July has arguably been the most challenging month in recent times with a multitude of supply chain disruptions. Various challenges across all trades continue with no sign of reprieve anytime soon. South Africa experienced two significant events which dominated the headlines in July, namely the looting chaos followed by the cyberattack on Transnet’s IT infrastructure. The timing, scale and impact of both events was very unfortunate and will certainly have further repercussions on our economy and supply chains.

The traditional global peak shipping period has commenced and the trend of capacity constraints, equipment shortages, port congestion, increasing freight rates and Covid lockdowns continues. A couple of countries have recently implemented stricter lockdowns which further compounds the delays in manufacturing and shipping.

The recent weakening of the Rand will add to the headaches of importers and place further pressure on cashflow and margins. The general market consensus is that we will continue to experience supply chain disruptions until at least the end of Q1 2022.

Sea update

It appears to be a never-ending story when it comes to importing cargo with multiple disruptions. The only constant is the anticipation of what will be the next major set-back to an already severely constrained sea freight market.

Every trade route has its challenges and the uncertainty in terms of when will shipments will depart and arrive keeps growing. Port congestion continues to hamper carriers’ efforts to reposition equipment and adhere to routings and sailing schedules.

Capacity is negatively comprised and as we enter the peak shipping period the overall impact is compounded creating a snow-ball effect across global supply chains. Longer lead times and increasing rates will remain a common theme and importers need to factor this into their business planning.

It is important to note that hazardous shipments are being delayed due to shipping lines and ports not accepting or delaying the acceptance of shipments, depending on the hazardous nature of the cargo. Growing uncertainty in the sea freight market will continue through August and September with no signs of returning to “normality”.

Shipping challenges could hurt South Africa’s retail high season

Widespread global shipping disruptions may jeopardise South Africa’s retail high season that includes November’s Black Friday and the December seasonal sales — unless importers move fast.

Capacity constraints

There was an increase in the reduction of capacity in July, especially from India, Far East and South America. At one stage there were close to 120 ports reporting congestion with a combined 328 ships idle or at anchor which equates to approximately 10% of global capacity.

Shipping lines had to implement blank sailings and voyage changes as a result which led to further capacity constraints across trade routes. Capacity challenges will remain for the coming months and importers need to compensate for this in their demand planning.

Sailing options ex-India and South America to South Africa are currently very limited with some carriers choosing to stop accepting new bookings for the coming weeks. USA and European import demand continue to grow which is worrying for other trades as shipping lines will focus on supporting the demand and drive freight rates up.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded global network, we have gained access to additional capacity which strengthens our service offering to our clients.

We recommend making bookings as far as possible in advance of your required sailing dates for all trades.

Equipment imbalance

The imbalance and shortage of equipment is being experienced across most trades now and is no longer just specific to 40HQ containers. 20GP and 40GP availability has been constrained due to the increase in demand for these container types caused by the shortage of 40HQ availability as well as the shipping delays which have hampered container circulation.

Shipping lines continue to release equipment on a priority basis and later than normal. Demand for 40ft non-operating reefers (NOR) has also increased as importers have to some extent tried to negate the 20ft/40ft container shortages and rising freight rates.

Growing uncertainty in the sea freight market will continue through August and September with no signs of returning to 'normality'.

Sailing schedules

Schedules remain erratic across all trades. The knock-on effect from the Covid disruptions to the ports of Shenzhen have contributed enormously to the schedules remaining unstable. The recent typhoon in China also had an immediate impact on sailing schedules from China and the Far East.

There has been an increase in port congestion across major European ports which is causing shipping lines to omit certain port calls as well as re-route cargo to transshipment ports using feeder services.

Published departures (ETD), arrivals (ETA) and routings are volatile and constantly need to be monitored. Shipping lines are in general not issuing advanced notices of changes to schedules.

Delays of between three to five weeks are still being experienced for major transshipment hubs such as Singapore and Tanjung Pelepas. The recent Transnet cyberattack will have a negative impact on future sailings and we anticipate schedules to be unstable. Amendments could be made for August and September because of the delays to vessels’ return voyages.

Port congestion

Ports around the globe are struggling with increased volumes, berthing delays and longer dwell times amongst other things. Such factors impact the operational performance and ultimately result in ports and shipping lines not being able to clear backlogs which results in more bottlenecks and congestion.

In extreme cases, shipping lines may choose to bypass a port due to congestion. Port congestion also impedes on transporters services as turn-around times to uplift or deliver containers to/from ports increases.

Closer to home, South African port operations were heavily impacted from 22 July due to the Transnet cyberattack. Shipping lines had no option, but to implement changes to their schedules which resulted in numerous port omissions and berthing delays.

Freight rates

Rates continue to increase and breach historical highs, specifically on the Far East and India trades. Shorter validities are common practice now and this will not change soon as shipping lines enjoy their position of being able to amend rates according to demand.

