Supply chains have had to adjust and be far more flexible than pre-Covid times. Scenario planning is key to supply chain design and planning. Companies need to be proactive and decisive in their decision making thereby mitigating the potential effect of future disruptions. What is clear is that delays and bottlenecks will be a common theme for the near future, and one needs to accommodate longer lead times for production and shipping.

The current electricity cuts in China will be of concern to all importers and with the Chinese New Year only a few months away, detailed supply chain planning is of critical importance.

China’s electricity crunch:

After one of the worst years on record for the logistics industry, the recent China electricity crunch threatens further disruption to global supply chains.

The below scenarios could play out due to the power cuts:

- Factories prioritise orders based on the size of their client(s)

- Shippers cancel bookings – if a high number of bookings get cancelled, shipping lines may cancel sailings due to a lack of volume as they want to keep rate levels elevated and maintain high vessel utilisation. This could create future over-bookings and rollings as well as add to port congestion and bottlenecks once manufacturing output increases and stabilises.

- Suppliers may revert from making bookings in advance to mitigate the risk of paying shipping lines cancellation fees as they can't guarantee when cargo will be ready for shipping. This could mean that suppliers end up booking late and orders ship significantly later than required.

- Once the electricity issue stabilises, manufacturing output will be ramped up creating a surge in demand for equipment and capacity that could potentially cause temporary trucking shortages or delays.

- Factories that have access to alternative power supply like generators may need to increase their prices due to the higher input costs incurred, especially with the increasing fuel prices.

- Increase in demand for air capacity as suppliers scramble to meet clients’ delivery dates.

Sea freight update

Port congestion, sailing delays, capacity shortages, high freight rates and equipment shortages remain common themes. The Far East, South America and Middle East trade routes continue to be the most challenging and frustrating to navigate. Delays of all kinds are now synonymous across these trades with no end in sight to the chaos in the short term.

The supply chain bottlenecks across the USA also remain troublesome and over the past month have escalated unfortunately, which places pressure on the shipping lines to restore capacity back into other trades and to reposition equipment to key export markets.

These same constraints mentioned above are now being experienced on a more elevated level in Europe and Mediterranean trades. Hazardous cargo shipments are experiencing longer booking lead times especially from China as various carriers and ports are reluctant to accept certain types of this cargo.

Capacity constraints:

Capacity constraints are being experienced across all trades now. It was anticipated that capacity would be under serious pressure throughout September especially with the build up to the Chinese Golden Week, the traditional peak shipping period and disrupted sailing schedules.

The capacity situation in Europe has got tighter and some carriers are reporting that vessels are fully booked late into October already.

India and Turkey are arguably more severe than the Far East considering that carrier choices are limited compared to the region.

Capacity from Asian countries that rely on transshipment routings into South Africa has been reduced due to feeder services into hubs such as Singapore and Tanjung Pelepas being delayed, and priority given to USA and European volumes. Booking lead times are up to four weeks and some shipping lines are fully booked until the end of October.

Scheduled and unscheduled blank sailings during and post the Chinese Golden Week will further impact the capacity supply in October. Space for export bookings from South America to South Africa is very scarce and the situation is not expected to improve soon due to the priority given to the reefer export season that commences in October.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded global network, we have gained access to additional capacity that strengthens our service offering to our clients.

We recommend making bookings as far as possible in advance of your required sailing dates for all trades.

Chinese Golden Week

China is celebrating their 72nd National Day and a week-long holiday known as the "Golden Week" from 1-7 October. According to Nikkei Asia, it is predicted that a record 250 million people will travel during the five-day break, around 28% more than in pre-pandemic 2019.

Equipment imbalance:

The circulation of equipment remains problematic for shipping lines and the imbalance extends beyond Asia into countries such as India, Turkey, Italy and even some major European countries. Some shipping lines have been focusing on repositioning equipment back into key trade hubs such as China and India at the expense of accepting freight-paying exports. Sailing delays, port congestion and supply chain bottlenecks across the USA are all factors that hamper shipping lines’ ability to reposition equipment to key markets.

