The peak shipping period is in full swing globally and its well documented that the disruptions to global supply chains are only getting worse. The import demand from the USA continues to grow placing further pressure on capacity, equipment availability and congestion. The spreading the Delta Covid variant has caused further chaos, especially across Asia in countries such as Vietnam, Taiwan, Indonesia, China and the like resulting in production delays, port and terminal closures, blank sailings, and flight cancellations.

All these untimely and unfortunate events have created an exceptionally challenging landscape for all stakeholders. Delays in getting cargo shipped via sea or air is being experienced across all trade routes.

Sea update

Ningbo-Zhoushan terminal closure disrupts global shipping

August was a particular challenging month to navigate, and September will be no different. Besides the extensive coverage of disruptions to global supply chains, arguably the biggest scare in sea freight was the temporary closure on 11 August of the Meishan Island International Container Terminal (MSICT) at Ningbo-Zhoushan port.

This created panic in the market and many shipping lines reacted very quickly by omitting the port resulting in shippers needing to make alternative plans to get cargo shipped.

As we have come to learn over recent months, these types of events have a severe knock-on effect across trades, and this was no different. The now common cycle of disruption continues which places pressure on ports, shipping lines, equipment availability, schedule reliability, rates and ultimately backlogs and bottlenecks become more extreme.

Ningbo leaves trade in limbo

Ningbo-Zhoushan is the world's third-busiest cargo port after Shanghai and Singapore. It's Meishan terminal fully reopened on 25 August, two weeks after a worker tested positive for Covid-19.

Ningbo in numbers

191

29 million

1 billion tons

260

Congestion and delays plague logistics industry

The main factor causing capacity shortages is due to port congestion and sailing delays. The Far East, South America and Middle East trades are still the most heavily impacted. Some carriers have advised that they are fully booked until the end of September and in cases into the middle of October already.

With the upcoming Chinese Golden Week from 1 to 7 October, the demand for space is high and many shipping lines are over-booked forcing them to stop accepting any new bookings for September.

In addition, some shipping lines have implemented blank sailings in September which effectively means capacity is temporarily removed from the market and pending bookings are rolled to a future sailing date.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network, gaining access to additional capacity which strengthens our service offering to our clients.

We recommend making bookings as far as possible in advance of your required sailing dates for all trades.

Listen to MoneywebNOW podcast

Denys Hobson talks to MoneywebNOW's Simon Brown about global supply chains remaining under pressure as the peak shipping period approaches.

Container shortage persists

There have been container shortages across all container types despite shipping lines efforts to re-position equipment across trades to meet peak season demand.

There have been cases where shipments have been delayed due to equipment not being available even though the booking has been accepted and released weeks in advance of the planned departure date.

Due to port congestion and operational challenges across all major ports, shipping lines are unable to meet demand. Equipment is still generally being prioritised to the highest paying shipper.

Additional surcharges have been implemented for September such as equipment imbalance surcharges of up to $1,000 per container for shipments moving from China.

Some shipping lines will only accept bookings if the shipper accepts their priority booking surcharges which could be as much as $1,500 per container in addition to the base freight rate.

The USA has a large rolling pool of containers that have not been circulated back to areas such as the Far East. As South America starts gearing up for their key reefer shipping season from October, shipping lines will start prioritising the repositioning of their equipment to the South American hubs which will create further pressure on equipment availability and container type options for the South Africa trade.

Some shipping lines will only accept bookings if the shipper accepts their priority booking surcharges that could be as much as $1,500 per container in addition to the base freight rate.

Sailing schedules erratic

Erratic and unpredictable would probably be the best way to summarise the current state of sailing schedules. The overall global average on time performance remains below 40%.

There are numerous factors such as port congestion, terminal closures, bottlenecks to name a few that cause schedules to be inconsistent. Transit times have increased on all trades and in some cases up to four weeks longer.

Berthing delays of more than 10 days have also been reported. South Africa has experienced a fair share of transit and berthing delays as well as port omissions in the past few weeks. It is near impossible now to predict when sailing schedules will return to normal and we encourage importers to factor delays into their supply chain planning.

Port bottlenecks abound

Operational productivity and efficiencies have been impeded in South Africa due to bottlenecks, the hangover effect of the Transnet cyberattack, rail congestion and poor weather conditions. This has resulted in container uplifts from port being delayed and subsequently deliveries as well.

There are currently new processes being implemented within the Durban port which will hopefully improve the efficiencies and turn-around times going forward.

It's not only the South African ports that are being subjected to congestion and bottlenecks. Ports across the USA, Far East and Europe have all been struggling operationally.

Soaring shipping costs

In this episode's of Investec's No Ordinary Wednesday podcast, my colleague Dr Greg Cline talks about what's driving a 336% YoY increase in shipping prices. Have a listen from 11:42.

Freight rates coninue to soar

As we anticipated, rates continue to increase and break new highs. The shipping lines are retaining their position to dictate rates to the market across all trades.

Shipping lines are enjoying strong demand for capacity at current rate levels. Taking into consideration the equipment shortages, the pending Chinese Golden Week and th peak shipping period, demand for capacity is far greater than supply which allows the shipping lines to constantly push through increases and surcharges. Market rates can be as high as $16,000 per 40ft container when you include the various surcharges.

