Economic Highlights

Economic highlights

3 min read

21 Jan 2025

If US government policy is designed to weaken the dollar, we will have to pay attention and consider hedging strategies again.

A week ago, in the face of bond market volatility, I wrote that it was a time for calm heads to prevail, and they did. There seems to be an unusually large amount of noise in financial markets at the moment and it is very easy to become unduly influenced by short term movements and the cacophony that surrounds them. I suspect that will be the case more than ever in the weeks ahead as newly inaugurated US President Trump unleashes a salvo of new policies, more on which anon.

Even so, and in some contradiction to the above, there are definitely times when investors’ sentiment can shift rapidly, and so we are always alert to that danger. While clearing up my desk over the weekend, I found a copy of the Financial Times from December of last year (2024). It was open on a page that had an article entitled “Sterling nears highest against euro since vote to exit from EU”. Although only made five weeks ago, some of the comments had not aged at all well. How about one from the FX strategist at a major investment bank: “We have more political stability in the UK. We have a clearer path”. Or this from another Head of FX Analysis at a currency manager: “[Sterling’s rise] points towards the fact that, in the absence of any banana skins, sterling is on a long-term recovery trajectory”. Cue a major incident involving a delivery from Fyffes…

I’m not going to rehash everything I went through last week regarding the strain under which the UK’s public finances find themselves, caught between the pressure of rising costs and potentially falling revenues (as the economy remains cool). You can find that here: Weekly Digest: G(u)ilty. Suffice to say that it can be unsettling when the mood changes. Over the Christmas holiday I read Malcolm Gladwell’s latest book, The Revenge of the Tipping Point. It served as a reminder that once a trend or situation changes, it can do so with remarkable speed. And, although the shift seems to be unexpected, in retrospect it appears remarkably obvious.

It served as a reminder that once a trend or situation changes, it can do so with remarkable speed. And, although the shift seems to be unexpected, in retrospect it appears remarkably obvious.

I am often asked about currency hedging, usually when the pound is strong and weighing on overall portfolio returns for sterling-based investors, which some find frustrating. If we hedged our non-sterling exposure, which continues to increase as we expand our coverage of and investment in global equities, then we could reap the gains of rising overseas markets without suffering any potential foreign exchange translation losses. Sounds tempting, doesn’t it? However, currency hedging one’s equity exposure potentially creates enormous risk relative to one’s benchmarks and sets up the possibility of elevated volatility, which we are usually trying to mitigate.

Let’s look at returns over the last year, for example. The MSCI World ex-UK Equity Index, quoted in US dollars has generated a capital return of 19.8%. Had we taken the view that the pound was going to rise and hedged the currency (assuming minimal cost, owing to the fact that dollar and sterling interest rates are similar), then we would have locked in that return. As it turned out the pound fell over the period, and the return on an unhedged basis was 25.6%.

OK, that’s one snapshot and you could easily cherry pick the data to find periods when it would have been better to hedge, but we find that forecasting currency movements is a bit of a mug’s game. Indeed, despite a long and detailed search, we have never managed to find a currency fund that might be suitable to invest in as something to diversify portfolio risk or to generate idiosyncratic alpha (investment returns above a risk-free rate or other benchmark that are entirely attributable to manager skill).

Are there any exceptions to the rule? Well, yes, at it happens. If a country embarks on a strategy that implicitly or explicitly aims to weaken its currency, then there can be a justification to hedge. That was the case, for example, when the late Prime Minster of Japan, Shinzo Abe, launched his “Three Arrows” strategy in 2012. For several years we invested in the “sterling hedged” class of any funds that we used to gain exposure to Japan. However, with the Yen by most estimates now deemed to be massively undervalued, that strategy is no longer appropriate, especially as the Bank of Japan is in rate-increasing mode when most other central banks are cutting (or would like to).

We might also consider “event risk”. In the build up to the Brexit referendum, for example, we considered that the downside risk to the pound in the event of a win for “Leave” was much larger than the upside potential if Remain prevailed (as widely expected). And so, we shifted some of our safer fixed income exposure into non-sterling bonds. That worked out well. But we didn’t need to do anything to our equity portfolios because overseas equities would do fine and large capitalisation UK equities provided a decent (although not complete) hedge owing to the large non-sterling revenue and profits that they generate, which accounted for around three-quarters of the total (and still do).

In the build up to the Brexit referendum, for example, we considered that the downside risk to the pound in the event of a win for “Leave” was much larger than the upside potential if Remain prevailed (as widely expected). And so, we shifted some of our safer fixed income exposure into non-sterling bonds. That worked out well.