Sailing schedules:

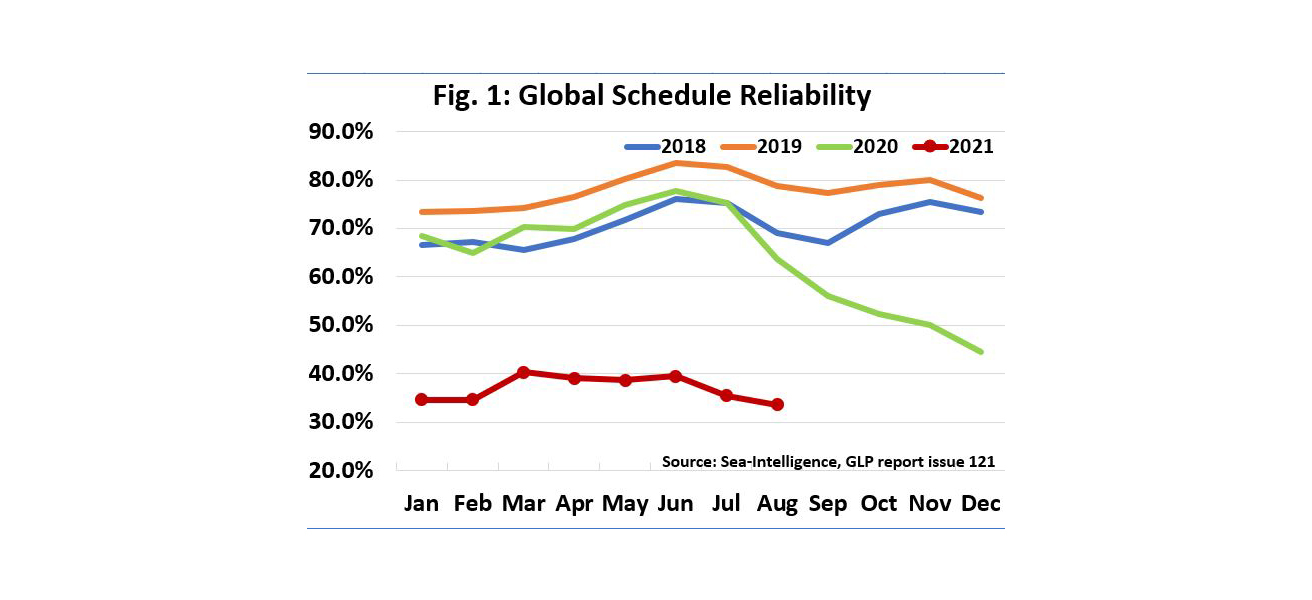

Global schedule reliability has declined over the past month. Historical lows were record for August with the global on-time reliability sitting at around 33% according to Sea-Intelligence’s latest report. This is astounding to think when the global average was around 80% in August 2019 and 64% in August 2020.

