Receive Focus insights straight to your inbox

One in eight, or 13% of GPs (general partners) do not know how they are going to finance their personal commitment to their firm’s next fund, according to the latest GP Trends survey, which canvassed the opinion of around 300 private equity professionals globally. That figure rises to almost a quarter (23%) of those below partner level.

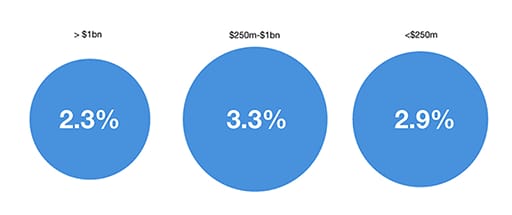

It’s not hard to see why. GPs expect to commit an average of 2.9% to their next fund, the survey found. While this is a drop from 3.3% a year earlier, it is a far cry from the one per cent norms of a decade ago. And 2.3% - the average commitment for vehicles of over $1bn - is still a substantial amount of cash if you are investing a ten-figure mega fund.

Focused average comparison by size of fund

Indeed, with average fund sizes climbing steeply – up from $321m in 2013 to $408m last year, according to Preqin – GPs are having to stump up ever larger sums in absolute terms. The average amount that GPs and their teams are now expected to commit personally stands in the region of $17m per fund.

Limited partner demands for greater alignment of interest have been the key driver of escalating GP commitments. “Skin in the game” can also be a powerful incentivisation tool for senior management, and – of course – for individuals, a source of great wealth. But for those below partner level, accessing the sums of money involved can be a daunting prospect.

Despite significant macroeconomic uncertainty over half (55%) of respondents, expect their next fund to be more than 25% larger than their current fund.

“When you look at these junior team members who may be getting married, or buying a home, or any other of these expensive milestones in life, at the same time as wanting to commit to a fund that could be highly lucrative for them and important for their career, it is clear that the timing and liquidity pressures can be immense,” comments Investec Fund Finance’s Slade Spalding.

The challenge will only become more acute as fund sizes continue to grow. Despite significant macroeconomic uncertainty, over half (55%) of respondents, expect their next fund to be more than 25% larger than their current fund, while one in eight (12%) expect their next fund to be double the size of its predecessor.

Funding commitments with carry means that GPs don’t have the cash available. This can be risky.

Know your options

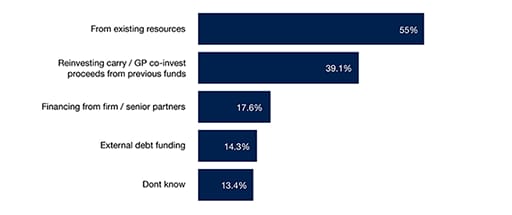

To fund their personal commitments, 39% of GPs surveyed said they planned to reinvest carry or co-investment proceeds from previous funds, up from 36% last year. But in a potentially volatile economic environment, relying on carry can be precarious.

“Funding commitments with carry simply means that GPs don’t have the cash available, now,” says Simon Hamilton, Head of Fund Finance. “This can be risky, particularly as the uncertain outcome of unfolding political events coupled with concerns around the growing amount of dry powder in the market are becoming harder to ignore.”

In addition, the rapid escalation in fund size from one generation to the next means that legacy funds may not throw off sufficient carry to fund a GP commitment comfortably and, in any case, will be of little use to newer team members. The speed at which managers are currently returning to market with new funds can also create timing pressures for GPs.

“These GPs may be asset rich but potentially face a liquidity challenge,” says Spalding. “They want to continue investing ever larger sums into funds, but where the firm might previously have gone to market every six or seven years, they are now coming out with a new fund every three or four years. That means capital is still locked up in previous vehicles.”

There are other options for GPs. One mechanism that a GP can utilise to fund the GP commitment is a management fee waiver. However, LPs are often not happy with this approach. As Jennifer Choi, Managing Director for Industry Affairs at the Institutional Limited Partner Association explains:

“Next generation leadership may not have accumulated the wealth to commit the right amount to the GP commitment. If the alternative is a fee waiver, LPs are open to the conversation – but not if the established leadership in a GP is doing it for other reasons.”

Meanwhile, 17.5% of those surveyed said they expected to receive financing from their firm’s senior management team and 14.3% expect to use some form of external debt.

How GPs will fund their portion of their GP commitment

The Investec advantage

External debt financing to fund a GP commitment can take the form of a personal loan, whereby the bank takes a long-term view on an individual’s prospects, typically backed up with tangible assets such as a house or liquid stock portfolio.

Alternatively, we will also lend to the corporate, based on the collateral of contractual management fees, in order to provide suitable leverage which the corporate can then on-lend to the individuals who will be making commitments into the underlying funds.

The advantage of leverage at a corporate level is that there is limited recourse to the partners themselves. In lending to the corporate, the general partnership also retains control over how it on-lends to individual team members, meaning the financing can be tailored to different levels of employee within the firm.

Another advantage of the model is the advance rate. Providing there is sufficient collateral standing behind it, we can advance higher percentages in support of those commitments.

Whilst senior members of the GP team may well have accumulated sufficient wealth to comfortably fund their personal stake, it is important for LPs to see that the GP commitment to a fund comes from the entire investment team – it is a key alignment mechanism, after all.

“The fact that so few team members below partner level know how they will fund this is an issue,” says Hamilton. “There are a number of financing options for these kinds of situations and it is important that GP leadership teams investigate them fully – if not for themselves, then for their more junior colleagues.”

Beyond the primary GP commitment

GP financing solutions extend well beyond primary GP commitments to incorporate the support of broader strategic moves. We can provide funding, for example, when one manager is acquiring another, in order to gain diversification or a new set of LPs, or if a GP is looking to buy a secondaries stake in its own fund.

“The GP may have a two per cent commitment on day one, but then an LP will look to sell out after four years,” explains Slade Spalding. “The GP understands the value of that portfolio and how they are going to drive that value. And so, they acquire another two or three per cent through the piece being sold in the market.”

GPs also increasingly receive co-investment opportunities. Or a general partnership may be restructured as part of succession planning. “These are the discussions we are used to having,” says Spalding. “These are the strategic value drivers for GPs that we look to support with creative financing solutions.”