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

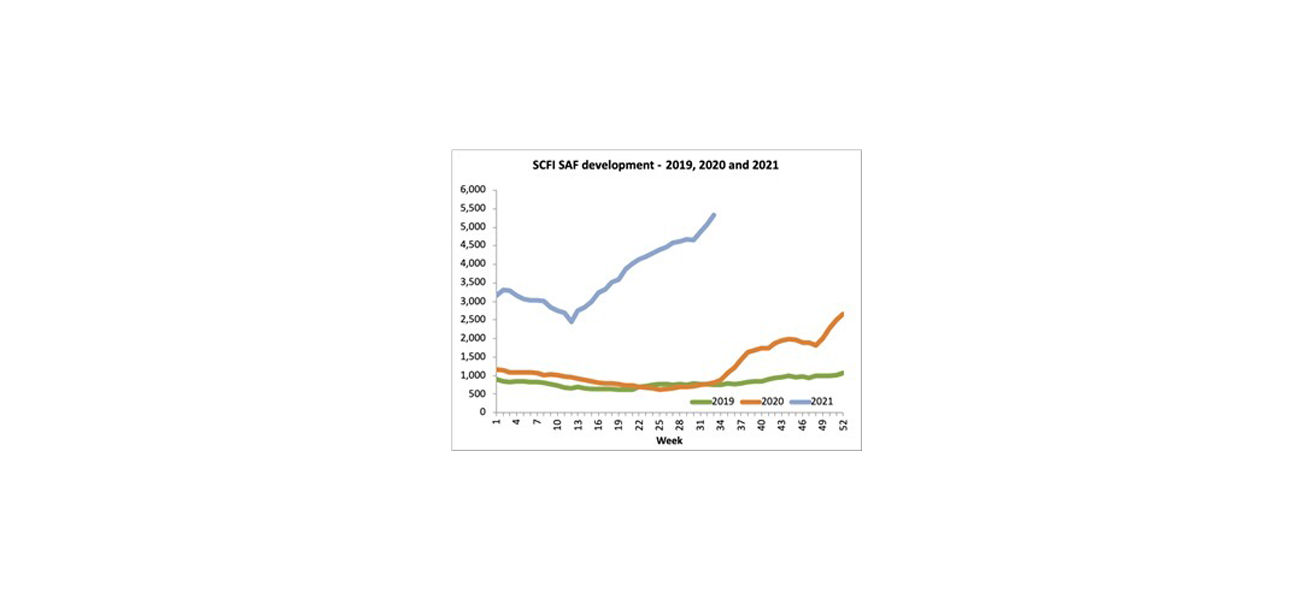

SCFI (Shanghai Container Freight Index): the below graph demonstrates the freight rate increases per TEU ex-China to South Africa

Air update

Air freight sees similar challenges to sea freight

The air freight market has recently experienced its fair share of challenges and instances mirror those seen in the sea freight market such as capacity shortages, longer than usual lead times and rapidly increasing rates.

The recent reporting of several positive Covid cases at the Shanghai International Pudong Airport (PVG) has severely impacted services and resulting in over 40% of flights being cancelled over the past few days.

This could not have come at a worse time considering all the disruptions already experienced across the globe. Combine this with the peak season demand, and the market conditions will not be favourable for most.

China's 'zero tolerance' Covid-19 policy weighs heavily on air freight capacity

Numerous carriers have suspended or reduced their flight frequencies to and from China, most notably Shanghai, due to the disruptions to services caused by positive Covid cases, long Covid quarantine periods, labour shortages and congestion.

The delays and bottlenecks in the sea freight market have also been a major contributor to the increase in demand for capacity. Pressure on capacity is expected to last for a few weeks based on current conditions. There have been signs of capacity being increased into South Africa with the likes of Emirates and Delta Airline adding flights into the country.

We do have various options at our disposal, including access to space on charter flights and the ability to offer alternative departure points and routings to ensure we secure space at very competitive rates.

Shanghai Pudong Airport closure adds to air freight challenges

Cargo aircraft operations at Shanghai Pudong International Airport were suspended on 20 August when several workers tested positive for Covid-19. Pudong handles over 3.1 million tons of cargo annually and is one of China's main loading hubs.

Transit delays set to continue

Lead times are increasing in general, and one can unfortunately expect to experience delays on a more frequent basis. Cargo loading delays as well as congestion at major transshipment hubs will contribute to longer transit times. It's important to make provision for extended lead times.

Collection delays in the USA have been reported due to the increase in demand for trucks and driver shortages as well as congestion at consolidation facilities and terminals.

We encourage importers to clearly define their required on-site dates prior to confirming a shipment. Flight and schedule details can often only be confirmed once shippers make bookings with an airline.

Our air freight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Air freight rates up by 50% over two-week period

Rates have increased by more than 50% over the past two weeks on certain trades such as China. Some airlines have withdrawn space and long-term pricing agreements which has created more demand for spot pricing and capacity. These factors drive-up short-term rates and validities are not guaranteed.

With our expanded network we are well positioned to offer a variety of options to meet your airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.