It’s not like global supply chains haven’t been dealing with continuous challenges already and now a fresh wave of new challenges and disruptions is going to cause further headaches.

The impact of this invasion has already had a wide-ranging affect from escalating brent crude prices, suspension of logistics services to and from both Russia and Ukraine and various financial sanctions imposed on Russia to name just a few.

According to Bloomberg, almost half the world’s container shipping capacity has halted service to Russia.

We should all be well versed by now to know that we can expect a ripple effect throughout global trade. It’s premature to know at this stage what the full impact will be on our economies and supply chains but be prepared for increased pressure on air and sea freight capacity, delays in manufacturing and supply of products as well as inflationary pressures due to escalating costs as a result of fuel and various commodity price increases.

While all the above needs to be closely monitored, we all still need to keep our finger on the pulse and pro-actively manage everything else that’s going on around us across the rest of the globe. All trades continue to be impacted by existing challenges such as trucking and shipping delays in the USA and Europe as well as port congestion and erratic shipping schedules globally.

Closer to home, the All Truck Driver Forum (ATDF) have been airing their grievances and protesting in parts of South Africa regarding the employment of foreign nationals in the transport sector. The situation remains volatile and there is a possibility of further disruptions to the local logistics industry.

Sea freight update

The expectation for congestion and capacity pressures easing off post-Chinese New Year has not been realised and if anything, port congestion worsened which has had a cascading impact on all trades and sailing schedules.

The USA East Coast, Europe, including the Mediterranean, and Far East ports such as Singapore have certainly been battling while there has been positive reduction in the number of vessels waiting to berth on the USA West Coast (i.e., Los Angeles), however the situation remains problematic.

We could potentially experience a surge in demand for sea freight capacity from China to Europe as shippers avoid using the rail service and revert to sea freight with the current Russia and Ukraine conflict.

This could result in shipping lines deploying additional capacity on this trade route and vessels operating on the South African trade could be deployed onto the Far East-Europe trade to accommodate for the additional capacity demand.

Capacity constraints

Capacity from the Far East was severely impacted in February because of multiple blank sailings implemented. This has caused a backlog at origin port as well as in the transshipment hubs.

Thousands of containers have been rolled post the Chinese New Year period and shipping lines are prioritising these shipments. Far fewer blank sailings are planned for March, so we expect to see the situation improve over the coming weeks.

Capacity from South America and India remains tight. Capacity pressures have escalated on the European and Mediterranean trade, including the UK and we continue to see vessels fully booked up to six weeks in advance sometimes. Booking in advance (four to six weeks) remains essential.

More than 12% of global capacity is tied up outside ports across the globe due to port congestion. Acceptance of hazardous shipments by carriers continue to be challenging and booking acceptance time frames are inconsistent across the carriers and ports of load.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded global network, we have gained access to additional capacity which strengthens our service offering to our clients.

We recommend making bookings as far as possible in advance of your required sailing dates for all trades.

Equipment imbalance

The availability of containers is in general relatively stable across the Far East. An imbalance of containers is being experienced across parts of Europe and Turkey.

Sailing schedules

Schedules remain erratic and unpredictable on all trade routes. There have been several vessels phased in and out of trades which has contributed to shipping delays. The market experienced numerous departure delays, port omissions and direct bookings being transshipped and rolled by several weeks.

This has severely impacted lead times and in some cases, shipments have been delayed by six weeks as a result of the above-mentioned factors. Shipping lines have also amended their routings and port rotations at short notice.

Freight rates

We continue to see freight rates softening on the Far East trade which has been welcomed. We don’t anticipate any significant upswings in freight rates over the next few weeks. We do however expect an upward adjustment in the bunker surcharges from April as global bunker prices continue to increase, but these adjustments are relatively small when considering the base freight rates.

We won’t be surprised if additional surcharges are implemented by shipping lines on certain trades as a result of port congestion for example. We expect inland trucking rates to increase due to trucking bottlenecks and shortages as well as rising fuel prices.

Effective 1 April 2022, annual landside price increases will be implemented. The updated charges will be communicated once all rates have been received from the various shipping lines, transporters and other logistics providers.

