What I'm after is not living to 1 000. I'm after letting people avoid death for as long as they want to.

*Someone who studies ageing

I was recently asked by two prospective clients, who are both in their mid to late fifties, to prepare recommendations for them as they contemplate early retirement. On face value, it seemed as though they had prepared well for retirement and that they had saved enough money to maintain their respective lifestyles until their deaths, and then to pass on the remainder to their heirs – the primary goal of most clients. The key question I put to them was: "How long do you think you'll live?"

Of course, nobody knows the answer to this question, but what we do know is that people are living longer and staying healthier – and, thanks to the work of people like Aubrey de Grey, scientists and businesses are working to extend the length and quality of human life.

With the above in mind, what would happen to a planner's financial projections if his/her clients added another 20 or 30 healthy years to their lives? And what if it were more?

The prospect of greater longevity will completely disrupt our long-standing assumptions of the planning, management and transfer of wealth.

Rethinking retirement

The concept of stopping work at a certain age is a fairly recent invention. Yet it's time for the concept to be reinvented to suit today's circumstances better, both from a working life perspective and a retirement planning one.

Plan for a long lifespan

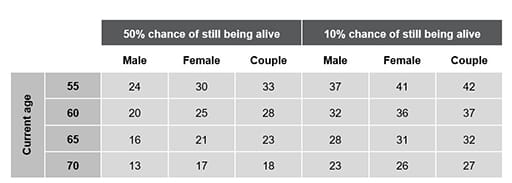

In an article written by Allan Gray's Shaun Duddy, titled 'How to achieve a sustainable retirement income', he gives a rough sense of how many years of income to plan for if you want to be either 50% or 90% sure that you will not outlive your planned income stream (as shown in the table below). An important caveat is that these time horizons will continue to evolve as life expectancies increase.

Longevity risk – years of income required

Source: Allan Gray, ASSA, SA Annuitant Standard Mortality Tables 1996-2000

As an example, consider a male aged 65. To be 50% sure that he won't outlive his income, he should be planning for at least 16 years of income, at which point there is still a 50% chance that he will be alive and that he will need more than what has been accounted for. On the other hand, if he wants to be 90% sure, he needs to plan for at least 28 years of income. At that point, there is about a 10% chance that he will still be alive and need more income than he planned for. Of course, we are all different, but if you want a reasonable level of certainty, you need to plan for at least 30 years in retirement.

And that is only half of the story: in each of those years, you'll need to increase your income with inflation to maintain your income in real terms. Inflation, therefore, determines the level of income required in each of the 30+ years and determines the nominal returns required for that income to be sustainable. While we have become quite accustomed to relatively low inflation levels and a reasonably stable inflationary environment, this has not always been the case and may not be the case in future. Portfolios need to be resilient in the face of inflation, in order to generate the necessary real returns.

Conclusion

As noted by Duddy in his article, retirees drawing an income face three key risks:

- longevity risk – the risk of living longer than expected

- inflation risk – the risk that the rising cost of living eats away at their investment

- investment risk – the risk of their investment return not being sufficient to compensate for the other two risks.

The first two risks are, to a large extent, outside of your control, though you can have some control over your longevity through the lifestyle that you choose to live. It's therefore crucial to focus on the third risk. To do this, we would advise you to:

- Plan for a long lifespan – don't retire until you have to

- Structure your retirement portfolio for growth – retirement is not a time to shy away from growth assets. Research indicates that retirement portfolios should have at least 50% in growth assets (such as equities) to generate the necessary real returns

- Make sure you draw a sustainable level of income – for drawdowns of more than 4%, the odds are not in your favour.

Meeting the retirement investing challenge emphasises the importance of individualised investment solutions tailored to meet the needs of different people. Individual investors often suffer from behavioural limitations and, typically, lack the expertise needed to make educated investment decisions. A well-qualified and experienced adviser can help people with this process.

About the author

Patrick Duggan

Wealth manager: Investec Wealth & Investment

Patrick is a senior private client wealth manager with Investec Wealth & Investment, specialising in providing holistic investment planning advice to some of South Africa’s high net worth and ultra-high net worth individuals, families and their associated entities.

Receive Focus insights straight to your inbox