South African corporate treasurers are a resilient lot. Going back a few decades, they’ve endured events such as the Russian debt crisis of the late 1990s, the rand selloff of 2001, the Global Financial Crisis of 2008, the Covid-19 pandemic lockdowns of 2020 and 2021, and a number of other volatile episodes in between.

Many of today’s top treasurers cut their teeth managing the falls in the rand or spikes in interest rates that were common during many of those periods.

This institutional memory has stood the South African corporate treasurer in good stead during more recent volatility events, argues Peter Rattey, head of treasury sales at Investec. These include the war in Ukraine, lockdowns in China, rising inflation and shortages of key commodities and components on the global front; and load shedding, transport infrastructure problems and the recent floods in KwaZulu Natal, on the local front.

“Based on our interactions with South African corporate treasurers, we’ve found that they have an understanding of how market swings are part of life and that they have the skills, experience and temperament to manage risk”, he adds.

A new toolset for a changing world

Rattey however poses the question of whether this set of tools is enough for what is becoming an increasingly complex world. He cites recent events, from which some common threads have emerged that reveal the extent of this complexity.

“From a geopolitical perspective, a global realignment appears to be taking place, from the unipolar, US-dominated world that characterised the world in previous decades, to a multipolar world in which China stakes its claim as a world power and other regional powers flex their muscles,” he notes.

At the same time, the previous paradigm of globalisation is coming under threat, as nations look to protect their own interests, driven in turn by the populist agendas of their leaders.

Against this backdrop, central banks across the developed and emerging world are acting to bring inflation under control, increasing the likelihood that the world will slip into recession in the coming months.

“Overlay this with the ongoing threat posed by climate change and the efforts by governments and businesses to address this threat. Climate change is already leading to extreme weather events that in turn threaten regional and global stability,” he warns.

This increasingly complex world will have many knock-on effects, some of which we are already seeing played out in our daily lives. Supply chain disruptions and rising inflation are just two of the effects that spring to mind.

Rattey says that in the past, companies could focus on a few macroeconomic and cyclical variables when it came to managing their currency, interest rate or commodity price risk. A more nuanced and agile approach will be required in the years ahead however.

“It’s not enough to simply secure a rate or price. Businesses now have to think more holistically, understanding the different moving parts that contribute to the risks that they face,” says Rattey.

What then will the corporate treasurers of the future need in their toolbox to stay on top of this ever-changing world?

To answer this question, Rattey highlights the main areas where these complexities are likely to manifest themselves in the coming years:

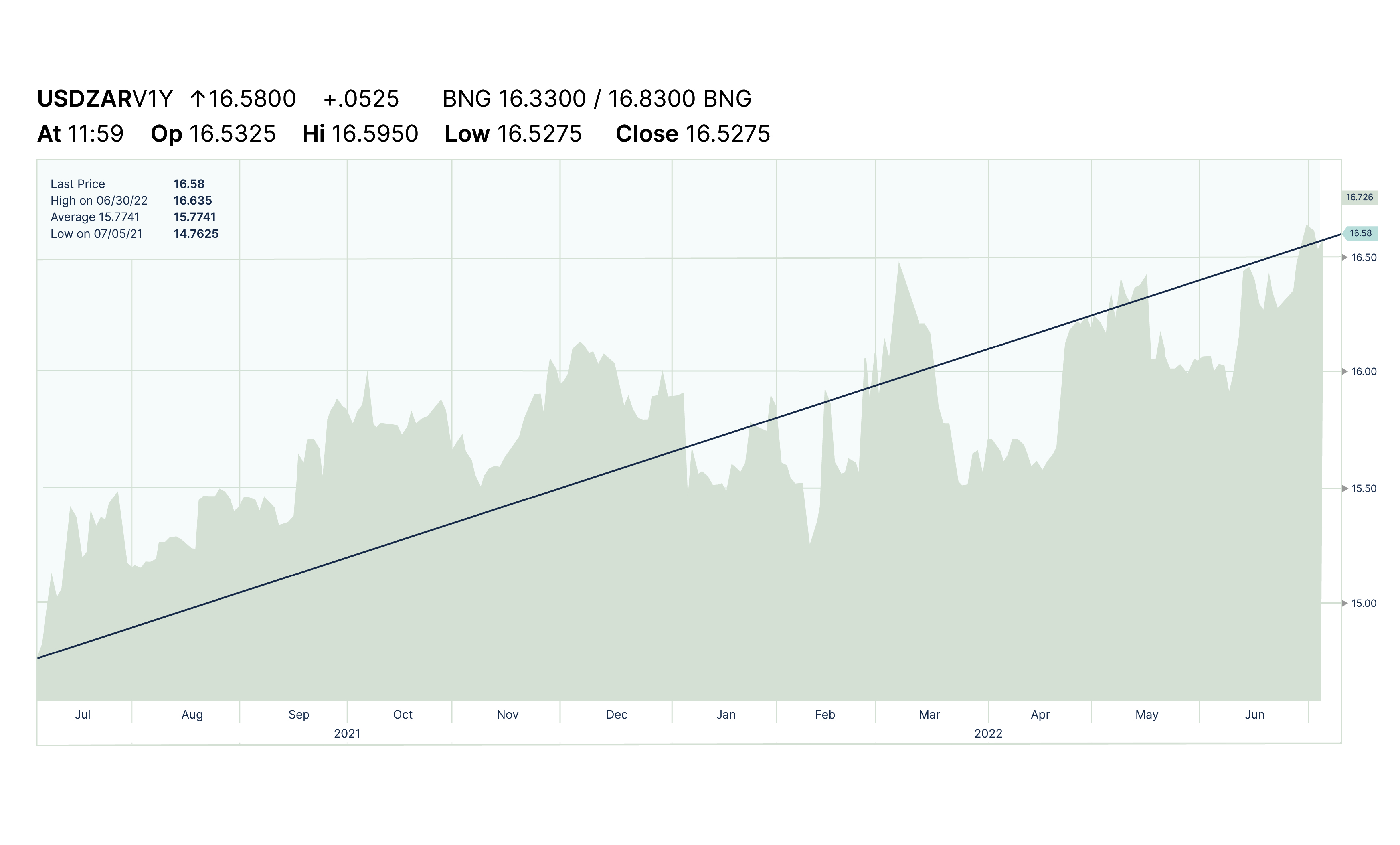

Volatility. As alluded to above, from equity markets to bonds and foreign exchange, we’ve seen volatility on the rise in the first half of this year.

“Given the uncertainties around inflation, supply shortages and tensions between leading global economies, it’s a reasonable assumption to make that bursts of volatility will become the norm,” he says.

The graph below shows an average band of volatility of the Cboe Volatility Index (VIX) pre Covid-19 and a higher band post Covid, which reflects the increased levels of uncertainty and the general change in market sentiment after the initial impact of the Covid-19 pandemic.

Source: Bloomberg, ICIB, July 2022

Rising inflation. High inflation in the world’s leading economies is not something that businesses have had to deal with for years. “While some of the inflation can be attributed to supply-side shocks, there’s a risk of inflation expectations becoming baked into consumer and business behaviour, which would make the current inflationary phase more persistent,” explains Rattey. “This is the big challenge facing central banks right now.”

Inflation in the high single digits or double digits however has major implications for forward planning, especially if the business is not able to pass these rising costs onto customers.

The working capital cycle. Inflation also has an impact on working capital management, as have uncertainties about supplies of key commodities or other inputs that are crucial for any business. To manage these, businesses are looking increasingly at ‘just in case’ strategies rather than ‘just in time’ and corporate treasurers will often need to rethink their strategies. “Again, these come at a cost that need to be factored into your planning,” says Rattey.

ESG (environment, social, governance). These three words are on almost everyone’s lips these days and stakeholders – including investors, suppliers and customers – are increasingly asking companies pointed questions about carbon footprints, impact on society and so on. Rattey notes that, as managers of risk, corporate treasurers increasingly need to understand the impact of the business’s activities beyond their shareholders and customers, while scrutinising not only their own activities but also those of their counterparties in transactions.

Technology, data, artificial intelligence. These are terms that are regularly mentioned, but what do they mean for businesses and the treasury function? How can we tackle the vast array of data available to the business, or how to harness it? Can technology be harnessed to manage working capital better? Can it also be used as a way to finance and support a business’s ecosystem of suppliers and buyers?

Regulation. On top of all the above complexities, companies are increasingly having to work under more onerous regulation, including stricter reporting and compliance standards. While these are designed to create a more robust business operating environment, corporate treasurers need to find ways to fulfil their legal obligations, while remaining nimble.

“Other challenges are likely to emerge in the coming years, but they all require a similar sort of skillset,” says Rattey.

As examples, he highlights the following skills and capabilities:

· An ability to look at risks holistically, beyond the simple silos of currency, interest rates and commodity prices. Understanding the dynamics of supply chains and other operational risks that affect their businesses.

· A willingness to access new skills – and “unlearn” others – whether through directly recruiting those skills or working through a trusted partner. This is particularly the case when it comes to the growing world of data science, machine learning and other related skills.

· An ability to understand and exploit opportunity – in a risk-conscious way. Periods of volatility and market displacement have historically created opportunities and there’s no reason to believe that this time will be different.

· Similarly, there’s an opportunity for corporate treasurers to “embed” themselves in the strategic management of their business.

“The good news is that access to these next generation skills should not be a bridge too far for South Africa’s corporate treasurers. There’s a core of knowledge, experience and resilience that underpins corporate treasuries of South Africa. By partnering with the best providers of the services and products that are available, the corporate treasurer can look to the future with confidence rather than trepidation,” he concludes.

Get Focus insights straight to your inbox