The other instance in which we might consider currency hedging is when we want to optimise our fixed income exposure. If we can get better exposure to a certain part of the yield curve, say, by investing in US Treasuries, we would consider that. However, as sovereign fixed income assets are very much part of the “insurance” element of portfolios, we would not want to take on the currency risk.

In the longer run, one can’t avoid the fact that the pound has tended to lose value against other major currencies. What will realistically turn that around? A change of government doesn’t seem to have helped! Lacklustre productivity growth is going to prove hard to improve, although we could cross our fingers for an AI-led revolution (but it would still have to be more revolutionary than other countries’). We seem to be stuck with persistent fiscal and current account deficits.

Putting all of that together, it supports the case for a more global approach to investing. And should the pound have a better spell and weigh on nominal returns in sterling, we can always console ourselves with the fact that imported goods and overseas holidays are cheaper.

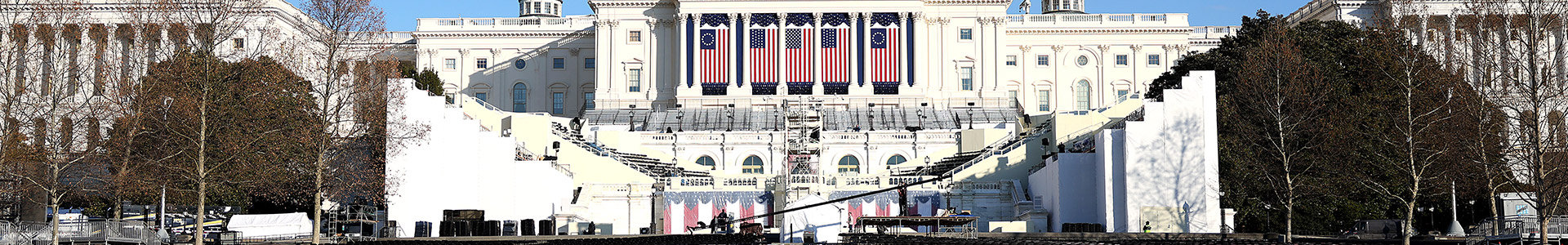

I can’t let the moment pass without reference to Donald Trump’s inauguration as President of the United States. He follows Grover Cleveland as only the second President in history to win back the White House (which must be worth some pub quiz trivia points). As I alluded to earlier, he is going to assail us with new policies immediately, and this raises the potential for economic and financial market disruption – although it could, of course, turn out that everything he does is market-friendly. The main areas are expected to include the curbing of immigration, the imposition of tariffs and various deregulation measures, although the details are going to be key. Some of this he intends to do by invoking emergency measures or through executive orders, thus bypassing Congress, which means that some impact could be felt very quickly.

Additionally, and more optimistically, reports of a conversation last week between Trump and China’s President Xi were interpreted positively, suggesting that the two might be able to negotiate a more market-friendly trade relationship. This was reflected in the fact that Trump gave Tik Tok a six-month stay of execution in the US, although it will still need to end up in American ownership eventually.

One feature of the period since Trump’s fortunes started to turn up in late September is the strength of the dollar. It has been driven by a number of non-Trump-induced factors, including persistently strong economic growth and somewhat sticky inflation, which have meant that expectations for cuts in US interest rates in 2025 have been reduced. But Trump’s proposed policies, focused on boosting domestic growth, have added extra fuel. There is also the fact that tariffs will probably trigger one-off consumer price increases. However, he also says he wants a weaker dollar to make US exports more competitive, while at the same time emphasising the dollar’s leading reserve currency status. It's difficult to reconcile his wishes with economic reality, but we cannot discount the possibility of some sort of global currency pact that weakens the dollar, as happened in 1985 with the Plaza Accord (however difficult it is to see that being replicated today). But if US government policy is designed to weaken the dollar, we will have to pay attention and consider hedging strategies again.

Economic highlights

3 min read

Please speak with your Investment Manager or Financial Planner, or find their details on our Contact Us page.

We’re now part of Rathbones and are no longer offering our wealth management services to new clients from Investec Wealth & Investment (UK). Our combined team would be happy to help you via rathbones.com.

Find out more about how we’re integrating our businesses here.

The information in this document is believed to be correct but cannot be guaranteed. Opinions, interpretations and conclusions represent our judgment as of this date and are subject to change. Past performance is not necessarily a guide to future performance. The value of assets such as property and shares, and the income derived from them, may fall as well as rise. When investing your capital is at risk. Copyright Investec Wealth & Investment Limited. Reproduction is prohibited without permission.