at a higher utilisation factor on the Europe and USA trades to South Africa. Demand from Europe is more consistent, and vessels are generally fully booked in advance. Direct sailings from the USA are limited and vessels are also fully booked in advance because of the limited capacity currently on offer.

Despite the challenging environment, we will endeavour to provide solutions to keep your cargo moving. With our expanded global network, we have access to additional capacity and alternative routings which strengthens our service offering to our clients.

Sailing schedules:

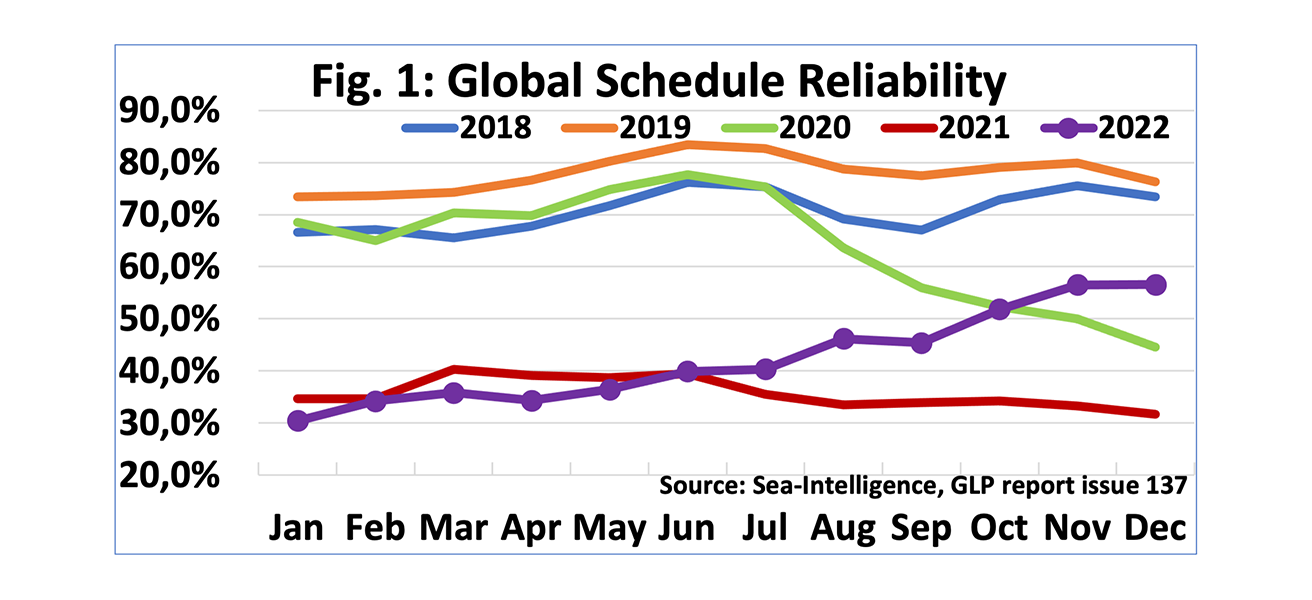

Schedule reliability continues to improve, albeit in small increments and the delays experienced are not anywhere near as severe as experienced in 2022. This trend can be attributed to an improvement in port congestion and transshipment delays. The reliability is still not at the same levels as pre-Covid times and carriers are still confronted at times with maintaining their scheduled port calls and rotations. Recent severe local weather conditions and operational constraints at South African ports have impacted vessel berthings and discharges which has contributed to a few additional days to lead times.

Please refer to the below Sea-Intelligence schedule reliability graphs for annual comparisons.

Freight rates:

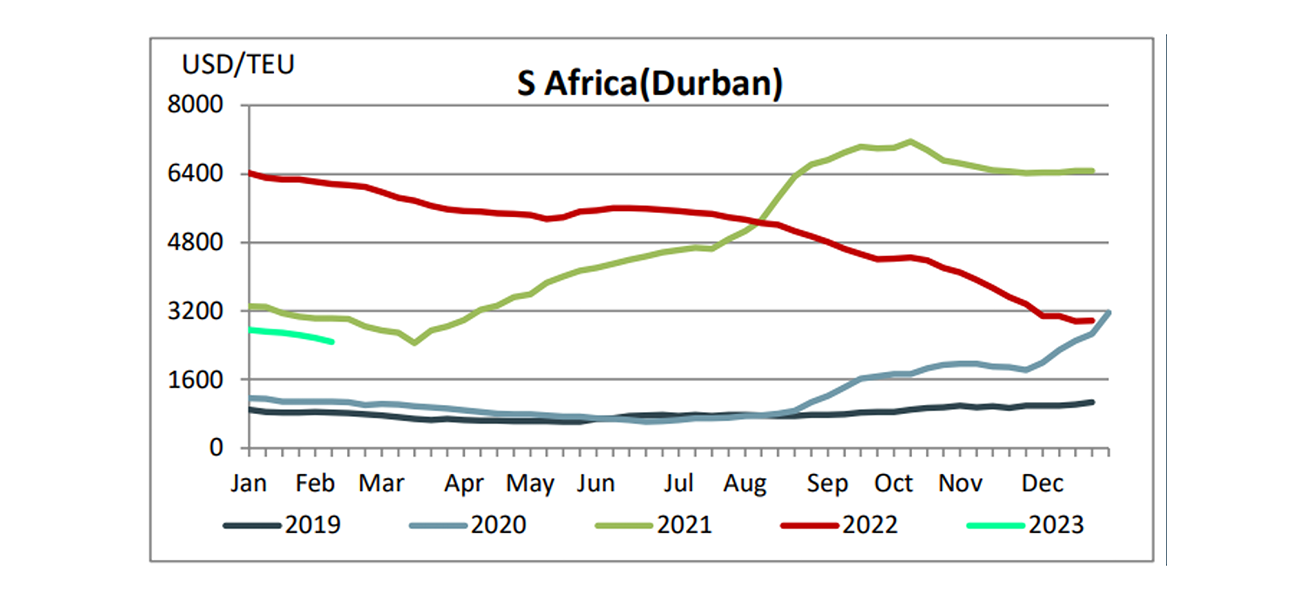

Rates continue to decline for the Far East and Middle East/India trade. As previously anticipated, carriers are desperate to utilise their capacity and therefore are competing amongst themselves to attract volumes. Reducing freight rates is the most obvious method to attract additional volumes and if demand remains subdued and capacity supply outweighs demand, the rates will continue to soften.

Rates for the US and Europe trade are more stable with minimal fluctuations.

SCFI (Shanghai Container Freight Index)

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

Air freight update

The market remains stable with no major disruptions to report on. Passenger demand continues to rapidly recover, but air cargo growth remains sluggish. Improvements in the sea freight market and reduced global economic growth are some of the factors impacting air cargo growth.

Capacity:

There is currently adequate capacity in the market to cover demand. Demand remains flat relative to the first half of 2022.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times:

We have not experienced major delays to transit times and transit times remain consistent across the various service levels and trades.

We encourage you to provide your required arrival dates in advance for us to offer you optimal routings and rates to meet your requirements.

Freight rates:

The spot rate levels have softened across most trades and are significantly down from the peak rate levels.

With our expanded network we are well-positioned to offer a variety of options to meet our clients' airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.