The trend towards to higher spot pricing continues to gain momentum with shipping lines offering priority for capacity and equipment to those that are willing to accept rates at a premium.

Freight and surcharge increases have also been implemented on the European and USA trades. Bunker levels are also increasing which contributes to the overall rate increases.

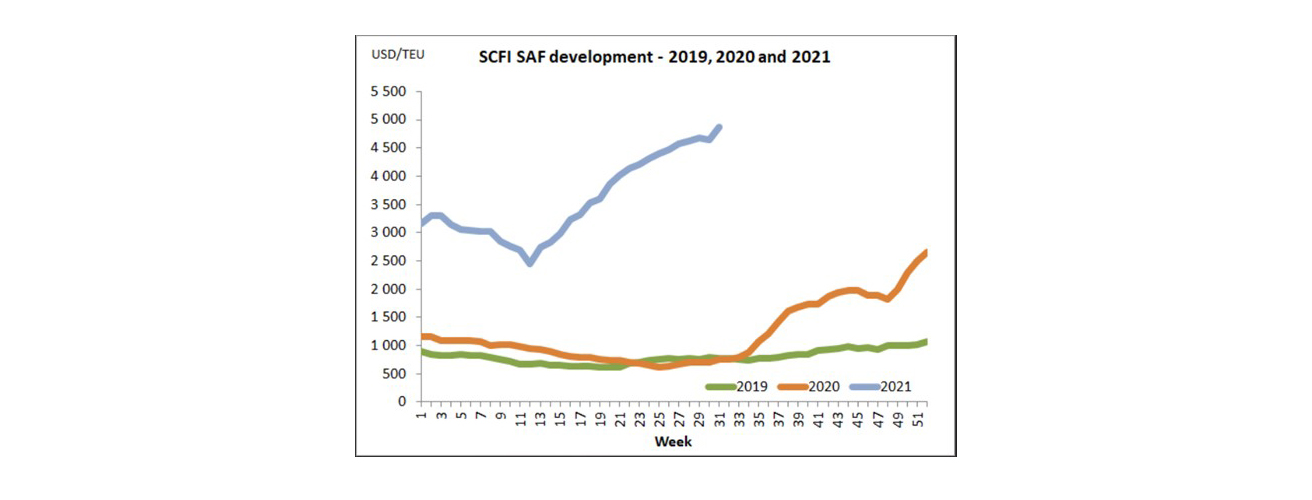

SCFI (Shanghai Container Freight Index)

The below graph demonstrates the freight rate increases per TEU ex-China to South Africa.

Transnet cyberattack

The recent cyberattack on Transnet created panic and turmoil for businesses. This significant event has caused concern for stakeholders and there will be further consequential disruptions to all modes of transport in one way or another.

Delivery delays, port omissions, cargo re-routing, congestion and amended sailing schedules are just a few examples of what to expect.

Vessels are likely to be delayed on their return voyages and this could lead to shipping lines having to omit certain ports calls on their inbound voyages to South Africa in the coming weeks. These are all factors beyond our control.

We have been pro-active in our planning and worked closely with our various partners to ensure we deliver shipments at the earliest possible opportunity.

Air update

Demand for airfreight will start increasing and it wouldn’t be a surprise to see a rapid increase on certain trades due to the disruptions in the sea freight market and manufacturing delays.

The increasing sea freight lead times combined with the increasing freight rates will make airfreight a more viable and attractive option as importers scramble to get stock landed in time.

Capacity

There has been a global increase in companies making use of airfreight as an alternative to sea freight as they adjust their supply chain to improve their inventory and meet demand for their product.

This type of change in strategy has contributed to the demand for capacity increasing which will place pressure on this mode as we head into the peak shipping period.

Importers from Europe will also start to experience capacity constraints with the upcoming summer holidays.

Airlines will likely adjust freighter capacity to meet increased demand on various trades. Demand for charter services will also increase as the likes of the automotive industry scramble to move critical components to avoid production line stops and manufacturing delays.

Alternatively, large shipments may need to be moved over a few flights. Hazardous shipments remain a challenge with carrier acceptance taking longer than general cargo. Flight options are also limited.

We do have various options at our disposal, including access to space on charter flights, to ensure we secure space at very competitive rates.

Transit times

There has been an increase in transit times in general as demand increased and handling facilities and hubs are experiencing additional congestion. Limited flight options and backlogs from various trade routes such as South America and India are placing further pressure on transit time predictability. Delays can be expected for both economy/consol and express services.

We encourage importers to clearly define their required on-site dates prior to confirming a shipment. Flight and schedule details can often only be confirmed once shippers make bookings with an airline.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Freight rates

We anticipate rates to continue in an upward trajectory in the coming months as result of the combination of factors already mentioned. As is the case with sea freight, spot rate offerings and short validity periods are common practice.

With our expanded network we are well positioned to offer a variety of options to meet your airfreight requirements.

Get Focus insights straight to your inbox

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.