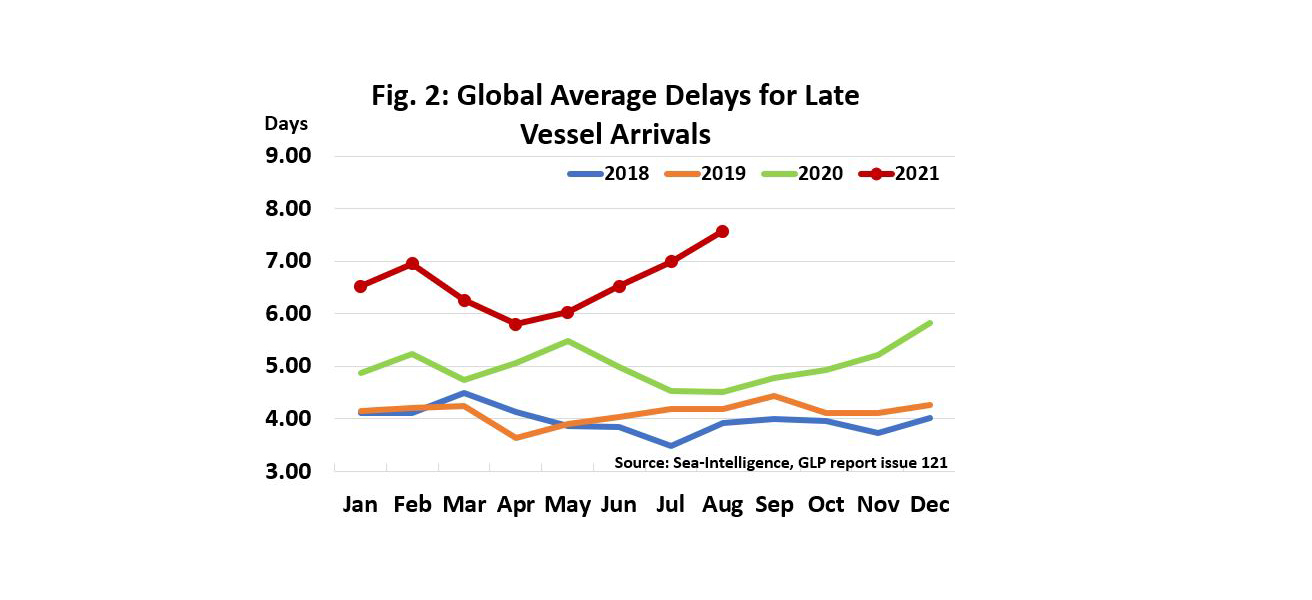

The average number of days for late vessel arrivals globally has increased to 7.57 days. Port congestion, port shutdowns, vessels in quarantine due to Covid cases on board and instances of severe conditions such as typhoon Chanthu in China have contributed to the disruptive schedules and at times forced shipping lines to enforce blank sailings and vessel omissions on certain trades.

Ports:

Port congestion has been extensively covered across various media and reporting platforms over the past few months. Major ports of the USA, China and Asia have all been struggling with congestion and bottlenecks.

The knock-on effect is felt throughout global supply chains with delayed vessel departures and arrivals, container rollings, port omissions and voyage changes amongst some of the factors resulting in longer lead times, capacity shortages, equipment shortages and rate hikes.

At one point in September there were more than 70 vessels anchored outside Los Angeles port awaiting berthing. Singapore and Tanjung Pelepas transshipments are anywhere between 1-5 weeks. Even the European ports like Rotterdam and Hamburg have been struggling with heavy port congestion that has impacted the main services from Europe to South Africa. As we have come to experience, port congestion takes weeks and months to clear up and for normality to be restored.

Freight rates:

