Once again, supply chains are at risk of being dramatically de-stabilised because of a significant event; strike action declared by recognised unions within Transnet. Transnet have proceeded to declare Force Majeure as result.

This has come at a time when our economy can ill-afford an event of this magnitude and has the potential to cascade into a wave of negative effects down the line such as product shortages, revenue loss, job losses and ultimately overall GDP growth to name a few.

This strike comes at a time when the country is already battling with rising interest rates, a weakening Rand and unemployment. We can only hope that an agreement is reached immediately between Transnet and the two unions.

The impact of the following key factors needs to be continually assessed and considered:

- Transnet strike

- Sea freight declining demand and rate reduction

- Port congestion easing

- Declining sea freight rates

SAFM podcast: Ongoing strike action at Transnet costing SA billions

Economists estimate that the ongoing strike action by Transnet employees is costing South Africa billions of Rands, also warning that it could have a wider negative impact in that countries can lose confidence in ordering goods from South Africa. For more on this, SAFM's Elvis Presslin spoke to the head of logistics at Investec for Business, Denys Hobson on the First Take SA podcast.

Let's talk

Discover how we can simplify and improve your global trade transactions to optimise your cash flow and lower your supply chain risks.

Sea freight update

The current strikes by Transnet employees have dampened the mood for our economy and have happened just as the industry was beginning to celebrate positive news of global port congestion easing and further rate declines.

The impact of the strike is already being felt and amongst other things forcing shipping lines to re-route cargo to alternative ports outside of South Africa. There are still significant consequences to follow should this strike continue for a protracted period.

Shipping lines may decide to cancel future sailings to South Africa or alternatively they will discharge cargo in neighbouring ports such as Maputo and Walvis Bay until the situation improves. This all leads to additional costs, longer lead times and financial pain for many.

Capacity

Demand for space continues to decline across major trades and we are seeing a definite improvement in space availability across most trades with South America being the main exception. The previously constrained capacity situation has been helped by a general improvement in global port congestion and falling demand, thus less capacity is being tied up by vessels caught up in port congestion and berthing delays.

The pre-Chinese Golden Week shipping rush was soft compared to prior years. It won’t come as a surprise if shipping lines implement additional blank sailings in the coming weeks, especially on the Far East trade, as they try to strike a balance between supply and demand.

This will support their efforts in curtailing the speed of the current freight decline trend. It’s important to note that shipping lines may even suspend bookings should the South African port strikes continue for an extended period.

We still encourage bookings to be made well in advance of the required shipment dates and factor in longer lead times based on the current uncertainty in the market. Trucking and rail capacity remains constrained throughout Europe and parts of the USA.

Despite the challenging environment, we will endeavor to provide solutions to keep your cargo moving. We will look at each shipment individually to find solutions and our teams have been briefed to consider alternative options based on each client's requirement.

Equipment imbalance

With the improvement in global port congestion, equipment availability is in general stable with very few instances where equipment has not been available.

Sailing schedules

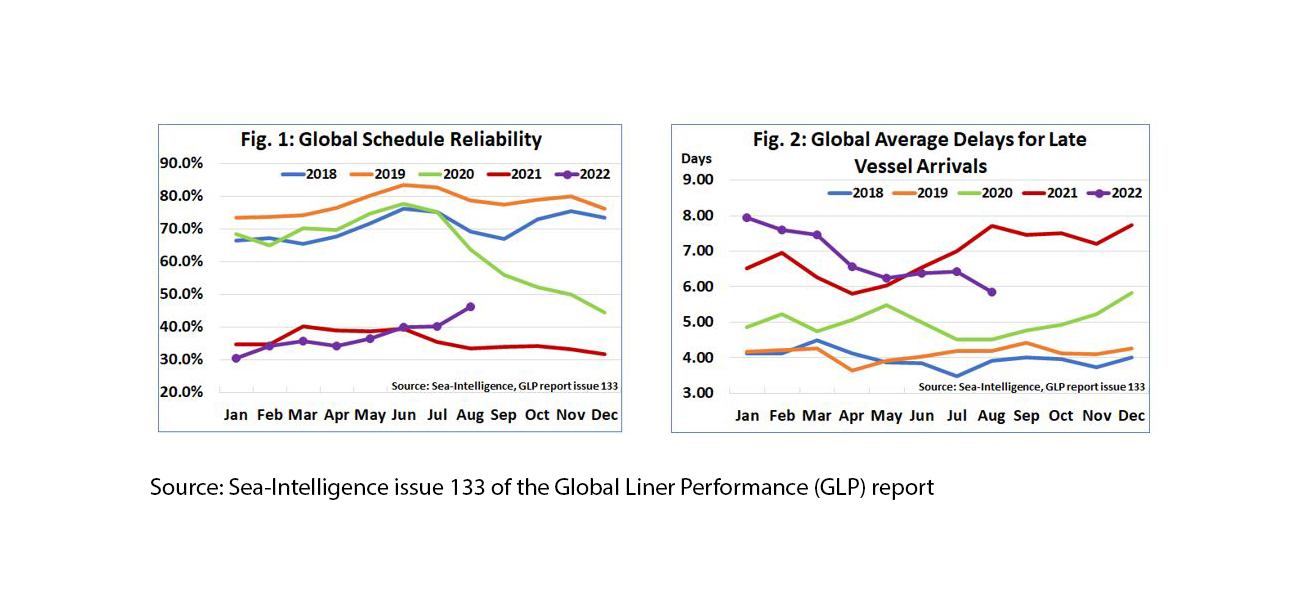

Global schedule reliability continues to improve and average on-time performance is approaching 50%. Based on the latest Sea-Intelligence analysis, schedule reliability was at 46.2% which is a 5.8% improvement on prior month and a 12.7% improvement compared to August 2021.

