Receive Focus insights straight to your inbox

Saving for your retirement is a multi-decade journey that takes you through periods of growth and decline. You might enjoy a multi-year ‘run’ during which, growth on your retirement capital outpaces inflation each year, but equally there are negative periods when your overall portfolio returns dip into the red.

Poor returns by equities in recent years - relative to cash - have left many local investors asking: Is it time for me to retreat to the safety offered by cash? The answer to this question varies from one investor to the next and hinges on a close assessment of the nature of your investments, the time remaining until your retirement, your country of domicile, and the global ‘spread’ of your assets, among others. We ask some of Investec’s global investment experts for their view.

How close are you to retirement?

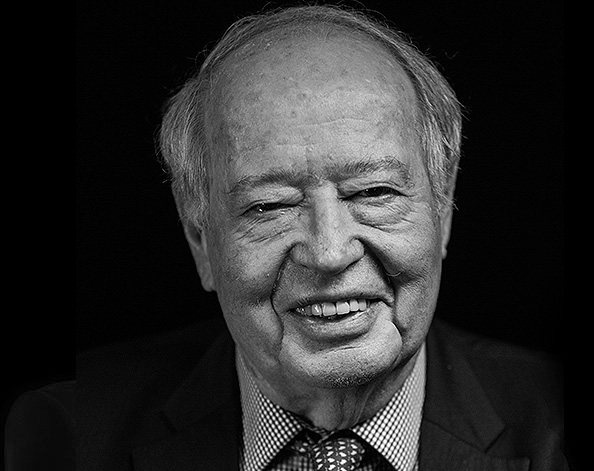

Prof Brian Kantor, Chief Strategist & Economist, Wealth & Investment SA, says that adjusting your cash exposure is extremely time-dependent and thus closely linked to your unique circumstances: “If you still have a lot of time until retirement then you are likely to stick with high-yielding equities, but as you near retirement you would be inclined to take some risk off the table by moving into cash”.

He adds that individual investors should not attempt to alter the cash weighting in their retirement portfolios without substantive input from their financial advisers.

READ MORE: Running out of money?

If you still have a lot of time until retirement then you are likely to stick with high-yielding equities; but as you near retirement, you would be inclined to take some risk off the table by moving into cash.

What is your time horizon?

“The longer your time horizon, the more relaxed you can be about short-term market performance,” says John Wyn-Evans, Head of Investment Strategy, Wealth & Investment UK.

He references UK market data that confirms positive real returns from equity investments for every 22-year holding period going back to the 1890s. And it is impossible to achieve similar successes using bonds or cash only.

Asset managers have more flexibility than individual investors insofar timing their entrance to and exit from asset classes, but even they admit that ‘calling’ the top or bottom of a cycle is next to impossible. “We know that we will leave the markets before the peak, but we are very happy to leave a little bit at the end for those people who want to play the last part of the game,” says Wyn-Evans.

"The longer your time horizon, the more relaxed you can be about short-term market performance."

Timing is important for discretionary investment decisions too. "If you need money in the near term then market volatility becomes much more relevant to you," says Chris Hills, Chief Investment Officer, Investec Wealth & Investment UK.

It makes sense, therefore, to convert such savings to cash if an equity market downturn is imminent. But he urges both those saving for retirement and those with discretionary investments to avoid knee-jerk responses to day-to-day market price fluctuations. The best defence against costly mistakes is to consult with your financial adviser before making a rash decision.

READ MORE: Who decided 65?

The investment fund manager will assess whether or not the best buffer against the world’s stormy conditions is in cash or some other fixed income investment, either of which will be uncorrelated with the other risk assets you hold.

Find a trusted partner

“If you have a third party investment manager you should not even think about whether to stay in equities or move to cash; let them make the decision for you,” says John Haynes, Head of the Research team for Investec Wealth & Investment and Chairman of its Global Investment Strategy Group.

He adds that your financial adviser should have a good measure for your psychological capacity to stay exposed to investments during periods of market volatility. This investor profiling develops over time, beginning with the initial investor meeting and risk profiling and continuing with each subsequent engagement between adviser and client.

“Your adviser should have put in place a mandate that enables a degree of buffering of the inevitable volatile experience that the markets will give you during uncertain times,” he says.

Being in cash in SA vs US and UK

The arguments for and against cash will vary from one global marketplace to the next. Cash returns may look attractive for SA investors, but their counterparts in the US and UK have little to gain from cash exposure due to decade-low interest rates.

“Hiding in cash, usually requires you to get a return from that cash that at least compensates you for inflation; and for much of the last decade cash has not compensated you for inflation – that’s the whole point of the post-GFC quantitative easing system in the US and UK,” says Chris Hills, Chief Investment Officer, Investec Wealth & Investment UK. He adds that US cash appears to be “a more attractive place to hide” in 2019 than in previous years.

Hiding in cash, usually requires you to get a return from that cash that at least compensates you for inflation.

To re-weight a retirement portfolio to cash is a tough decision that will have long-term financial consequences. The consensus view is that such decisions are best left to the professionals. You should only make changes to your retirement strategy with guidance from your financial adviser who in turn, will leave the optimal mix of asset allocation within that strategy to the investment fund managers.

“The investment fund manager will assess whether or not, at a given point in time, the best buffer against the world’s stormy conditions is in cash or some other fixed income investment, either of which will be uncorrelated with the other risk assets you hold,” concludes Haynes.

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.