Get Focus insights straight to your inbox

It is estimated that South Africa faces a combined life and disability cover shortfall of at least R34.7 trillion1, and the gap is growing every year. This means there’s a widening divide between the risk cover people have taken out and the actual needs of their families when they become ill, disabled, or die.

Startling as it is, this figure doesn’t even include the gap most people face between the cost of medical care and the cover from medical aid. Our own research shows that South Africans consistently underestimate the costs of a severe illness beyond what their medical aid covers. This is often most visible in the affluent sector, where insufficient cover can mean significantly downgrading one’s lifestyle, getting into debt, or even heavily compromising one’s retirement savings. Narrowing that gap, or even closing it completely, is foundational to your overall financial planning strategy for the future.

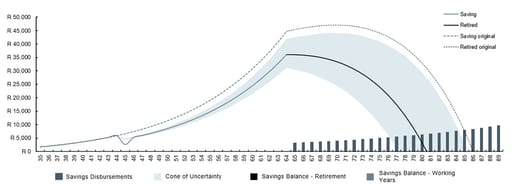

The graph below shows the impact of having to withdraw R2m from your retirement savings (this is provided you have some accessible retirement savings that are not completely locked up in a pension, provident, or retirement fund) to cover unexpected medical/illness-related costs where, for example, you lack sufficient severe-illness funding assistance.

Impact of withdrawing from retirement savings

If you withdraw R2m at the age of 45, which is 10 years after starting the policy, it will cause your retirement savings to run out 5 years earlier than originally planned.

Should you have a taken up a Severe Illness Cover policy, the premiums that are paid up until a claim (in 10 years time) would have been R108,000 or an average of R900/month (assuming you are a 35-year-old, non-smoker with average health). This is compared to the benefit of an additional R10,800/month in your pension/retirement income until age 85.

Assuming you live to age 85, lost future pension income would be R2.8m. This is a reduction of 19% in income after retirement, versus a cost of 1% in illness cover premiums.

Many of us don’t really look at the cost-benefit equation in this way. We think of our premiums in isolation, until we claim. At this point, the benefits we realise from our policy tend to offset the monthly payments we’ve been making over time by a large margin.

A culture of underinsurance

Underinsurance is in part cultural, because many people rely on extended family to step in where there’s a gap in benefits. One person is rarely one person. Our research shows that financial provision flows in multiple directions within the family structure. If one person is underinsured, it becomes another’s responsibility to pick up the slack. This burden often sits within the professional or affluent segment where success comes with increased responsibility: you earn more, therefore you contribute more.

But “burden” is also the wrong word. For many, provision is a privilege, and relationships extend beyond the nuclear construct of what constitutes a family. From an insurance perspective, this places even more responsibility on policyholders to select the appropriate level of cover to meet the needs of their dependants.

We under-value our earnings over time

When an illness hits or we become disabled and can’t work, we underestimate the impact on our earnings over time. If you were 35 years old and became permanently disabled on a take-home annual income of R800,000, income protection cover would pay this out to you every year with upward inflation adjustments until you reach retirement. Taken over time, these payouts represent far more than you’d reasonably be able to save to self-support for the rest of your working life.

We also underestimate how our own earnings increase over the course of a career. Professionals, especially, will move through salary levels that far outstrip inflation. Having cover that’s flexible enough to change as you change is essential to maintaining your financial position.

We underestimate the costs of an illness

We think of medical aid as a cure-all when we’re in hospital but forget that getting sick costs money at a time when doing your job may not be possible. And while a medical aid may cover the base costs of treatment, it won’t pay your bond or child’s school fees. Families can end up getting into deep debt and depleting their savings and retirement nest eggs at a time when recovery is most important. Financial stress during an illness adds immense strain on the individual and their dependants, which can negatively impact mental wellness and support.

Our research into the affluent segment shows that while 95% of respondents had prioritised medical aid, severe illness and income protection cover were significantly lower priorities.

We focus on the premium, not the benefit

In a recessionary environment where incomes are under pressure, value is especially paramount. But value doesn’t only come from price. It’s important to understand your benefits. You may, for instance, be drawn to a lower life insurance quote that offers you “accelerated cover”. This type of cover means you’re cross-subsidising your insurance across different product types. A claim for severe illness would then reduce the value of your death benefit (i.e. paying you less when you subsequently die).

We need to protect ourselves and our families from events that could cause severe financial hardship. Serious illnesses, death, and disabilities are already traumatic experiences. Adding financial stress to the equation only makes things worse. By getting insurance coverage that is easy to understand and offers benefits that match your specific needs, you can ensure that you are protected when you need it the most.