We can expect significant disruption to schedule reliability into South Africa because of the current strike action at our ports. Future sailings are also likely to be impacted as vessels will be delayed on their return voyages from South Africa to their respective origin ports.

Freight rates

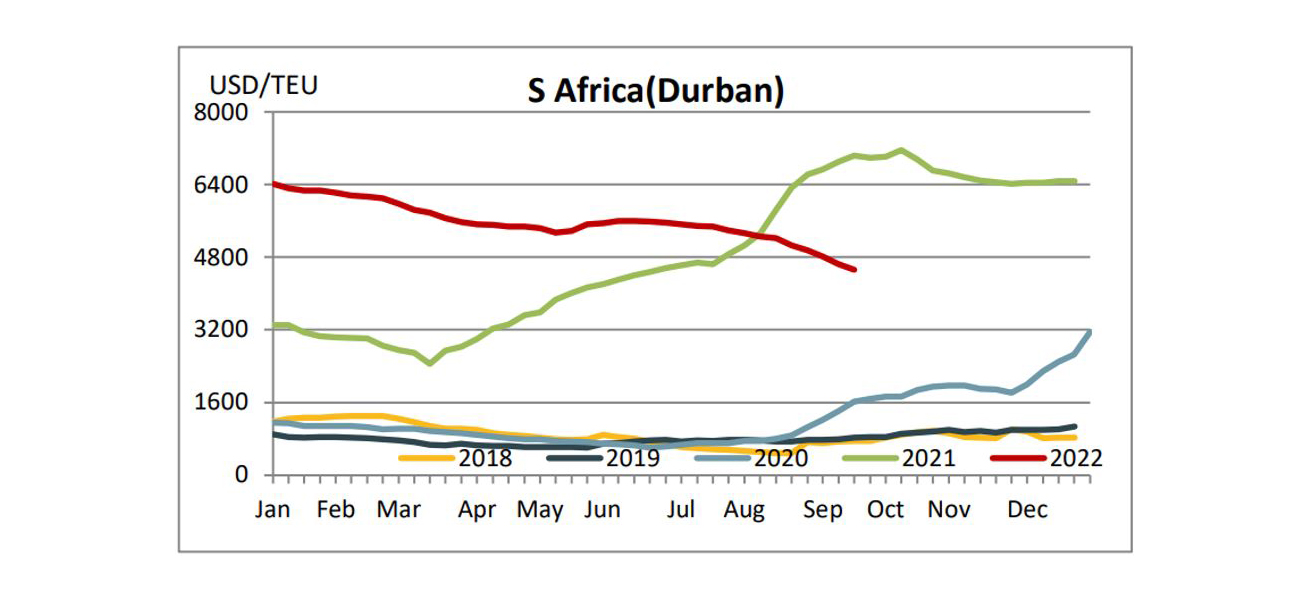

Importers have been enjoying the welcomed freight reductions over the past few weeks, most notably on the Far East trade route. Freight rates have declined circa 50% compared to the same 2021 period and the market indications are that the rates will continue to soften.

It’s very difficult to predict at what level they will stabilise, but based on the current demand and vessel utilisation, shipping lines are aggressively competing for volumes which means there is room for further rate reductions. Forty-foot (40ft) rates from main ports China are averaging below $6700. Spot rates on the Middle East and Europe trades have also softened.

If capacity is reduced through blank sailings as a knock-on effect of the current port strikes, then shipping lines may have an opportunity to increase freight rates.

SCFI (Shanghai Container Freight Index)

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa

Air freight update

Peak demand has been relatively subdued and with that we have seen rates either stable or in instances softening. We can expect demand to increase to South Africa should the port strikes be protracted forcing importers to convert sea freight shipments to air freight.

Capacity

There is sufficient capacity in the market to accommodate current demand levels, but the dynamics could change quickly if there is no agreement reached soon to end the South African port strikes.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times

We have not experienced delays of any significance. With sufficient capacity on offer, cargo has been moving timeously. Backlogs have been minimal across most trades, and this has also contributed to transit times being consistent.

We encourage you to provide your required arrival dates in advance for us to offer you optimal routings and rates to meet your requirements.

Freight rates

Freight rates have been relatively stable across the trades, and this has been helped by the fact that there hasn’t been a spike in demand especially in the lead up to the Chinese Golden Week.

With the sea freight market improving and cost pressures, the demand for airfreight has not been as buoyant compared to the same 2021 period. If demand spikes because of importers needing cargo urgently due to the sea freight delays caused by the port strikes, then we can expect market rates to increase.

With our expanded network we are well positioned to offer a variety of options to meet our clients airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.