Receive Focus insights straight to your inbox

The world is changing at an accelerating pace. Covid-19 has accelerated that pace and moved us, by a giant leap, even faster into a technology-driven future. The question many people are asking is: “What impact will the Covid-19 pandemic have on the estate planning I have in place?”

Tax residence for individuals

In many jurisdictions, your status as a tax resident is determined (or at least partially determined) by the number of days you are present in that country per tax year. The onset of the Covid-19 pandemic has resulted in severe and widespread restrictions on movement. As a result, we have found that many of our clients are forced to stay in a country longer than the limited number of days permitted before they become a deemed tax resident.

SARS has made no official concessions for individuals who may breach this limit because they are not able to leave South Africa. However, one hopes that SARS will consider Covid-19 related circumstances as an acceptable ‘excuse’ for such a breach. In the UK, for example, Her Majesty’s Revenue and Customs (HMRC) has acknowledged that the pandemic is affecting people's ability to move freely to and from the UK, and announced that it will 'look sympathetically' at individual cases where the pandemic has caused such challenges. It went further and agreed to accept certain specified (listed) circumstances as 'exceptional' and which may not automatically trigger UK tax residency.

One such circumstance is where a person is quarantined or advised by a health professional or public health guidance to self-isolate in the UK. However, HMRC warned that the annual limits set out in the statutory residence test remain in place and that it will consider the facts of each individual case before deciding to disregard days spent in the UK due to such circumstances. The Canada Revenue Agency (CRA) has also come to the party, by granting administrative relief for individual and corporate taxpayers who might otherwise be facing Canadian tax residency or cross-border issues because of coronavirus-related travel restrictions. The relief applies for the period 16 March 2020 to 29 June 2020, but may be extended if necessary.

Restructuring opportunities

While it’s true that every crisis creates opportunities, it’s also true that they aren’t always taken advantage of. In the case of Covid-19, the opportunity that presents itself is where the value of your investments may have fallen due to the economic impact of the pandemic. Transferring assets from one legal entity or person to another comprises a capital gains tax event. Where embedded gains on particular assets are significant, this often serves as a disincentive to move such assets, even where there may be long-term benefits to doing so.

However, where asset values are lower than normal or where you hold cash, the capital gains tax ‘cost’ of a restructure will be lower or, in the case of cash, none. There are many reasons why you may choose to restructure. Although the detailed tax consequences differ depending on many factors, in general, you may be able to achieve long-term benefits with the use of a trust for cross-generational investments. These benefits often include estate (death) tax savings as well as asset protection, from not only creditors, but also marriage regimes, prodigality and minority. There are other factors, which may necessitate restructuring, such as the acquisition of a US tax profile by an existing trust beneficiary or the reorganisation of your affairs during an emigration process.

Drafting and executing a will

Where changes to an estate plan need to be made, lockdowns and social distancing (to combat the spread of Covid-19) present an immediate practical problem, namely, the difficulties that advisers may have taking proper instructions and the difficulties that people face in signing their wills. In South African law, a will must be witnessed by two people (broadly) who are not mentioned in the will. If you are in lockdown with only your family members, securing appropriate witnesses is a challenge.

In some cases, the actual signature and witnessing of the new will can be delayed until after lockdown. However, with elderly clients or clients who are already ill, such delays can be very risky. The Fiduciary Institute of South Africa made a submission to the acting Chief Master to have the drafting and execution of wills declared an essential service under lockdown. Unfortunately, to date, no formal advice or response has been received in this respect.

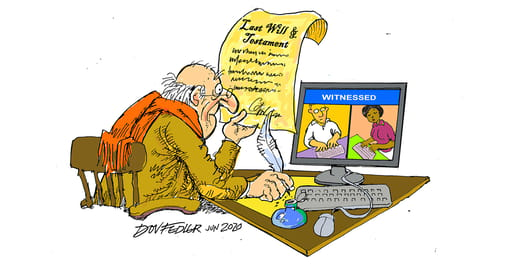

A partial solution appears to lie in technologies such as FaceTime, Zoom, Teams, WhatsApp video calling etc. However, few authorities around the world have confirmed that e-signatures or video witnessing will be accepted. In the UK, for example, electronic signatures on contracts and many deeds are legally valid, but wills remain an exception to this1.

As the weeks of lockdown have mounted, certain jurisdictions began to introduce technology-based concessions to their normal signature and witnessing rules. Scotland, Jersey and certain Canadian provinces are allowing witnesses to use video technology to witness will signing. This is a temporary measure to help stop the spread of the coronavirus by reducing physical contact with others. In New Zealand, enduring powers of attorney (PoAs) and wills may now be signed and witnessed via remote electronic audio-visual link. This is however subject to a note being made on the document specifying that it is being signed via an audio-visual link because an pandemic notice is in force. A copy or scan must be immediately sent to the person who has been chosen to hold the enduring PoA, which will continue to be valid after the pandemic is declared over.

Video conference recordings should be kept in case the will is later challenged. When the virus is less of a threat, the use the video technology will no longer be allowed because certain duties incumbent on the lawyer drafting the will are almost impossible to fulfil this way. In this regard, lawyers are, inter alia, obliged to verify the identity of their clients, assess that they possess adequate (as required by law) mental capacity to make a will, and to check whether any undue influence is being exerted by a third party.

Now that South Africa has entered Level 3 of our lockdown, finding a witness has become easier for most. However, the same challenges remain for anyone still having to or going into any period of isolation.

1 “Making a will in the time of coronavirus” STEP 23 March 2020

Conclusion

As the world becomes more complex, so does estate planning, especially for wealthier individuals who have assets and family members scattered across the globe. This is a highly specialised area and expert advice should be taken before any changes are made to your planning.

Investec Tax & Fiduciary helps Investec clients, who meet the discretionary minimum investment requirements, to navigate the complexities of local and international wealth structuring.

Trust us to manage your wealth today