Get Focus insights straight to your inbox

Finance Minister Tito Mboweni’s 2020 Medium-Term Budget Policy Statement (MTBPS) has maintained a message of fiscal discipline and responsible governance while reinforcing President Cyril Ramaphosa’s Economic Restructure and Recovery Plan (ERRP), seemingly with higher levels of cabinet backing.

The statement focused on expense control and government wage constraints, although implementation remains a risk. The message from government is that debt levels are a key concern but the budget deficit trend will not be allowed to get out of control. Execution and government competence to manage and implement the ERRP and increase the efficiency of government spending remain key challenges.

It is also clear that policy momentum has improved. There is limited room for fiscal maneuvering with more focus on productive and targeted expenditure, tax collection, and anti-corruption efficiencies. Added to this is also increasing conditionality and external oversight due to loans from international lenders such as the IMF, World Bank, New Development Bank, and the African Development Bank.

On the currency front, the rand weakened ahead of the MTBPS owing to global risk-off sentiment caused by an acceleration in COVID-19 infection rates and US-related issues such as gridlock on a second fiscal stimulus package and the election on 3 November.

The MTBPS added some momentum to rand weakness as market expectations of a reduction in bond supply, was disappointed.

Key points:

- On fiscal consolidation over the Medium-Term Expenditure Framework (MTEF): Budget deficit/GDP is down, debt stabilisation is projected in the financial year 25/26 while debt servicing costs as a percentage of total spending is up.

- On spending: Social grants and expanded public works programme has been reprioritised, the reduction of the wage bill remains unresolved and there’s higher spending on infrastructure.

- On policies to boost growth: An economic restructuring and revival growth plan (ERRP) and an infrastructure fund as well as better composition of spending. However, programmes to boost efficiency of spending remain unclear.

- On SOE’s: South African Airways will get another cash injection of R10,5 billion while other state-owned enterprises such as SABC, Denel, and the Post Office will have to wait for February 2021.

Get all Investec's insights on the latest Budget Speech and SONA

Our economists, tax experts, personal finance and investment experts unpack what the latest fiscal measures mean for income, savings and daily expenses of individuals and businesses.

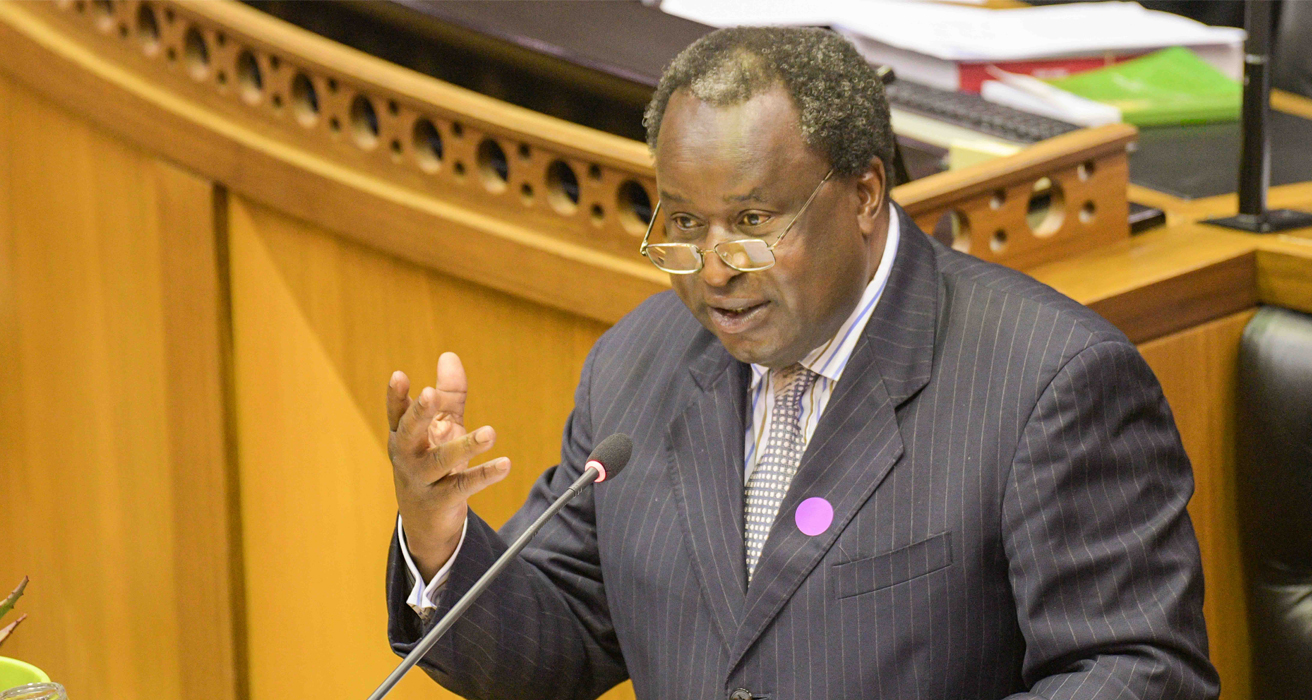

Finance Minister Tito Mboweni delivers the mid-term budget review in Parliament on October 28, 2020.

Debt discipline

The focus of the October 2020 MTPS has been on the reduction in current spending to reign in the budget deficit over the next five years to reduce the probability of a debt trap. This included spending cuts of R300bn over the next three years which could translate into a flat increase in non-interest spending over the MTEF period. Spending cuts of this magnitude will lower spending as a share of GDP from a high of 37.2% of GDP in F20/21 to 32.3% by F23/24, which is similar to F19/20 levels.

