Receive Focus insights straight to your inbox

Between 1908 and 2003, the best cyclists in Great Britain mustered just one Olympic gold medal between them, an awkward record given their empire status.

Then, Sir Dave Brailsford arrived with his theory of marginal gains. By improving everything by 1% – from the comfort of his team’s bedding, to how they washed their hands – he would significantly raise their performance on the pedals.

At the close of the 2012 Games, 70% of the gold cycling medals on offer swung from British necks. Team Sky went on to win the Tour de France seven times before the decade was out.

The South Africa Revenue Service (SARS) looks to have borrowed the marginal gains playbook. And their performance is telling.

Above one

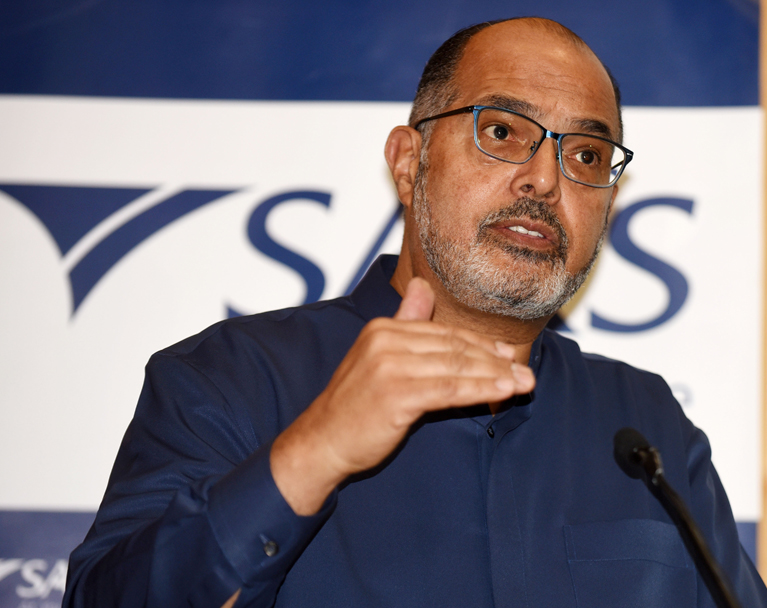

“In the era of State Capture, our tax buoyancy dropped below one. That figure is now being sustained well above one, which means that our tax revenues are growing faster than GDP,” said Edward Kieswetter, SARS Commissioner.

Essentially, SARS has got more efficient at collecting taxes. And if they can keep the tax buoyancy coefficient above one for the next 3-5 years, Kieswetter believes the government’s books will balance (provided fiscal frugality remains in place) removing the need to increase individual or corporate tax rates. Is that music playing?

According to Kieswetter, the improved performance of our revenue service is the culmination of 12,500 dedicated employees – hired for their skill and inspired by the prospect of improving lives – fighting tooth and nail every day to get the little things done right, starting with some justice.

“The improvement in SARS administrative efficiencies becomes all the more important as the electricity, rail and logistics crisis impacts tax receipts as the economic growth slows,” said Investec Treasury Economist Tertia Jacobs.

Make them pay

Wastage and theft aside, paying taxes sticks in our throats because we hear rumours that the super wealthy or powerful use accounting cleverness to avoid paying their fair share. Righteously, SARS is hunting them down.

Through the Pandora and Panama papers, we have identified 346 South Africans who we are now engaging with to understand the nature and extent of their non-compliance. We will continue to apply tax laws without fear or favour. No official or politician will find immunity.

Words are words. But SARS is racking up real convictions in the High Court off the back of the State Capture and Zondo Commissions. How long we have pleaded for such justice, and how little fanfare we make of it.

The smart use of data, data science, technology, and automation at SARS are enabling those convictions. The same modernity is working to simplify the act of paying our taxes.

2022/23 tax year in numbers

SARS improvement in administration and efficiencies are yielding fruit. An increase in compliance has made a material contribution to the improvement in revenues, which were R88bn above target. (According to SARS) Targeted interventions yielded R227bn in revenue, which is an increase from R215.4bn in the previous fiscal year.

2067.8bn

381.1bn

8.3%

7.6%

Source: The South African Revenue Service (SARS).

A bigger circle

“Last year, we identified 26,000 people who generated more the R1 million who were not registered for tax. They are being contacted, risk-profiled, and registered.”

Through their sleuthing and beefed-up tax registration campaigns, SARS added 1,5 million individuals to the tax base in the 2022 financial year, worth an estimated R6 billion in tax revenue. Not massive, but not nothing either.

Making the circle smaller, just over 6,000 individuals abandoned our beautiful but listing ship. Kieswetter says the revenue impact of their leaving is minimal but obviously damaging for our reputation.

“Another challenge is the compliance of the informal sector. At present, the only solution is to walk the streets asking for documentation. What would change the game here? Less cash in the system, with SARS plugged into every point-of-sale device. That would give us the electronic paper trail we need.”

Side note: the SARS boss reiterated that employees don’t need tax numbers to be considered for work – employers can easily obtain an existing tax number or register new employees using SARS eFiling or SARS e@syFile.

Not so foreign

Given their rekindled love of investigation, don’t be surprised to see more SARS officials frequenting Mauritius for business.

To identify companies that are working the system unfairly and eroding the tax base, SARS is taking a particularly keen interest in exotic structuring, or loans with no commercial rationale.

High-hanging fruit

Illicit trade in tobacco and alcohol – given new life by pandemic-time prohibitions and the now higher cost of everything – undercuts the collection of sin taxes.

“Excise tax payments (on tobacco and alcohol) have not yet reached pre-pandemic levels,” said Jacobs.

Strong demand for cheaper puffs and swigs is one challenge. Another is the gangsters willing to supply them.

“We need a coordinated effort that includes SARS, SAPS, and the Hawks to seize and detain. There has been some success, but really we’re just scratching the surface. And it goes well beyond tobacco and alcohol. There’s illicit trade in gold, clothing, and leather goods too. It’s deeply embedded in our society.”

Sustainable collection

After several years at the helm, Kieswetter will step down as SARS Commissioner in May 2024 ands he’s an upbeat realist about the future of our revenue service – a Smart Modern SARS with unquestionable integrity that is trusted and admired:

“There are no rules or regulations that can prevent dishonest people from abusing the system. But we have built a resilient SARS leadership model, a culture of excellence and integrity, and a team filled with competent people. No meritocracy leads to poor performance.”

Hopefully the next Commissioner steps forward from those ranks, willing to carry forward the marginal gains torch.

Receive Focus insights straight to your inbox