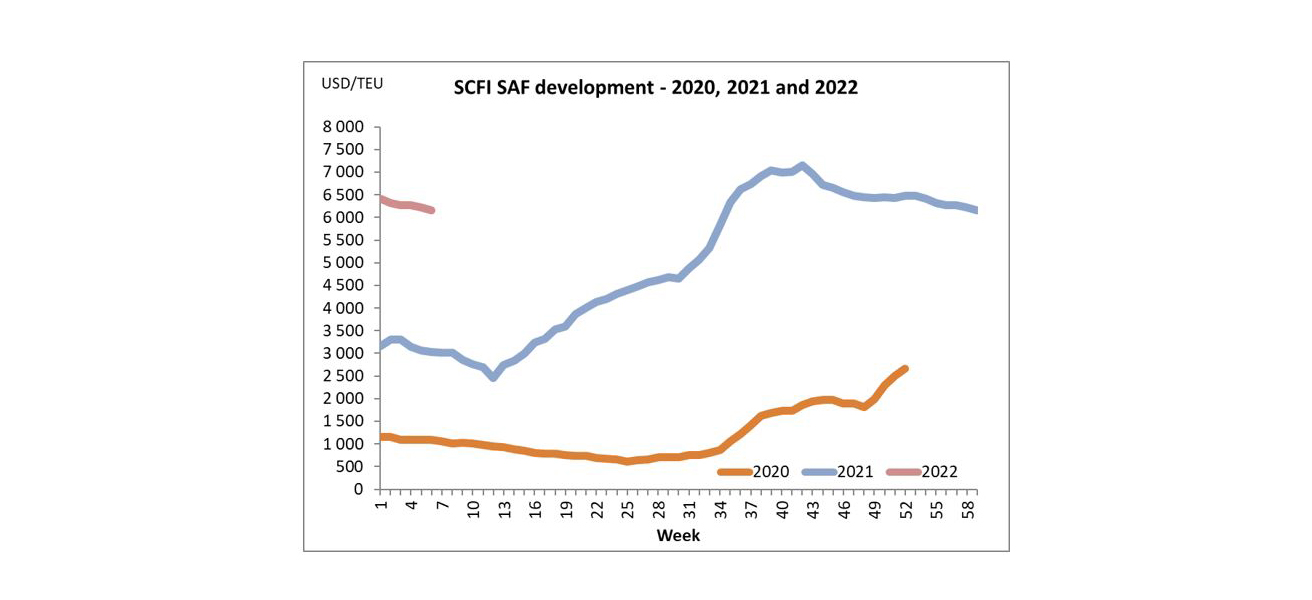

SCFI (Shanghai Container Freight Index)

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa:

Air freight update

The market can brace for changes in capacity, lead times and routings because of the Russia/Ukraine conflict. Sanctions placed on Russian owned carriers and cargo only aircraft effectively means a reduction in capacity and shippers need to make use of alternative carriers to move cargo. This places capacity pressure on both handling facilities, transshipment hubs and airlines’ capacity.

In addition, the Russian air space has been a declared a no-fly zone forcing airlines to amend their routings which adds additional time to their transit times and in cases changes to their schedules may need to be made. For example, carriers operating between Asia and Europe would usually fly over the Russian airspace now need to change their routings to avoid this flight path. Some airlines have already cancelled flights for the coming days while they adjust their routings and schedules.

Capacity

Based on the above-mentioned factors, capacity will come under pressure and time will tell how significant the capacity pressures will in fact be. Carriers may decide to deploy capacity from other trades onto the USA-Asia or Asia-Europe trades in order to compensate for the sudden reduction in market capacity caused by sanctions and flight cancellations. Bumping of cargo could become more frequent in the coming days due to the current challenges and changes taking place.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times

Transit times have until now remained relatively consistent, but the market does anticipate a level of transit time unpredictability.

Freight rates

We started to see a general softening of rates in the market, but with the increasing global fuel prices and disruptions caused by the above-mentioned conflict, the market is bracing for rate levels to climb. Collection and delivery rates will also increase.

With our expanded network we are well positioned to offer a variety of options to meet our clients airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.