This is at a slower pace as set out in the June 2020 Supplementary Budget (SB), which pencilled in a reduction of R230bn over the next two years (with the MTBPS factoring a reduction of R150bn), but which was widely seen as too ambitious. A wage freeze, early retirement, and attrition account for about half of the spending cuts and lowers the share of compensation as a share of income from 32.7% over February 2020 to the MTBPS MTEF framework of 31.3%.

The premise of the decision to focus on spending cuts as opposed to accelerating spending was based on research conducted by the SARB that showed the effect of an increase in spending on growth through the spending multiplier has declined. More fiscal stimulus will therefore not raise growth.

Added to this is the fact that the tax base has narrowed and that tax buoyancy assumptions are volatile. The assumptions for tax increases have remained limited at R5bn, R10bn and R10bn announced in the June 2020 Supplementary Budget. There was no further guidance provided about issues such as a wealth tax or solidarity tax and this is likely to be addressed only in the February 2021 Budget Review.

The risk of a debt trap remains evident in the pace of growth in debt servicing costs, accelerating by 16.9% in F22/23 before moderating to 11.2% in F23/24. The primary balance, forecast to widen to 9.8% of GDP in F20/21, is expected to moderate to -1.4% of GDP by F23/24. The GDP growth forecast assumptions remain conservative over the outer years of the MTEF period at 1.7% and 1.5% following a rebound in 2021 to 3.5% (2020: -7.8%).

The forecasts are in line with the SARB and Bloomberg consensus forecasts with the exception of 2020 which is around -8.5%. The debt/to GDP ratio is forecast to rise to 81.8% of GDP in F21/22 and stabilize at 95.3% of GDP in F25/26 compared. This compares to 121.7% and 84.8% of GDP in the SB’s passive and active scenarios.

Sensible (productive) allocation of expenditure

There is a commitment to changing the composition of spending from consumption to capital spending. The effect of elevated spending levels on the wage bill over the past few years is evident in the decline in public spending on infrastructure from R16/17 to F19/20 – from R250bn to R183bn.

The expenditure ceiling remains in place and there is a focus on enhancing the efficiency of spending programmes and permanently suspending underperforming ones. Since June 2020, the National Treasury has been reviewing government spending to improve efficiency, undertaking 30 spending reviews across all functions.

Preliminary findings indicate that there is significant room for improvement and cost savings:

- Many policies are designed and adopted without considering their total costs and affordability.

- Multiple institutions share overlapping responsibilities or mandates, leading to duplication of work.

- In several high-spending procurement areas, including information and communications technology, and

- Infrastructure, it appears that government is overpaying for goods and services.

The spending reviews will be used to inform the zero-based budgeting approach that government will use to review baseline allocations in the 2022 MTEF period.

SAA was allocated another R10,5bn in the mid-term budget review.

SOEs support remains unresolved with elevated risks

A detailed plan for dealing with SOEs remained absent and has been rolled over to February 2021. As expected, SAA received funding of R10.5bn from a reprioritization of spending, which was deficit-neutral. The financial position of Sanral has also deteriorated to the extent that it is unable to meet its financing obligations in March and September 2021.

The MTBPS stated that Sanral will repay R10.7bn of maturing debt and interest payments of R10.8bn. The contingent liability risk for government has increased with guaranteed debt redemptions averaging R35.6bn over the MTEF period, up from R27.5bn last year.

The February 2021 Budget Review will announce the magnitude of assistance to the various SOEs, which is expected to be neutral for the spending trajectory.

Thoughtful revenue management and tax approach

The focus remains on improving SARS capacity and widening the tax base. Aside from penciling in the expected R40bn of tax increases over the MTEF, the revenue forecast over the MTEF is slightly higher than announced in the June 2020 SB.

This can be ascribed mainly to a change in variables of the macroeconomic forecast, which had an effect on the composition of revenue receipts. Tax buoyancy assumptions are therefore slightly higher than assumed in the June 2020 SB.

We think a wealth and solidarity tax is under investigation. In addition, improved tax collection and administration in achieving fiscal consolidation remain a key focus:

- A tax gap study is expected to be published in December 2020, which will quantify the difference between how much tax should be collected and how much is collected.

- Focus on attractive tax planning using transfer pricing

- Increasing enforcement to eliminate syndicated fraud and tax crimes.

- Using third-party data to find non-compliant taxpayers;

- And following up on outstanding taxpayer returns through filing and liabilities paid.

President Cyril Ramaphosa delivers his Economic Reconstruction and Recovery Plan in Parliament on October 15, 2020.

No further detail on policy reform momentum but building blocks put in place

The MTBPS did not provide more detail on the infrastructure fund, budgeted at R100bn over the next ten years. Operation Vulindela will focus on accelerating the implementation of reforms as announced by President Ramaphosa in the ERRP.

The short-term measures consist of infrastructure spending, the mass public sector employment programme, energy investment, and industrialization; with medium-term measures rebuilding the network industries, lower barriers to entry and regional integration and trade. These measures have the ability to raise GDP growth on average by 3% over the next 10 years and create 1 million jobs. The implementation schedule will be closely monitored.

Government bond supply to remain elevated over the MTEF period

The size of the bond auctions in F20/21 is expected to remain unchanged at R462.5bn but is expected to rise to R472.2bn (SB: R388bn), R500.8b, and R436.8bn over the MTEF period. A key change has been the magnitude by which cash balances are forecast to be run down in F21/22: The SB penciled in a drawdown of R84.2bn but this has been reduced to R14.3bn.

The increase in long-term debt obligations from an average of R134.4bn from R37.3bn in the previous ten years, create rollover risks. To mitigate the risk, cash balances will be increased through borrowing in the domestic and international capital markets which is essentially pre-funding. Switch auctions will continue.