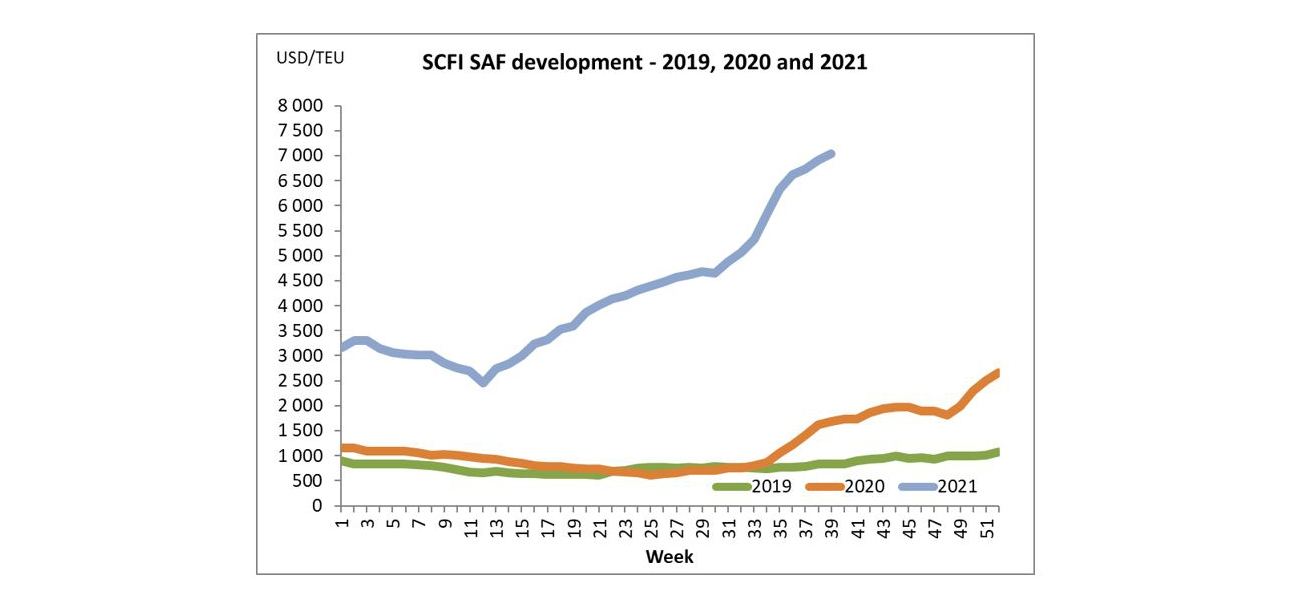

Rates remain at historical high levels and the gap between contracted rates compared to freight all kind (FAK) or spot rates has increased resulting in greater disparity. Some significant announcements have been made by a few shipping lines over the past month regarding future pricing trends.

For example CMA-CGA announced that they will not implement rate increases until the end of January 2022, some shipping lines are pushing towards long-term contractual rates, and some have extended September rates until 14 October on the Far East trade.

Shipping lines are in general still prioritising equipment and space to higher paying trades and shippers. We don’t anticipate any major rate reductions soon as capacity remains under severe pressure. The increasing bunker rates also reduce shipping lines' willingness to provide relief to rate levels.

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

SCFI (Shanghai Container Freight Index): the below graph demonstrates the freight rate increases per TEU ex-China to South Africa:

Air freight update

The airfreight market has seen demand for capacity increase pushing rates up over the past month. The main driving factors behind this have been due to the challenges in sea freight including:

- More and more importers and exporters converting sea freight orders to air

- Backlogs in some of the major air freight hubs

- Traditional air freight peak especially as China Golden Week holiday approaches as well as the mid-Autumn holidays in mid-September

- Flight cancellations in Shanghai due to the recent Covid-19 outbreak

- Electricity crunch in China resulting in time sensitive orders being late and the increasing fuel price.

Capacity:

Demand in capacity increased over the past few weeks as expected and we anticipate that it will remain strong over the coming weeks. Many airlines have reverted to prioritising higher-paying spot shipments over contractual space and in cases have cancelled block space and long-term contracts. Numerous agents have also cancelled space agreements with airlines in favour of their dedicated charter services.

The China electricity crunch will create additional demand for capacity due to manufacturing delays and shippers being forced into requiring switching orders to air freight to meet delivery deadlines.

Manufacturing delays in other parts of Asia caused by strict lockdown measures have also contributed to strong air freight demand as well as port congestion and sea freight bottlenecks in areas such as India, Turkey, South America and Europe.

Transit times:

Increased capacity demand, backlogs on key trade hubs, driver shortages in countries like the USA and UK, terminal labour shortages and large volumes moving through transit hubs have led to overall transit times taking longer. This is also applicable to express or flash shipments.

We encourage importers to clearly define their required on-site dates prior to confirming a shipment. Flight and schedule details can often only be confirmed once shippers make bookings with an airline.

Our air freight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Freight rates:

Market rates have increased in general across all trades with the most significant increases implemented from China. Spot rates have trended upwards in recent weeks due to the increase in capacity demand and the temporary reduction in capacity on certain trades. Rates are expected to remain elevated considering the factors such as the increasing fuel prices that also impacts the inland transport networks.

With our expanded network we are well positioned to offer a variety of options to meet your airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.